Region:Asia

Author(s):Dev

Product Code:KRAA6827

Pages:84

Published On:January 2026

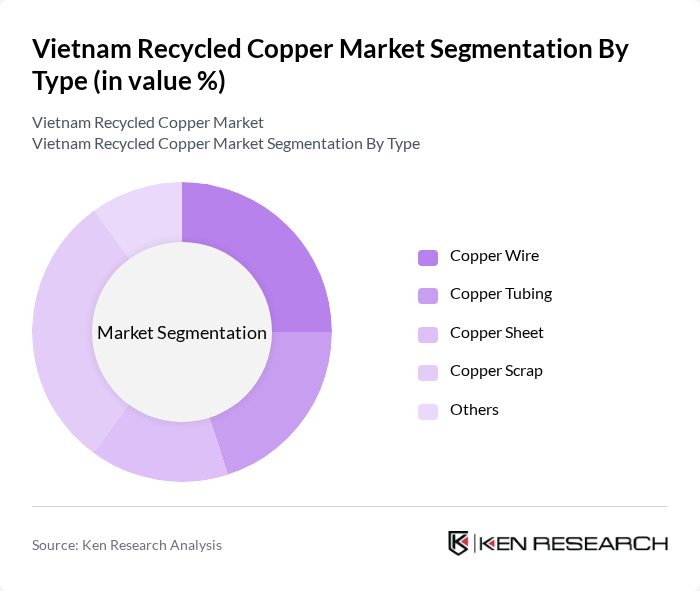

By Type:The recycled copper market can be segmented into various types, including Copper Wire, Copper Tubing, Copper Sheet, Copper Scrap, and Others. Among these, Copper Scrap is the leading sub-segment due to its widespread availability and lower processing costs. The demand for Copper Wire and Copper Tubing is also significant, driven by their applications in electrical and construction industries. The trend towards sustainable practices has further enhanced the market for recycled copper products.

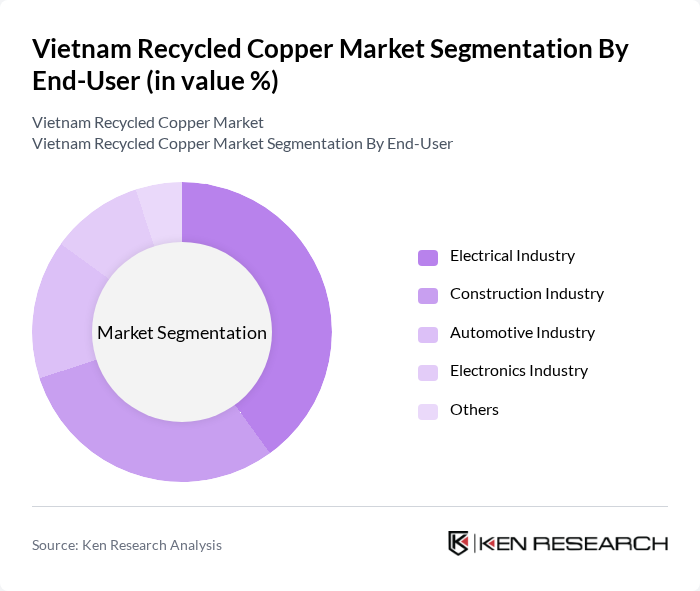

By End-User:The end-user segmentation of the recycled copper market includes the Electrical Industry, Construction Industry, Automotive Industry, Electronics Industry, and Others. The Electrical Industry is the dominant segment, driven by the increasing demand for electrical wiring and components. The Construction Industry follows closely, as recycled copper is widely used in plumbing and roofing applications. The growing emphasis on sustainable construction practices is expected to further boost the demand for recycled copper in these sectors.

The Vietnam Recycled Copper Market is characterized by a dynamic mix of regional and international players. Leading participants such as CMC Copper, Viet Copper, Huu Nghi Copper, Dong Nai Copper, Vinacopper, An Phat Copper, Hoang Ha Copper, Thanh Hoa Copper, Binh Duong Copper, Quang Ninh Copper, Hai Phong Copper, Da Nang Copper, Long An Copper, Can Tho Copper, Nha Trang Copper contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam recycled copper market appears promising, driven by increasing consumer awareness and government support for sustainable practices. As urbanization accelerates, the demand for recycled copper in construction and electrical applications is expected to rise. Additionally, the integration of advanced recycling technologies will likely enhance efficiency and quality, positioning Vietnam as a key player in the regional recycling landscape. The focus on circular economy initiatives will further bolster market growth, creating a more sustainable industrial ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Copper Wire Copper Tubing Copper Sheet Copper Scrap Others |

| By End-User | Electrical Industry Construction Industry Automotive Industry Electronics Industry Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Application | Electrical Wiring Plumbing Industrial Machinery Renewable Energy Systems Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Subsidies for Recycling Initiatives Tax Incentives for Recycled Materials Regulatory Support for Recycling Facilities Others |

| By Technology | Hydrometallurgical Processes Pyrometallurgical Processes Biotechnological Methods Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Recycling Facility Operations | 100 | Plant Managers, Operations Directors |

| Raw Material Suppliers | 80 | Procurement Managers, Supply Chain Coordinators |

| End-User Industry Insights | 70 | Manufacturing Executives, Product Managers |

| Government Policy Impact | 50 | Regulatory Affairs Specialists, Environmental Policy Makers |

| Market Trends and Forecasts | 90 | Market Analysts, Economic Researchers |

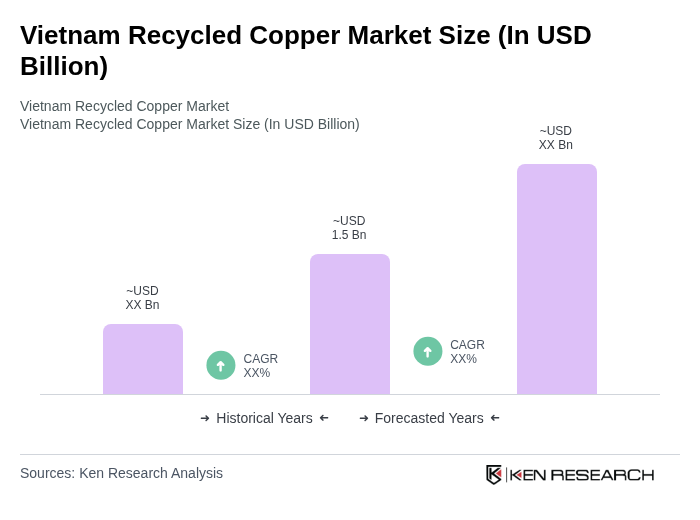

The Vietnam Recycled Copper Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increasing demand for sustainable materials and government recycling initiatives.