Region:Asia

Author(s):Dev

Product Code:KRAB4329

Pages:94

Published On:October 2025

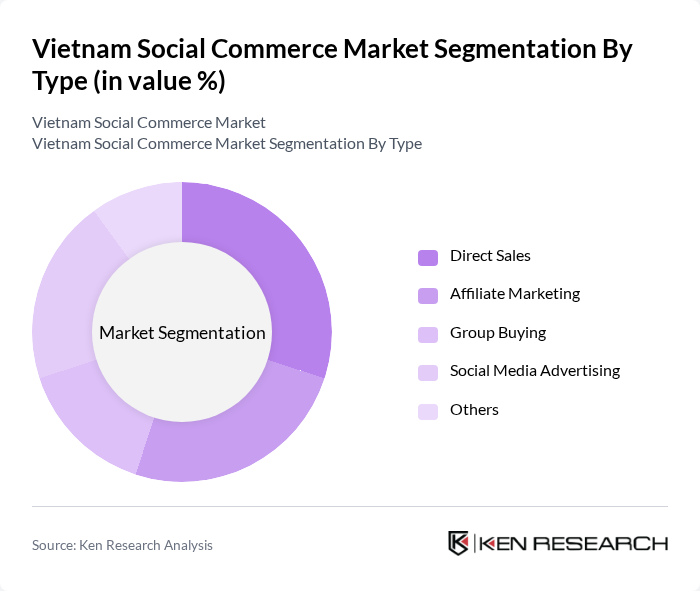

By Type:The market can be segmented into various types, including Direct Sales, Affiliate Marketing, Group Buying, Social Media Advertising, and Others. Each of these segments plays a crucial role in shaping the overall landscape of social commerce in Vietnam.

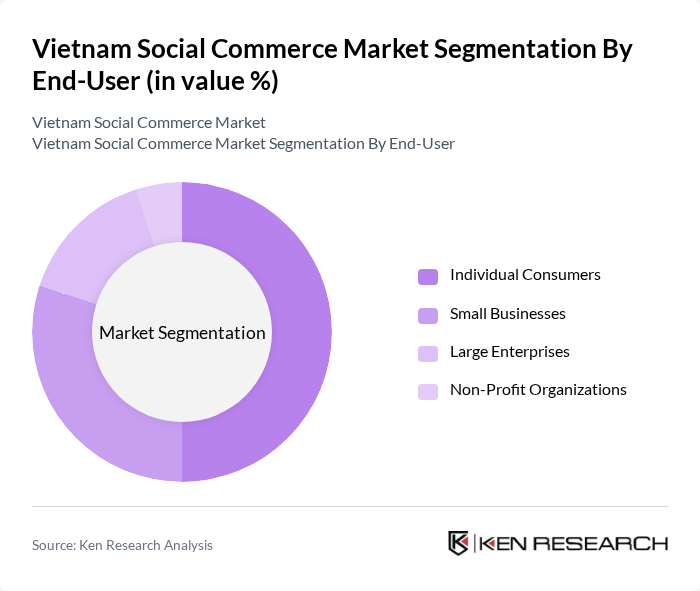

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Large Enterprises, and Non-Profit Organizations. Each segment has distinct needs and behaviors that influence their engagement with social commerce platforms.

The Vietnam Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tiki Corporation, Shopee Vietnam, Lazada Vietnam, Sendo.vn, FPT Retail, ZaloPay, MoMo, VNPay, Grab Vietnam, Facebook Vietnam, Instagram Vietnam, TikTok Vietnam, VNG Corporation, Be Group, Tiki Trading contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's social commerce market appears promising, driven by technological advancements and evolving consumer preferences. As digital payment solutions become more widespread, the ease of transactions will likely enhance user engagement. Additionally, the integration of augmented reality (AR) and virtual reality (VR) technologies is expected to revolutionize the shopping experience, allowing consumers to interact with products in innovative ways. These trends will shape the market landscape, fostering growth and attracting new participants.

| Segment | Sub-Segments |

|---|---|

| By Type | Direct Sales Affiliate Marketing Group Buying Social Media Advertising Others |

| By End-User | Individual Consumers Small Businesses Large Enterprises Non-Profit Organizations |

| By Sales Channel | Social Media Platforms E-commerce Websites Mobile Applications Others |

| By Product Category | Fashion and Apparel Beauty and Personal Care Home and Living Electronics Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Urban vs Rural |

| By Payment Method | Credit/Debit Cards E-wallets Bank Transfers Cash on Delivery |

| By Marketing Strategy | Influencer Marketing Content Marketing Paid Advertising Organic Social Media Growth |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Behavior in Social Commerce | 150 | Online Shoppers, Social Media Users |

| Small Business Utilization of Social Platforms | 100 | Small Business Owners, Marketing Managers |

| Influencer Marketing Impact | 80 | Social Media Influencers, Brand Managers |

| Trends in Mobile Commerce | 120 | Mobile App Users, E-commerce Managers |

| Regulatory Perspectives on Social Commerce | 60 | Policy Makers, Legal Advisors |

The Vietnam Social Commerce Market is valued at approximately USD 5 billion, reflecting significant growth driven by increased smartphone penetration, internet access, and a rising trend of online shopping among consumers.