Region:Asia

Author(s):Geetanshi

Product Code:KRAD3952

Pages:84

Published On:November 2025

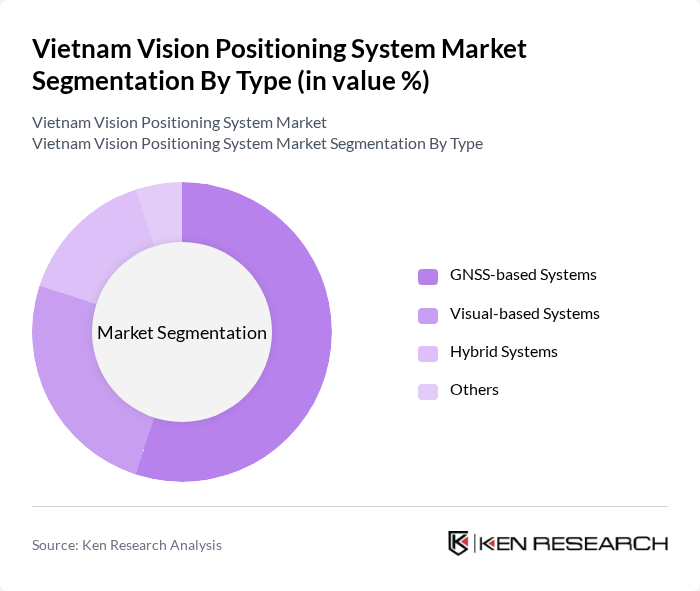

By Type:The market is segmented into GNSS-based Systems, Visual-based Systems, Hybrid Systems, and Others. GNSS-based Systems are currently leading the market due to their widespread application in various industries, including agriculture and transportation. The increasing need for accurate positioning and navigation solutions has driven the demand for these systems. Visual-based Systems are gaining traction as well, particularly in sectors requiring high precision, such as surveying and mapping. Hybrid Systems combine the strengths of both GNSS and visual technologies, catering to specialized applications.

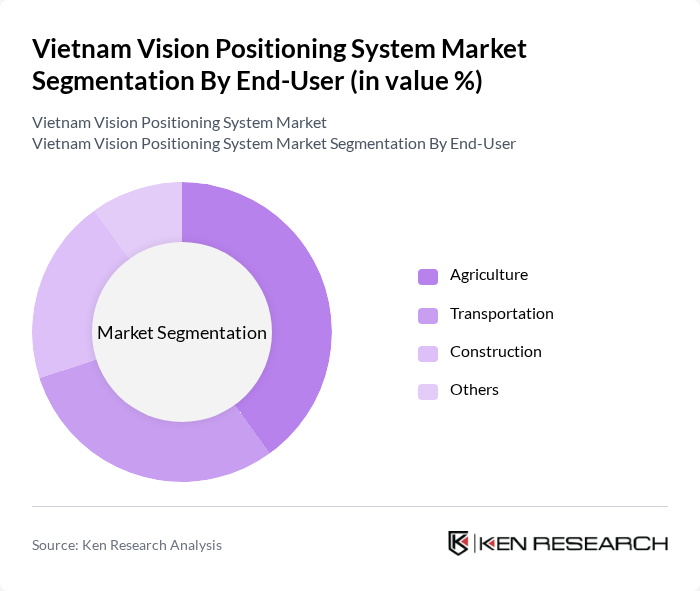

By End-User:The end-user segmentation includes Agriculture, Transportation, Construction, and Others. Agriculture is the leading segment, driven by the increasing adoption of precision farming techniques that require accurate positioning for effective resource management. Transportation follows closely, as the demand for efficient logistics and fleet management solutions continues to rise. The construction sector is also witnessing growth due to the need for precise surveying and mapping solutions, while other sectors contribute to the overall market demand.

The Vietnam Vision Positioning System Market is characterized by a dynamic mix of regional and international players. Leading participants such as VNPT (Vietnam Posts and Telecommunications Group), Viettel Group, FPT Corporation, CMC Corporation, Navisens, GIM Technologies, Geosystems Vietnam, VNG Corporation, TMA Solutions, MobiFone, HPT Vietnam, VTC Digital, Viettel Post, DTT Technology Group, and Vinasat contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam Vision Positioning System market appears promising, driven by technological advancements and government support. As urbanization accelerates, the integration of positioning systems in smart city initiatives will become crucial. Additionally, the rise of autonomous vehicles will necessitate enhanced navigation solutions. With increasing investments in telecommunications infrastructure, the market is poised for growth, fostering innovation and collaboration among stakeholders to address emerging challenges and capitalize on new opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | GNSS-based Systems Visual-based Systems Hybrid Systems Others |

| By End-User | Agriculture Transportation Construction Others |

| By Application | Fleet Management Surveying Mapping Others |

| By Industry | Automotive Telecommunications Defense Others |

| By Technology | RTK (Real-Time Kinematic) PPP (Precise Point Positioning) DGPS (Differential GPS) Others |

| By Investment Source | Private Investments Government Funding International Aid Others |

| By Policy Support | Government Grants Tax Incentives Research and Development Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Applications of Positioning Systems | 100 | Agronomists, Farm Managers |

| Transportation and Logistics Sector | 120 | Logistics Coordinators, Fleet Managers |

| Urban Planning and Smart City Initiatives | 80 | Urban Planners, City Officials |

| Telecommunications Integration | 70 | Network Engineers, Telecom Managers |

| Consumer Electronics and Navigation Devices | 90 | Product Managers, Retail Buyers |

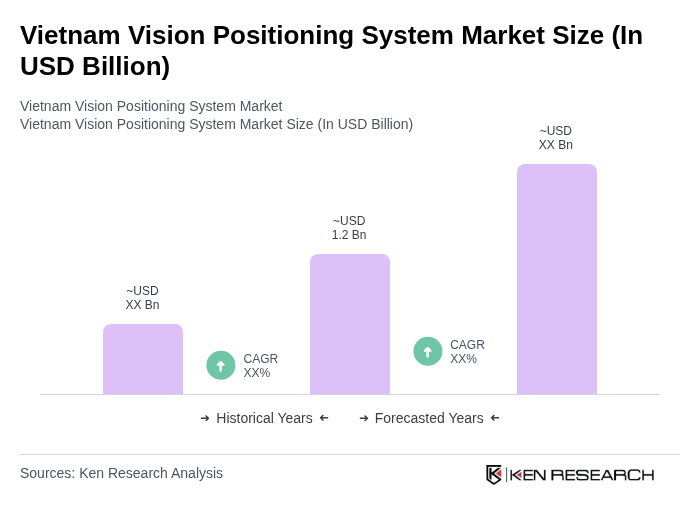

The Vietnam Vision Positioning System market is valued at approximately USD 1.2 billion, driven by increasing demand for precision across sectors like agriculture, transportation, and construction, along with advancements in technology and infrastructure development.