Region:Middle East

Author(s):Shubham

Product Code:KRAA8463

Pages:91

Published On:November 2025

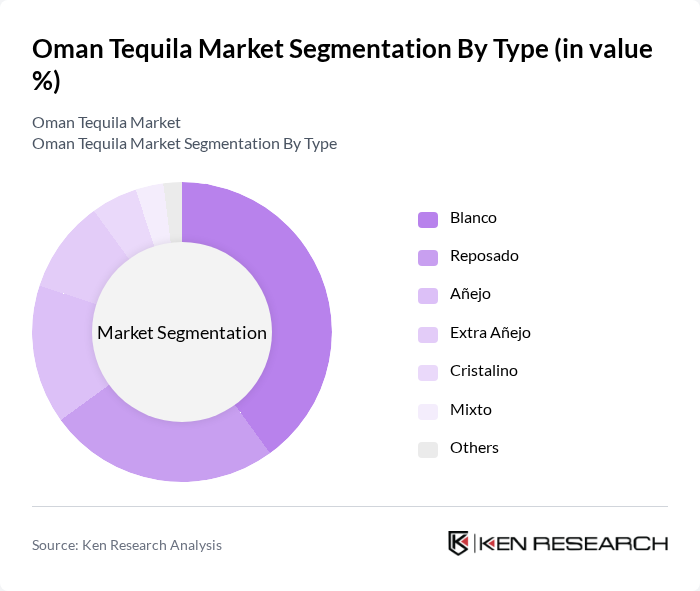

By Type:The tequila market can be segmented into various types, including Blanco, Reposado, Añejo, Extra Añejo, Cristalino, Mixto, and Others. Among these,Blanco tequilais currently the most popular choice among consumers due to its versatility and affordability. It is often preferred for cocktails and mixed drinks, making it a staple in bars and restaurants.ReposadoandAñejoare also gaining traction as consumers seek more aged and premium options, reflecting a growing trend towards quality over quantity. The premiumization trend is particularly evident in urban hospitality venues, where aged and craft tequilas are increasingly featured on cocktail menus .

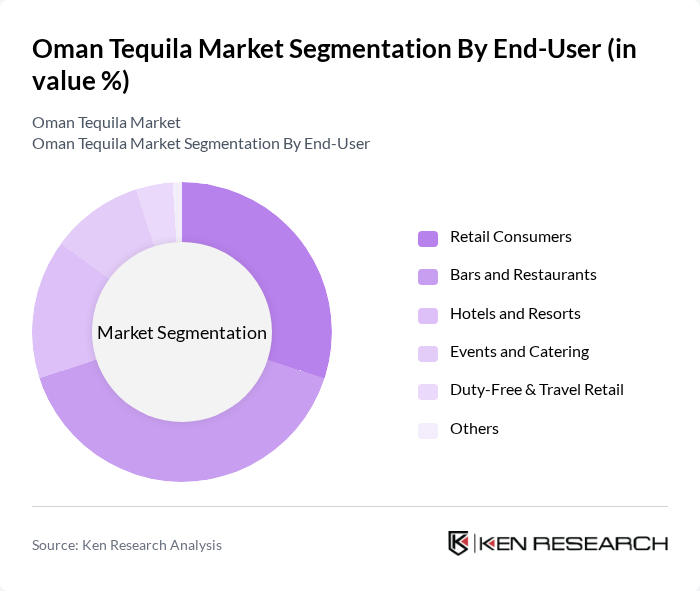

By End-User:The end-user segmentation includes Retail Consumers, Bars and Restaurants, Hotels and Resorts, Events and Catering, Duty-Free & Travel Retail, and Others. TheBars and Restaurantssegment is currently leading the market, driven by the increasing number of establishments serving tequila-based cocktails and the growing trend of social drinking. Retail consumers are also significant contributors, as more individuals purchase tequila for home consumption, especially during celebrations and gatherings. The hospitality sector’s focus on premium experiences and curated cocktail menus further supports growth in these segments .

The Oman Tequila Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diageo plc (Don Julio, Casamigos), Bacardi Limited (Patrón Spirits Company), Brown-Forman Corporation (El Jimador, Herradura), Proximo Spirits (Jose Cuervo, 1800 Tequila), Campari Group (Espolòn, Cabo Wabo), Casa Noble Tequila, Tequila Cazadores (Bacardi Limited), Tequila Fortaleza (Tequila Los Abuelos S.A. de C.V.), Tequila Siete Leguas, Tequila Ocho, Tequila Alquimia, Milagro Tequila (William Grant & Sons), Don Eduardo (Brown-Forman Corporation), Casa San Matías (Producers of Pueblo Viejo, Rey Sol), Omani Trading & Distribution Co. (Local Importer/Distributor) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman tequila market is poised for growth, driven by increasing consumer interest in premium spirits and the expansion of the hospitality sector. As disposable incomes rise, consumers are likely to seek out high-quality tequila options, enhancing market dynamics. Additionally, the emergence of online sales channels is expected to facilitate access to a broader range of products. However, addressing cultural perceptions and regulatory challenges will be crucial for sustained growth in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Blanco Reposado Añejo Extra Añejo Cristalino Mixto Others |

| By End-User | Retail Consumers Bars and Restaurants Hotels and Resorts Events and Catering Duty-Free & Travel Retail Others |

| By Packaging Type | Glass Bottles PET Bottles Cans Miniatures Others |

| By Distribution Channel | On-Trade (Hotels, Bars, Restaurants) Off-Trade (Retail Stores, Supermarkets) E-commerce Duty-Free Others |

| By Price Range | Premium Super-Premium Mid-Range Economy Others |

| By Occasion | Celebrations Casual Gatherings Corporate Events Tourism & Hospitality Others |

| By Consumer Demographics | Age Group Gender Income Level Nationality (Expat vs. Local) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 60 | Store Managers, Beverage Buyers |

| Consumer Preferences Survey | 120 | Tequila Consumers, Alcohol Enthusiasts |

| Distribution Channel Analysis | 50 | Distributors, Importers |

| Market Trend Evaluation | 40 | Market Analysts, Industry Experts |

| Expatriate Consumption Patterns | 45 | Expat Residents, Social Groups |

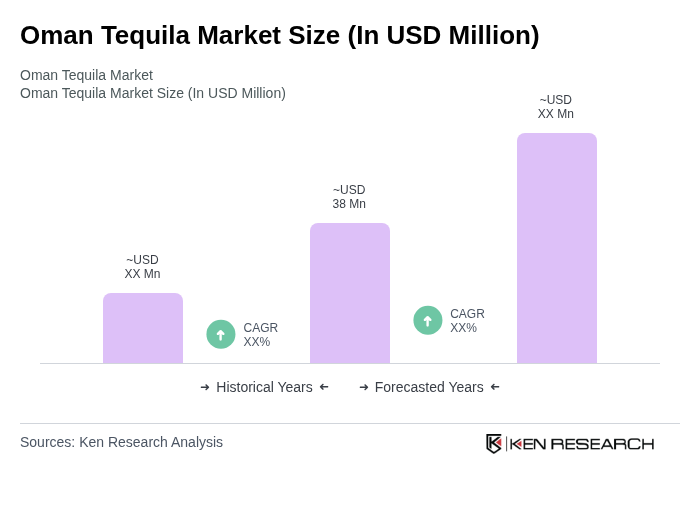

The Oman Tequila Market is valued at approximately USD 38 million, reflecting a growing interest in premium tequila among consumers, particularly younger demographics, and the rising trend of premiumization in alcoholic beverages.