Philippines E-Commerce Logistics space on the fast track for growth

philippines-e-commerce-logistics-market

June 26, 2023

Due to lockdowns and other restrictions brought on by the COVID-19 outbreak, e-commerce activity has significantly increased in the Philippines. The country’s freight and logistics sector is anticipated to be severely impacted by this increase in e-commerce because there is a growing need for dependable and efficient delivery services as more and more people buy online. Presently, the e-commerce logistics sector is growing at a CAGR of 40% between 2019 and 2020.

The market is highly poised to grow with a double-digit growth rate in the coming years. Read more to find out the growth enablers of the e-commerce logistics industry in the Philippines.

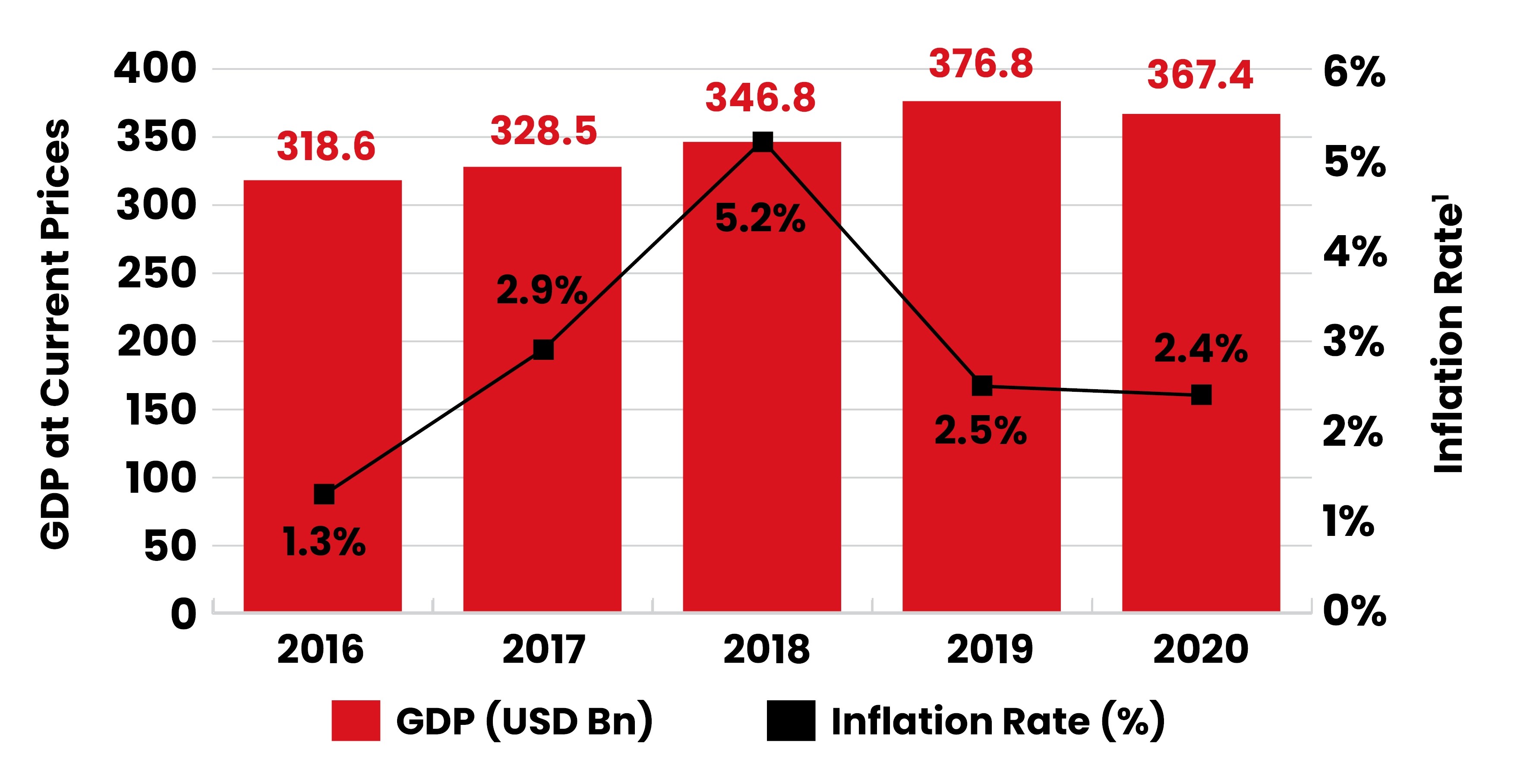

1. Philippines, 109.5 Mn populated country witnessed 2.5% decline in GDP…

Philippines

Country Demographics

- Population2: 109.5 Mn (2020)

- No. of Households till Dec 2020: 21.8 Mn

- Males (2020): 50.1%

- Females (2020): 49.9%

- Poverty declined from 23.3% (2015) to 16.7% (2018)2

- Life Expectancy: 71.28 years (2020)2

- Average Annual Household Income: ₱ 330K (2020) - NCR constitute 20.1%

- Average Annual Household Exp. ₱ 251K in 2020

- Service Sector (2019)1: 56.2% of GDP

- Industry (2019)1: 34.8% of GDP

- Contribution of E-Commerce Industry4: 3.4% of GDP

- Projected country’s real GDP growth at 5.8% (2019) 6.1% (2020) and 6.2% (2021)2

GDP2 and Inflation Rate6, 2015-2020

Gross Domestic Product and Sectoral Contribution to GDP

Major Industries

Major Industries as % of GDP (2019)1

- Manufacturing and Construction: 26.3%

- Trade and Repair of Motor Vehicles, Motorcycles, Personal and Household Goods: 18.9%

- Real Estate: 12.8%

- Transport, Storage and Communication: 5.9%

Geographical Location

- Number of Islands: 7,641

- Area (2020): 342,353 km sq

- Density: 320.1/km sq

- There are 3 main geographical divisions for the islands (North to South) : Luzon, Visayas and Mindanao.

Trade Scenario

- Imports1: Increased with a CAGR of 10.2% (2017-2019)

- Major goods: Electrical equipment, machinery including computers

- Major Countries: China, Korea, Japan, US

- Exports1: Increased at a CAGR of 6.8% (2017-2019)

- Major goods: electronic products, mineral fuels

- Major countries: US, China, Japan, and Singapore

Source: 1. Philippine Statistical Authority 2. World Bank Data 3: Department of Trade and Industry 4. Business Mirror Philippines 5: Commission of Audit 6. Statista

1.2…however displaying the Growth in E-Commerce due to increasing Internet Penetration

Maximum Orders are placed online by People in the Age Group of 25-34 years1

Key Statistics

~75 Million

Smartphone Users in Philippines

~73 Million

Internet Users in Philippines

~8%

% of Men making Online Transactions

~12%

% of Women making Online Transactions

E-Commerce Growth by Category over 2019 in terms of GMV2

+14%

Electronics & Physical Media

+20%

Foods & Personal Care

Online Shopping Trends

- Philippines saw the highest increase in the usage of shopping apps on Android phones, spending 53% more time in the 2nd quarter of 2020 compared to the 1st quarter of the year. The total number of sessions in shopping apps reached 4.9 billion3.

- The increase in online shopping and access to online bank transactions is increasing payment in the Philippines. Vendors are turning to online payment as a convenient buying method. However, the security concerns over platforms and a cash-based society’s culture limits its effectiveness.

- Philippines bucked the regional trend when it comes to the electronics category, which saw a huge (~50%) web traffic growth rate showcasing the increased demand for gadgets during social distancing.

Source: 1. Proprietary Database 2. Digital Philippines Report 3. Newspaper Articles

2. Philippines witnessed a large increase in Online Shoppers with 46Mn in 2020...

~46Mn Online Shoppers Spending ~PHP 35.5 Thousand Annually

E-Commerce Industry GMV grew @ 48.3% CAGR during 2015-20

Key Trends Observed

.png) Internet Penetratio

Internet Penetratio

Of the total 109.5 Mn population in Philippines, 67%1 (73 Mn) are the Internet Users, second largest in Southeast Asia in 2020. ~63% of the total Internet Users in Philippines are Online Shoppers.

.png) Government Initiative

Government Initiative

Philippines e-Commerce Roadmap 2016-20, with a goal to get online business activities to account for 25%2 of the country’s GDP by 2020, up from 10% in 2015.

.png) Time spent on Internet

Time spent on Internet

109.5 mn people in the country accounted for a young, tech-savvy group of Millennial & Gen Z consumers spending on an average 101 hours and two minutes every day using Internet, resulting in higher number of orders in 2020

Payment Method

Payment Method

Companies are increasingly extending their reach in other provinces as well apart from Metro Manila i.e. Visayas and Mindanao

COVID Impact

COVID Impact

Out of 91%3 internet users in Philippines searching for goods and services to purchase during the quarantine period, 76% consummated the transaction.

Source: 1) Hootsuite and We Are Social (2019) 2) DTI 3) Business World Interviews with E-Commerce Industry Experts, Ken Research Analysis

2.1...owing to Convenience & Huge Discounts offered by Leading Marketplace Platforms

Market Segmentation

Product Category

- Gadgets & electronics are the top eCommerce product category, followed by Fashion & Footwear in total Online Purchases in 2020.

- Beauty Care is the Third leading E-Commerce category wherein demand is increasing for Grooming products, Hair care and Skin Care in 2020.

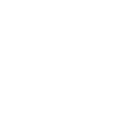

Reasons for Online Shopping1, 2020P

Preference

Type of Shipments

- Domestic shipments accounted for >90% of the total transactions wherein remaining is accounted by International Shipments for 2020.

- Thus, companies keep their focus on finding a reliable cross-border shipping partner & last-mile delivery provider that can deliver packages nationwide, without drastically increasing shipping fees.

Market Competition*

Company Strategies & Developments

- Online Marketplaces such as Lazada & Shopee notably strengthened their B2C segments through Lazmall & Shopee Mall - to highlight the established retailers using their platforms.

- Companies like Zalora, is looking forward to develop a country-agnostic shipping strategy, that will offer consumers products from both local and international players, thereby increasing cross border e-commerce

- SM Retail Inc, one of the largest retailer in the country, launched its own e-commerce platform, ShopSM, in 2019. Site carries variety of items from beauty products, baby products to footwears. Customers can earn points using SM Advantage/Prestige loyalty cards.

Source: 1) The Ultimate Ecommerce Guide To Shipping To Philippines 2020 By Janio, Online Survey conducted by Ken Research

Interviews with E-Commerce Industry Experts, Ken Research Analysis

* Companies are ranked on the Basis of GMV

3. The e-commerce logistics industry is Currently Positioned In the Growth Stage due to the Increasing Penetration of the E-Commerce Market in Philippines

Increasing E-Commerce Penetration and Digital Shift Likely to Drive the Market in the Coming Years

Phase driven by entrance of major e-commerce logistics players and e-logistics aggregators

I: Introduction Phase <2012

- Introduction of industry by major players such as LBC Express, 2GO Express, JRS Express and Air21 between 1945 and 1980.

- Industry was driven by investment by e-commerce companies such as Lazada and Kimstore.

- Industry has witnessed emergence of e-commerce logistics aggregators to facilitate delivery of small order volume.

Increased demand of E-Logistics due to increasing penetration of e-commerce

II: Growing Phase 2012- 2035

- Expansion of service portfolio which included return pickups , try and buy services, instant remittances, locker services, e-fulfillment.

- Introduction of technological advancements such as WMS , Big data analytics for forecasting and fleet management system for route optimization.

- Surge in average daily orders due to entrance of players like Shopee, Zalora, eBay, Galleon and others.

- Increasing trend of E-Commerce logistics aggregators to cater to needs of MSMEs.

Industry expected to reach maturity phase driven by stable e-commerce growth and increasing price wars among major players

III: Late Growth Phase >2035

- Technological development such as drone deliveries expected to enable quicker deliveries and Robots to ensure smooth fulfillment of orders.

- Intense competition among players leading to price wars.

- Increasing share of 3PL companies.

- High market consolidation as players with heavy financial backing and better brand value will acquire small players.

Market Nature

- Highly Concentrated competition with presence of 15-20 players in the industry

Market Drivers

- Digital shift, growing middle class, growing e-commerce penetration and government support

MMarket Restraints

- Complicated customs process, unique geography and low trust on digital payments

Source: Industry Articles, Company Websites, Interviews with E-Commerce Logistics Industry Experts and Ken Research Analysis

4. Growing Government Support along with Digital Penetration among Filipinos has complemented the growth in Philippines E-Commerce Logistics

Growing Middle Class & Brand Awareness

- Philippines has sustained average annual growth of 6.3% from 2010 - 20181, up from an average of 4.5% from 2000 - 2009 and is on its way to becoming an upper-middle income country in the near term.

- Growing awareness among Filipino consumers about global brands as well as preferences for improved and latest fashion trends and technologies has heightened the demand.

Digital Shift and New Technologies

- The number of internet users in the country has increased from 47.4 million 2015 to 73.0 million in 20202.

- Increasing usage of advanced mobile applications and banking solutions for the customers has made it easier for them to shop online, which further intensified the e-commerce logistics market in the Philippines.

- Faster deliveries and live tracking are the trends recently witnessed in the country for better and convenient deliveries.

Emergence of New E-Commerce Players

- Introduction of multiple E-commerce portals such as b2bpricenow, asiarx, the Philippines trade key & others have led to increase in online shopping and digital payment modes.

- Some of the popular startups launched in the Philippines include zennya, Sprout Solutions, Coins.ph, Kalibrr, mClinica Ayannah, Squadzip, engageSPARK, Edukasyon.ph, Pushkart.ph and several others.

Growing Government Support

- The country’s Department of Trade and Industry (DTI) developed the Philippines eCommerce Roadmap (2016-2020)3 with a primary goal of getting online business activities to account for 25% of the country’s GDP by 2020, up from 10% in 2015.

- The main focus areas are Infrastructure, Investments and Innovation is in the process of building clear rules and support systems for customers and other online merchants.

Online Grocery Logistics

- Filipinos spend half their earnings on food which is a tremendous opportunity for online grocery shopping or niche food related e-commerce businesses.

- Some of the major companies operating in online grocery in the Philippines include Pushkart PH, PhilGrocer.com, MetroMart, Walter Mart Grocery Delivery, The Green Grocer, Down to Earth and Happy Fresh.

1. World Bank Data 2. Digital Philippines Report 3. DTI Philippines

Source: Industry Articles, Company Websites, Interviews with Philippines E-Commerce Logistics Industry Experts and Ken Research Analysis

5. Several Technological Disruptions in E-commerce Logistics Industry...

Technological Disruptions

Aggregators

-

Faster turnaround with Sorted Inventory, Optimise Costs, More warehousing Fulfilment Centres

-

Warehousing and Trucking Aggregators, WMS/TMS, RFID tagging, ASRS

-

JRS, Entrego, Ninjavan, E-Com Express, Shopee Xpress

-

Trucking Aggregators (RLH, Cartrex) , WMS(Fasttract Solutions, Oracle, Schmidt), RFID (IoT Phil.)

Digital Up gradation

-

Faster turnaround, Cost optimization, Track transactions, Manage Data Volumes

-

Cloud, Big Data and Embedded Analytics Voice Directed Technology, Block chain, IOT

-

J&T Express, LBC Express

-

Appsolutely, BCS

Drone Technology

- In-house inventory monitoring

Asset performance monitoring

Drone makers claim scanning accuracy of close to 100%

-

My Drone Service, Skyeye

Marketing , Sales and Customer Experience

-

Consumers will be able to initiate and receive package digitally, track real time status, change pick-up and drop off locations at last minute

-

Delivery through Smart Lockers, Virtual Assistant Support Features

-

LEL Express, Shopee Express, Ninjavan, LBC Express

-

SmartBox Technologies For Smart Lockers

Futuristic Advancements

-

Manufacturing at retail location Expected to revolutionize distribution centers.

- Amazon Fly: 3D printing delivery truck, prints product as soon as an order is placed, on spot

Source: Industry Articles, Interviews conducted with Industry Experts in Philippines E-Commerce Logistics Market and Ken Research Analysis

5.1 …leading to huge impact on delivery of E-Commerce Shipments and driving the growth of the market in the future

| Stage |

Technological Advancements |

Impact |

| Line Haul |

- Route Planning and Optimization

- Real Time Delivery Report

|

- Warehouse Management with Real Time Shipment Tracking

- Transport Schedule Management

|

- Trend Analysis and Visual Data Representation

|

- 80% increase in damage protection

- 25%increase in vehicle utilization

- 20% increase in line haul visibility

- 45% decrease in maintenance cost

- 50% decrease in loading-unloading time

- 18% decreased carbon footprints

|

| Last Mile Delivery |

- Real time tacking

- Automated Planning and Optimization

- Real time ETA Calculations

|

- Electronic Proof of Delivery

- Dynamic Re-Routing

- Delivery Route Planning Visualization

|

- Interactive Planning Dashboard

|

- 35% increase in number of deliveries

- 20% increase in delivery resource optimization

- 40% increased route planning accuracy

- 40% decreased delay deliveries

- 25% decreased extra resource cost

- 19% decreased fuel consumption

|

| Reverse Logistics |

- Reverse Delivery Allocation

- RTO and RTM Delivery Management

- Route Planning Visualization

|

- Advance Geo-coding

- Automated Optimization

- Advanced Dashboard

|

|

- 45% increased route optimization

- 30% increased real time visibility

- 40% increase reverse channel efficiency

- 40% decreased turnaround time

- 12% increased overall delay

- 20% decreased reverse pickup cost

|

Source: Interviews conducted with major players in Philippines E-Commerce Market, Industry Articles, Newsletters, Ken Research Analysis

.png) Internet Penetratio

Internet Penetratio

.png) Government Initiative

Government Initiative

.png) Time spent on Internet

Time spent on Internet

Payment Method

Payment Method

COVID Impact

COVID Impact

.png)