Region:North America

Author(s):Dev

Product Code:KRAD5154

Pages:93

Published On:December 2025

By Component:

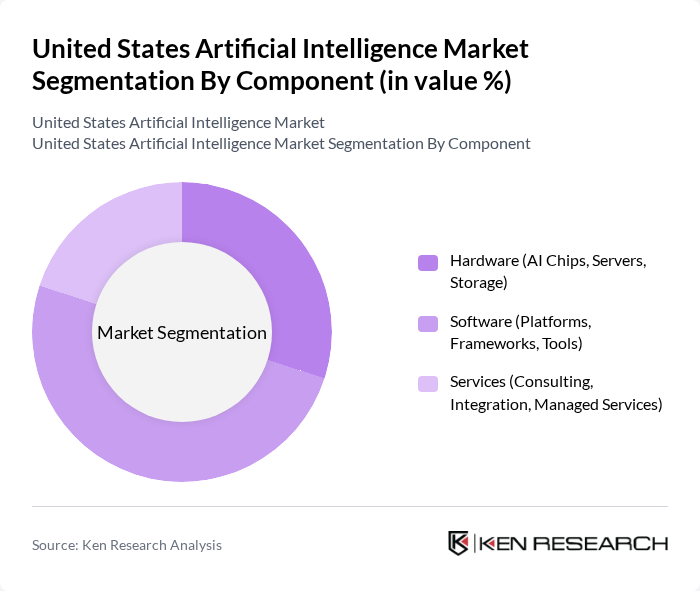

The United States Artificial Intelligence Market is segmented into three main components: Hardware, Software, and Services. Among these, the Software segment is currently dominating the market due to the increasing demand for AI platforms and tools that facilitate machine learning, natural language processing, computer vision, and generative AI workloads. Businesses are increasingly adopting AI software solutions, including AI-as-a-Service delivered via cloud platforms, to enhance operational efficiency, automate workflows, strengthen decision-making, and improve customer engagement. The rise of cloud computing and hyperscale data centers has also contributed to the growth of software solutions, as organizations seek scalable and flexible AI applications that can integrate with existing IT and data infrastructure. Hardware, including specialized AI chips such as GPUs, TPUs, and accelerators, is growing rapidly as a foundation for training and inference, but is often seen as a supporting element to the more dynamic software and services ecosystem.

By Technology:

The market is also segmented by technology, including Machine Learning, Deep Learning, Natural Language Processing (NLP), Computer Vision, Robotics & Automation, and Expert Systems. Machine Learning is the leading technology segment, driven by its wide applicability across various industries, including finance, healthcare, retail, manufacturing, and government services. The increasing volume of structured and unstructured data generated by businesses has necessitated the use of machine learning algorithms to derive actionable insights, optimize operations, and personalize products and services. Deep Learning follows closely, particularly in applications involving image and speech recognition, recommendation systems, and generative AI models, while NLP is gaining strong traction due to the rise of conversational AI, virtual assistants, chatbots, and large language models used in customer service, productivity tools, and developer platforms.

The United States Artificial Intelligence Market is characterized by a dynamic mix of regional and international players. Leading participants such as International Business Machines Corporation (IBM), Alphabet Inc. (Google Cloud AI & DeepMind), Microsoft Corporation (Azure AI), Amazon.com, Inc. (Amazon Web Services AI), NVIDIA Corporation, Meta Platforms, Inc. (Meta AI), Intel Corporation, Advanced Micro Devices, Inc. (AMD), Oracle Corporation (Oracle AI), SAP SE (SAP Business AI), Salesforce, Inc. (Salesforce Einstein & Data Cloud AI), OpenAI, L.L.C., Anthropic PBC, Palantir Technologies Inc., C3.ai, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. artificial intelligence market appears promising, driven by technological advancements and increasing integration across various sectors. As organizations prioritize digital transformation, AI is expected to play a pivotal role in enhancing operational efficiency and customer engagement. Moreover, the focus on ethical AI practices and regulatory compliance will shape the development of AI technologies, ensuring they align with societal values. This evolving landscape will likely foster innovation and create new business models, further solidifying AI's position in the economy.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (AI Chips, Servers, Storage) Software (Platforms, Frameworks, Tools) Services (Consulting, Integration, Managed Services) |

| By Technology | Machine Learning Deep Learning Natural Language Processing (NLP) Computer Vision Robotics & Automation Expert Systems and Others |

| By Application | Predictive Analytics & Forecasting Conversational AI & Virtual Assistants Image & Video Analytics Fraud Detection & Risk Management Recommendation & Personalization Engines Autonomous & Intelligent Systems |

| By Deployment Mode | Cloud On-Premise Hybrid |

| By Enterprise Size | Large Enterprises Small and Medium-sized Enterprises (SMEs) |

| By End Use Industry | Banking, Financial Services and Insurance (BFSI) Healthcare & Life Sciences Retail & E-commerce IT & Telecommunications Manufacturing Automotive & Transportation Government & Public Sector Media, Advertising & Entertainment Others |

| By Region | New England Mideast Great Lakes Plains Southeast Southwest Rocky Mountain Far West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Solutions | 100 | Healthcare IT Managers, Clinical Data Analysts |

| Financial Services AI Applications | 80 | Risk Management Officers, Financial Analysts |

| Manufacturing Automation Technologies | 70 | Operations Managers, Production Engineers |

| Retail AI Customer Experience Tools | 90 | Marketing Directors, Customer Experience Managers |

| AI in Transportation and Logistics | 75 | Logistics Coordinators, Fleet Managers |

The United States Artificial Intelligence Market is valued at approximately USD 54 billion, reflecting significant growth driven by advancements in machine learning, natural language processing, and increased investment across various sectors.