Region:Asia

Author(s):Rebecca

Product Code:KRAD4958

Pages:81

Published On:December 2025

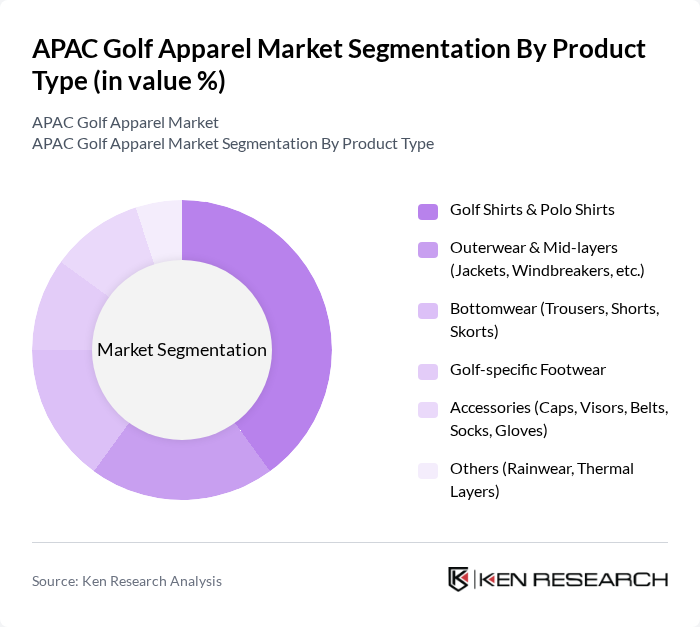

By Product Type:The product type segmentation of the APAC Golf Apparel Market includes various categories such as Golf Shirts & Polo Shirts, Outerwear & Mid-layers, Bottomwear, Golf-specific Footwear, Accessories, and Others. The segment structure aligns with global market practice where t?shirts and polo shirts are the leading category in golf apparel. Among these, Golf Shirts & Polo Shirts dominate the market due to their essential role in golf attire, combining functionality with style. The trend towards performance-oriented fabrics (stretch knits, moisture-wicking, UV-protection) and fashionable designs, as well as lifestyle crossover use off the course, has led to increased consumer preference for these items, making them a staple in golfers' wardrobes.

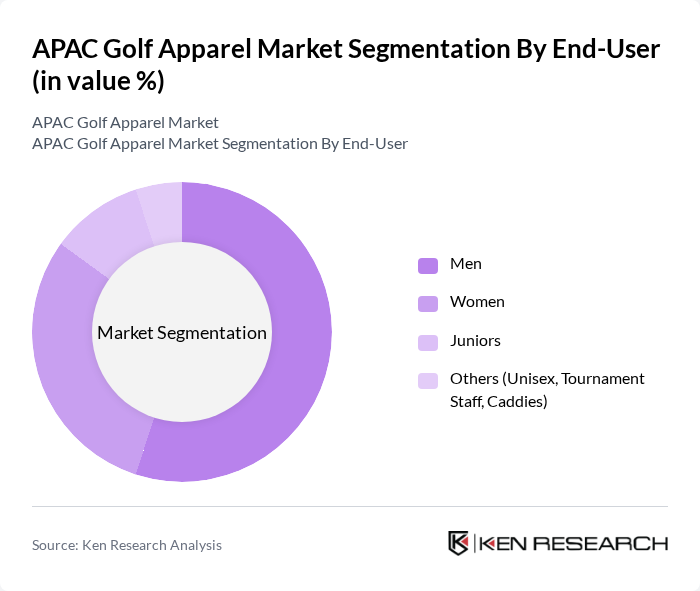

By End-User:The end-user segmentation of the APAC Golf Apparel Market includes Men, Women, Juniors, and Others. This structure is consistent with global golf apparel segmentation, where the men’s segment is the largest by revenue. The Men's segment is the largest, driven by the higher participation rates of men in golf and their demand for a wide range of apparel and footwear options for both professional and recreational play. However, the Women's segment is rapidly growing as more women take up golf, supported by initiatives from clubs and federations and by brands expanding women-specific lines, leading to increased offerings tailored specifically for female golfers and adding more fashion-forward and fit-focused designs, thus diversifying the market.

The APAC Golf Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., Puma SE, Callaway Golf Company, TaylorMade Golf Company, Inc., Mizuno Corporation, ASICS Corporation, FootJoy (Acushnet Holdings Corp.), DESCENTE Ltd., Honma Golf Co., Ltd., FILA Holdings Corp., Yonex Co., Ltd., Le Coq Sportif (Asia), New Balance Athletics, Inc. contribute to innovation, geographic expansion, and service delivery in this space, with many of these brands actively expanding golf-specific collections and partnering with professional tours and athletes in Asia.

The APAC golf apparel market is poised for continued growth, driven by increasing participation rates and rising disposable incomes. As consumers become more health-conscious and seek leisure activities, golf's appeal is expected to expand. Additionally, technological advancements in apparel, such as moisture-wicking fabrics and smart textiles, will likely enhance product offerings. Brands that adapt to these trends and focus on sustainability will be well-positioned to capture market share in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Golf Shirts & Polo Shirts Outerwear & Mid-layers (Jackets, Windbreakers, etc.) Bottomwear (Trousers, Shorts, Skorts) Golf-specific Footwear Accessories (Caps, Visors, Belts, Socks, Gloves) Others (Rainwear, Thermal Layers) |

| By End-User | Men Women Juniors Others (Unisex, Tournament Staff, Caddies) |

| By Distribution Channel | Golf Specialty & Pro Shops (On-course and Off-course) Sports & Department Stores Brand-owned Retail Stores Online Channels (E-commerce & Brand Websites) Others (Outlet Stores, Duty-free, Tournament Pop-up Stores) |

| By Material | Synthetic Performance Fabrics (Polyester, Nylon, Elastane) Natural Fibers (Cotton, Organic Cotton) Blended Fabrics Sustainable & Recycled Materials Others |

| By Price Range | Premium / Luxury Mid-range Mass / Economy Private Label & Off-price |

| By Country / Sub-region | China Japan South Korea Australia & New Zealand Southeast Asia (Thailand, Malaysia, Indonesia, Vietnam, Others) South Asia (India, Sri Lanka, Others) Rest of APAC |

| By Consumer Behavior | Performance-oriented Buyers Fashion & Lifestyle-oriented Buyers Value & Price-sensitive Buyers Sustainability-conscious Buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Golf Apparel Retailers | 140 | Store Managers, Buyers, Merchandisers |

| Golf Course Operators | 90 | General Managers, Pro Shop Managers |

| Golf Apparel Manufacturers | 70 | Product Development Managers, Marketing Directors |

| Golf Enthusiasts | 110 | Avid Golfers, Club Members |

| Industry Experts | 40 | Market Analysts, Sports Retail Consultants |

The APAC Golf Apparel Market is valued at approximately USD 1.1 billion, reflecting a robust growth trajectory driven by increasing golf participation, rising disposable incomes, and a growing trend towards athleisure and performance sportswear in the region.