Region:Asia

Author(s):Rebecca

Product Code:KRAE0856

Pages:89

Published On:December 2025

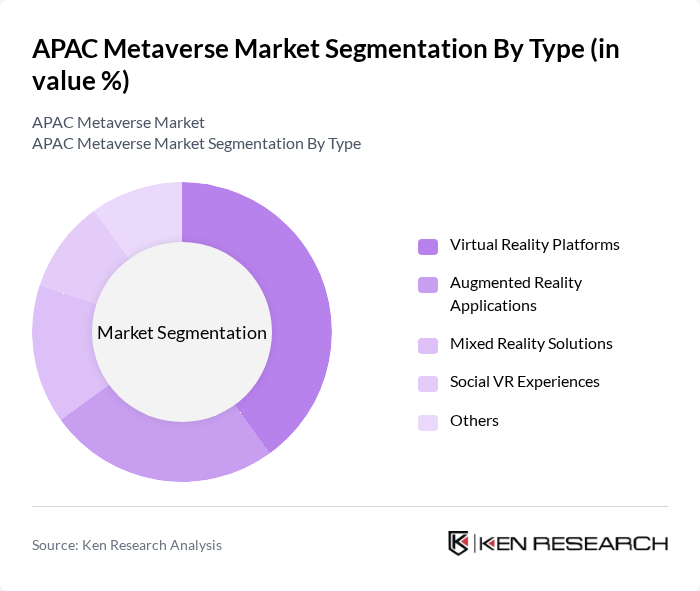

By Type:The APAC Metaverse Market is segmented into various types, including Virtual Reality Platforms, Augmented Reality Applications, Mixed Reality Solutions, Social VR Experiences, and Others. Among these, Virtual Reality Platforms are leading the market due to their immersive experiences that cater to gaming and entertainment sectors. The increasing adoption of VR headsets and advancements in technology are driving consumer interest and engagement in this segment.

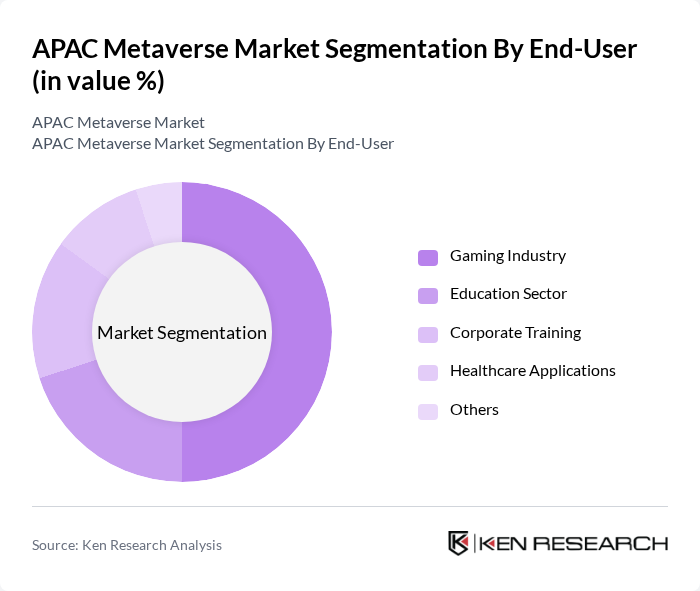

By End-User:The market is also segmented by end-user applications, including the Gaming Industry, Education Sector, Corporate Training, Healthcare Applications, and Others. The Gaming Industry dominates this segment, driven by the increasing popularity of online gaming and the demand for immersive experiences. The rise of esports and virtual reality gaming platforms has significantly contributed to the growth of this segment, attracting a large user base.

The APAC Metaverse Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meta Platforms, Inc., Roblox Corporation, Epic Games, Inc., Tencent Holdings Limited, Niantic, Inc., Unity Technologies, Inc., Microsoft Corporation, NVIDIA Corporation, Decentraland, Sandbox, HTC Corporation, Sony Interactive Entertainment, Square Enix Holdings Co., Ltd., Bandai Namco Holdings Inc., Valve Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The APAC metaverse market is poised for transformative growth, driven by technological advancements and increasing user engagement. As hybrid work environments become more prevalent, businesses are likely to leverage metaverse platforms for collaboration and training. Additionally, the integration of AI and machine learning will enhance user experiences, making virtual interactions more personalized and efficient. The focus on user-generated content will also foster community-driven ecosystems, further solidifying the metaverse's role in daily life and commerce across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Virtual Reality Platforms Augmented Reality Applications Mixed Reality Solutions Social VR Experiences Others |

| By End-User | Gaming Industry Education Sector Corporate Training Healthcare Applications Others |

| By Region | East Asia Southeast Asia South Asia Oceania |

| By Technology | D Modeling and Animation Cloud Computing Blockchain Integration AI and Machine Learning Others |

| By Application | Entertainment and Gaming Social Networking E-commerce Virtual Events Others |

| By Investment Source | Venture Capital Private Equity Government Grants Crowdfunding Others |

| By Policy Support | Tax Incentives Research and Development Grants Regulatory Frameworks Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gaming Industry Stakeholders | 150 | Game Developers, Publishers, and Marketing Executives |

| Virtual Reality Hardware Manufacturers | 100 | Product Managers, R&D Engineers, and Sales Directors |

| Content Creators in the Metaverse | 80 | Artists, Designers, and Influencers |

| End-Users of Metaverse Platforms | 200 | Gamers, VR Enthusiasts, and Casual Users |

| Investors in Metaverse Startups | 50 | Venture Capitalists, Angel Investors, and Financial Analysts |

The APAC Metaverse Market is valued at approximately USD 37 billion, driven by advancements in immersive technologies like AR and VR, as well as increasing digitalization in sectors such as gaming, retail, and education.