Region:Asia

Author(s):Dev

Product Code:KRAD7623

Pages:87

Published On:December 2025

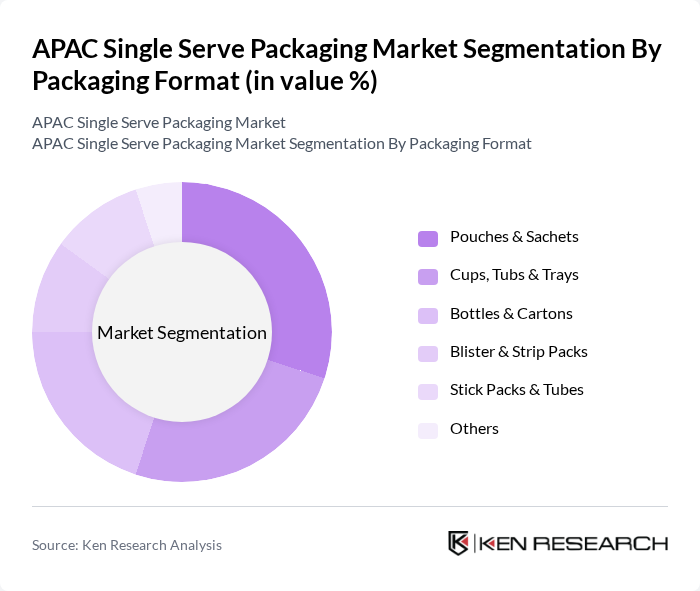

By Packaging Format:The packaging format segment includes various types such as pouches & sachets, cups, tubs & trays, bottles & cartons, blister & strip packs, stick packs & tubes, and others. Each format serves different consumer needs and preferences, influencing their market share.

The pouches & sachets segment is currently dominating the market due to their lightweight, convenience, and cost-effectiveness. They are widely used in the food and beverage industry for snacks, sauces, and single-serve portions, catering to the growing trend of on-the-go consumption. The versatility of pouches in terms of design and functionality also appeals to manufacturers, making them a preferred choice for packaging.

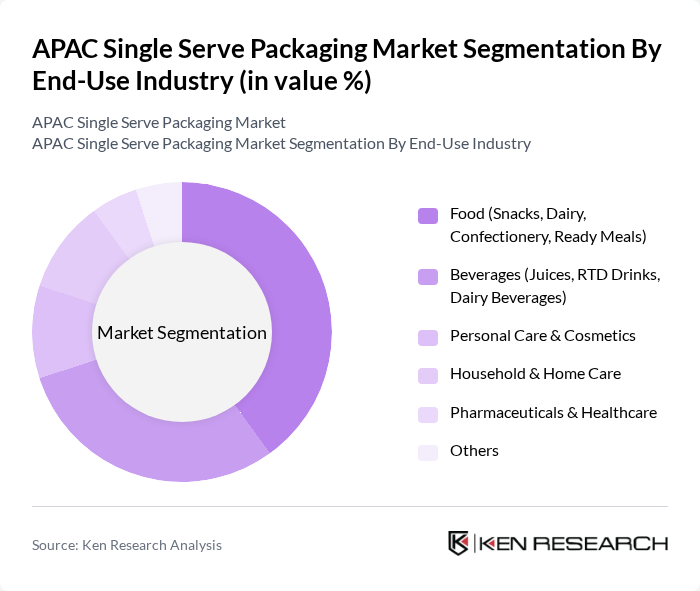

By End-Use Industry:This segment encompasses various industries including food (snacks, dairy, confectionery, ready meals), beverages (juices, RTD drinks, dairy beverages), personal care & cosmetics, household & home care, pharmaceuticals & healthcare, and others. Each industry has unique packaging requirements that influence the choice of single-serve formats.

The food segment, particularly snacks and ready meals, is leading the market due to the increasing demand for convenient meal options among busy consumers. The rise in snacking culture and the preference for portion-controlled packaging are driving growth in this segment. Additionally, the expansion of e-commerce platforms has further boosted the demand for single-serve food packaging.

The APAC Single Serve Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Huhtamaki Oyj, Tetra Pak International S.A., Mondi Group, Berry Global, Inc., Toyo Seikan Group Holdings, Ltd., Nippon Paper Industries Co., Ltd., Sealed Air Corporation, Uflex Ltd., Constantia Flexibles, Sonoco Products Company, WestRock Company, Winpak Ltd., ProAmpac LLC, Graphic Packaging Holding Company contribute to innovation, geographic expansion, and service delivery in this space.

The APAC single-serve packaging market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, companies are expected to innovate with eco-friendly materials and smart packaging solutions. The integration of technology, such as QR codes and NFC tags, will enhance consumer engagement and provide valuable product information. Additionally, the expansion of e-commerce and food delivery services will continue to shape packaging designs, emphasizing convenience and sustainability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Packaging Format | Pouches & Sachets Cups, Tubs & Trays Bottles & Cartons Blister & Strip Packs Stick Packs & Tubes Others |

| By End-Use Industry | Food (Snacks, Dairy, Confectionery, Ready Meals) Beverages (Juices, RTD Drinks, Dairy Beverages) Personal Care & Cosmetics Household & Home Care Pharmaceuticals & Healthcare Others |

| By Material | Plastics (PE, PP, PET, Others) Paper & Paperboard Aluminum Foil & Metal Laminates Glass Bioplastics & Other Sustainable Materials |

| By Distribution Channel | Supermarkets & Hypermarkets Convenience Stores Online Retail & E-commerce Foodservice & HoReCa Others |

| By Country | China Japan South Korea India ASEAN (Indonesia, Thailand, Vietnam, Malaysia, Others) Australia & New Zealand Rest of APAC |

| By Application | Ready-to-Eat Meals & Meal Kits Snacks & Confectionery Dairy & Frozen Desserts Hot & Cold Beverages Nutraceuticals & Dietary Supplements Others |

| By Sustainability Focus | Recyclable Mono-Material Packaging Biodegradable & Compostable Packaging Lightweighting & Material Reduction Reusable & Refillable Formats Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging Innovations | 120 | Product Development Managers, Brand Strategists |

| Consumer Preferences in Single-Serve Packaging | 100 | Market Research Analysts, Consumer Insights Managers |

| Sustainability Practices in Packaging | 80 | Sustainability Officers, Compliance Managers |

| Retail Sector Packaging Solutions | 100 | Retail Managers, Supply Chain Coordinators |

| Emerging Trends in Packaging Technology | 90 | Technology Officers, R&D Managers |

The APAC Single Serve Packaging Market is valued at approximately USD 2 billion, driven by increasing consumer demand for convenience, urbanization, and changing dietary habits. This market is expected to grow further as disposable incomes rise and e-commerce expands.