Region:Asia

Author(s):Rebecca

Product Code:KRAC2480

Pages:82

Published On:October 2025

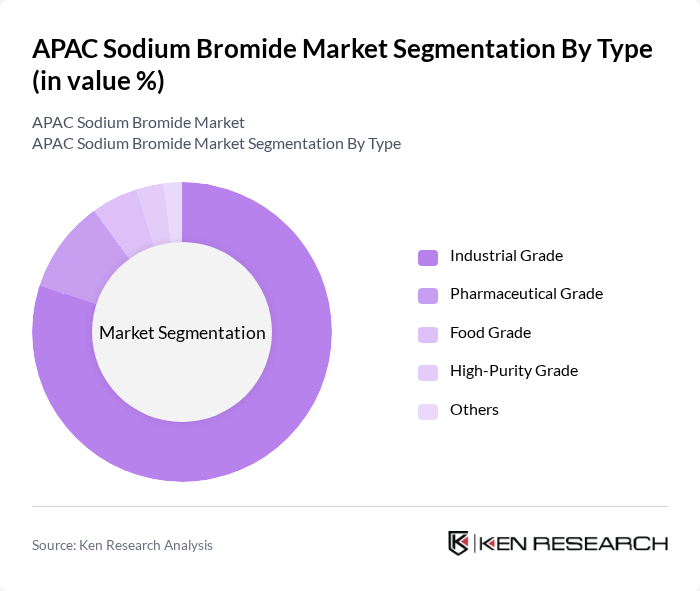

By Type:The market is segmented into various types, including Industrial Grade, Pharmaceutical Grade, Food Grade, High-Purity Grade, and Others. Each type serves distinct applications and industries, with specific quality and purity requirements. Industrial Grade sodium bromide holds the largest share in the APAC market, primarily due to its extensive use in oil and gas drilling fluids and as a flame retardant in various industrial applications. The demand for this grade is driven by the increasing exploration activities in the oil and gas sector, particularly in China and India. Additionally, the growth of the chemical manufacturing industry further supports the dominance of this segment .

The Industrial Grade sodium bromide segment is the leading sub-segment in the market, primarily due to its extensive use in oil and gas drilling fluids and as a flame retardant in various industrial applications. The demand for this grade is driven by the increasing exploration activities in the oil and gas sector, particularly in China and India. Additionally, the growth of the chemical manufacturing industry further supports the dominance of this segment .

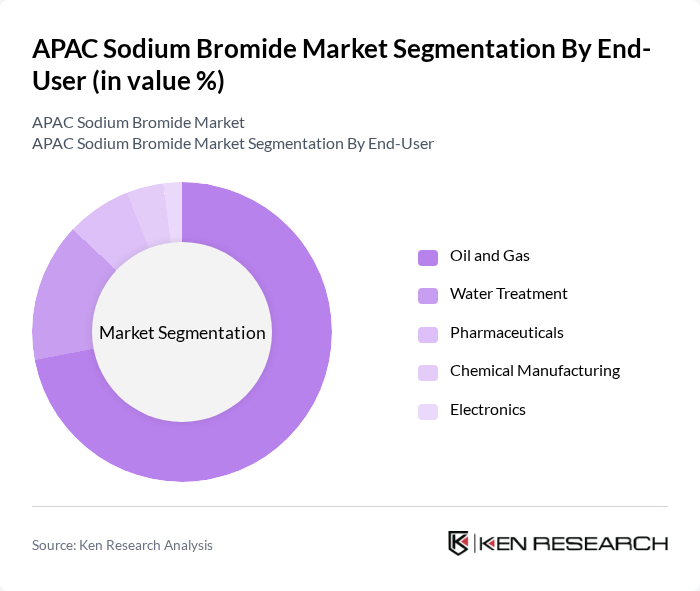

By End-User:The market is categorized based on end-users, including Oil and Gas, Water Treatment, Pharmaceuticals, Chemical Manufacturing, Electronics, and Others. Each end-user segment has unique requirements and applications for sodium bromide. The Oil and Gas sector is the dominant end-user of sodium bromide, primarily due to its critical role in drilling fluids, which are essential for the extraction of oil and gas. The increasing exploration and production activities in the APAC region, particularly in offshore drilling, have significantly boosted the demand for sodium bromide in this sector. Additionally, the Water Treatment segment is also growing rapidly, driven by the need for effective water purification solutions .

The Oil and Gas sector is the dominant end-user of sodium bromide, primarily due to its critical role in drilling fluids, which are essential for the extraction of oil and gas. The increasing exploration and production activities in the APAC region, particularly in offshore drilling, have significantly boosted the demand for sodium bromide in this sector. Additionally, the Water Treatment segment is also growing rapidly, driven by the need for effective water purification solutions .

The APAC Sodium Bromide Market is characterized by a dynamic mix of regional and international players. Leading participants such as Albemarle Corporation, ICL Group Ltd., Shandong Haiwang Chemical Co., Ltd., Jordan Bromine Company, Tosoh Corporation, TETRA Technologies, Inc., Gulf Resources Inc., Shandong Tianxin Pharma-Tech Co., Ltd., Jiangsu World Chemical Industry Co., Ltd., Shandong Tianyi Chemical Co., Ltd., LANXESS AG, Solvay S.A., Merck KGaA, Chemtura Corporation (now part of LANXESS), Shandong Dongyue Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC sodium bromide market is poised for significant growth, driven by increasing applications across various industries, including oil and gas, water treatment, and pharmaceuticals. As companies adapt to stringent environmental regulations, there will be a shift towards sustainable production practices. Additionally, technological advancements in production methods are expected to enhance efficiency and reduce costs. The focus on high-purity sodium bromide will likely continue, aligning with the growing demand for quality in pharmaceuticals and specialty chemicals.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Pharmaceutical Grade Food Grade High-Purity Grade Others |

| By End-User | Oil and Gas Water Treatment Pharmaceuticals Chemical Manufacturing Electronics Others |

| By Application | Drilling Fluids Flame Retardants Water Purification Photographic Chemicals Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | China India Japan Southeast Asia Rest of APAC |

| By Packaging Type | Bulk Packaging Bagged Packaging Drum Packaging |

| By Price Range | Low Price Medium Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | Formulation Scientists, Quality Control Managers |

| Agricultural Uses | 80 | Agronomists, Crop Protection Specialists |

| Water Treatment Sector | 60 | Environmental Engineers, Water Quality Analysts |

| Oil and Gas Industry | 50 | Production Engineers, Chemical Procurement Managers |

| Research and Development | 70 | R&D Directors, Chemical Engineers |

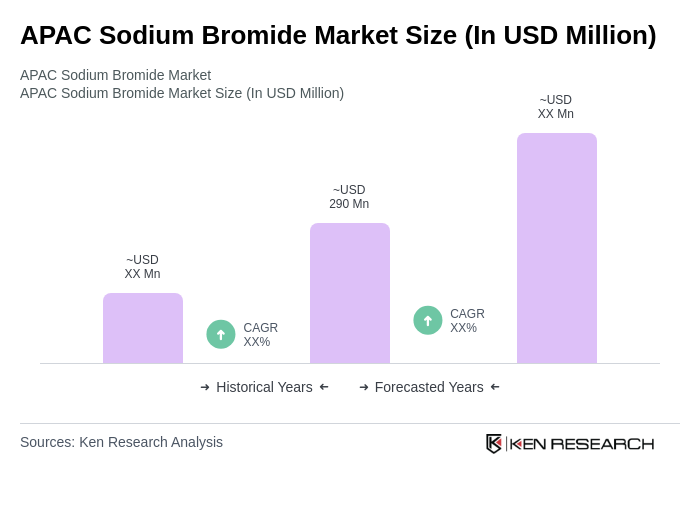

The APAC Sodium Bromide Market is valued at approximately USD 290 million, reflecting significant growth driven by increasing demand across various applications such as oil and gas drilling, water treatment, and pharmaceuticals.