Region:Asia

Author(s):Shubham

Product Code:KRAC2144

Pages:99

Published On:October 2025

By Type:The market is segmented into various types, including Space Debris Monitoring, Space Debris Removal, Space Situational Awareness (SSA) Services, Collision Prediction and Avoidance Maneuver Support, Consultation and Risk Assessment Services, and Research and Development Services. Among these, Space Debris Monitoring is currently the leading sub-segment due to the increasing demand for tracking and identifying debris in orbit. The rise in satellite launches and the adoption of AI-enabled tracking systems have heightened the need for effective monitoring solutions to prevent collisions and ensure the safety of space operations .

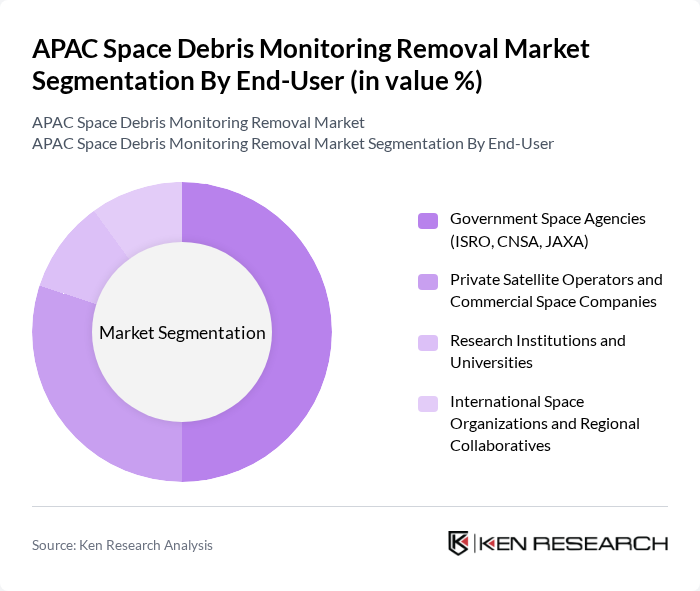

By End-User:The end-user segmentation includes Government Space Agencies, Private Satellite Operators and Commercial Space Companies, Research Institutions and Universities, and International Space Organizations and Regional Collaboratives. Government Space Agencies are the dominant segment, primarily due to their significant funding and resources allocated for space debris management initiatives. These agencies are increasingly collaborating with private entities to enhance their capabilities in monitoring and removing space debris .

The APAC Space Debris Monitoring Removal Market is characterized by a dynamic mix of regional and international players. Leading participants such as Astroscale Holdings Inc., LeoLabs Inc., Northrop Grumman Corporation, Airbus Defence and Space, Lockheed Martin Corporation, Rocket Lab USA Inc., Momentus Inc., SpaceX, Japan Aerospace Exploration Agency (JAXA), Indian Space Research Organisation (ISRO), China National Space Administration (CNSA), China Academy of Space Technology (CAST), European Space Agency (ESA) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC space debris monitoring and removal market is poised for significant evolution, driven by technological advancements and increased collaboration among stakeholders. As governments and private entities prioritize sustainable space practices, innovative solutions such as AI-powered tracking and contactless debris removal methods are expected to gain traction. Furthermore, the establishment of international partnerships will enhance resource sharing and knowledge exchange, fostering a more robust framework for addressing the challenges posed by space debris in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Space Debris Monitoring (Ground-based radars, optical sensors, AI-powered tracking systems) Space Debris Removal (Robotic arms, harpoons, nets, propulsion-based deorbiting) Space Situational Awareness (SSA) Services Collision Prediction and Avoidance Maneuver Support Consultation and Risk Assessment Services Research and Development Services |

| By End-User | Government Space Agencies (ISRO, CNSA, JAXA) Private Satellite Operators and Commercial Space Companies Research Institutions and Universities International Space Organizations and Regional Collaboratives |

| By Region | North Asia (China, Japan, South Korea) Southeast Asia (ASEAN nations) South Asia (India) Oceania (Australia) |

| By Technology | Laser-based Removal and Laser Ranging Systems Net-based Capture and Deorbiting Harpoon-based Capture Mechanisms Robotic Arms and Autonomous Removal Platforms Ion-beam Shepherding and Contactless Approaches |

| By Debris Size | Micro-debris (1mm to 1cm) Small Debris (1cm to 10cm) Large Objects (Greater than 10cm) |

| By Orbit Type | Low Earth Orbit (LEO) Medium Earth Orbit (MEO) Geostationary Orbit (GEO) |

| By Application | Satellite Operations and Constellation Management Space Exploration Missions Commercial Launch and Satellite Services Earth Observation and Remote Sensing |

| By Investment Source | Government Funding and Space Agency Budgets Private Venture Capital and Corporate Investments International Grants and Collaborative Funding |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Space Agencies | 60 | Policy Makers, Space Program Directors |

| Aerospace Engineering Firms | 50 | Lead Engineers, R&D Managers |

| Satellite Manufacturers | 40 | Product Development Managers, Operations Directors |

| Environmental NGOs focused on Space | 40 | Program Coordinators, Advocacy Directors |

| Academic Institutions researching Space Debris | 45 | Research Professors, Graduate Students |

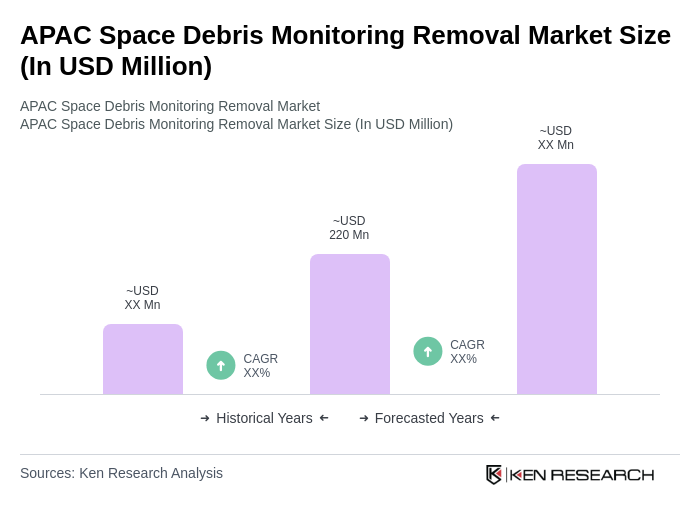

The APAC Space Debris Monitoring Removal Market is valued at approximately USD 220 million, reflecting a significant increase driven by the growing number of satellites, concerns over space safety, and advancements in tracking technologies.