Region:Asia

Author(s):Dev

Product Code:KRAC4037

Pages:97

Published On:October 2025

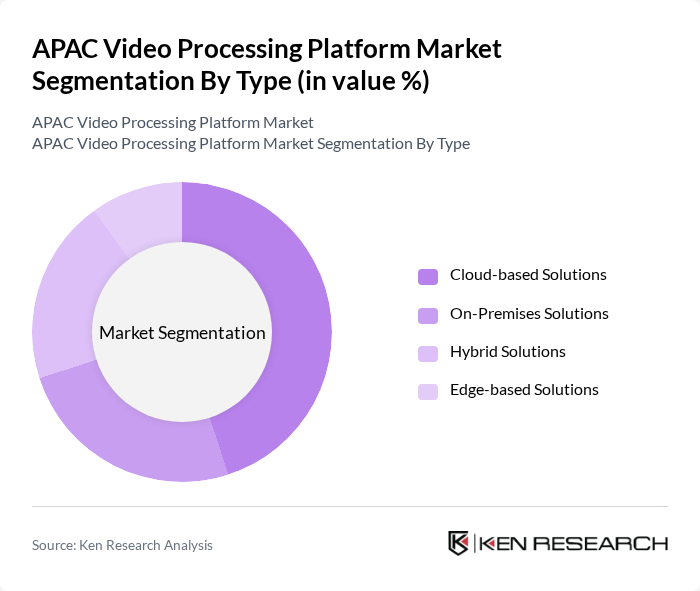

By Type:The market is segmented into four types: Cloud-based Solutions, On-Premises Solutions, Hybrid Solutions, and Edge-based Solutions. Each of these segments addresses distinct customer needs, with cloud-based solutions gaining significant traction due to their scalability, cost-effectiveness, and ability to support real-time, multi-device video processing. The adoption of edge-based and hybrid solutions is also rising, particularly for applications requiring low latency and localized processing in sectors such as live streaming and security .

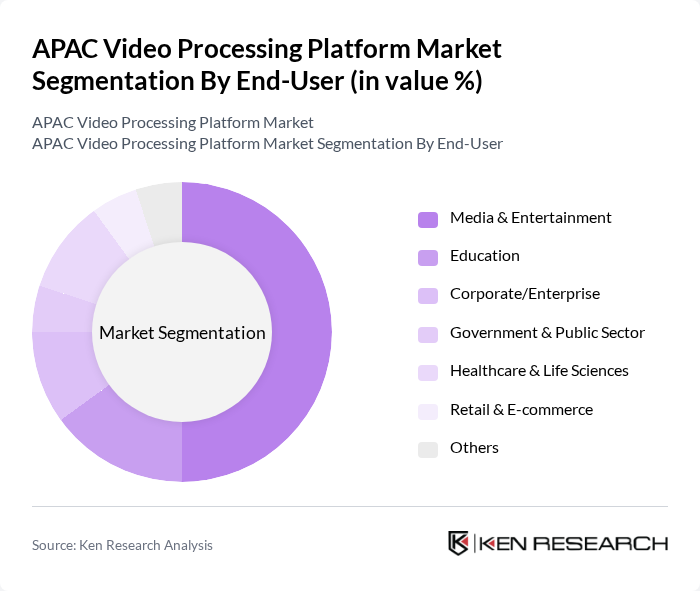

By End-User:The end-user segmentation includes Media & Entertainment, Education, Corporate/Enterprise, Government & Public Sector, Healthcare & Life Sciences, Retail & E-commerce, and Others. The Media & Entertainment sector is the largest consumer of video processing platforms, driven by the increasing demand for high-quality video content, live streaming, and OTT services. Education and healthcare are also emerging as significant segments, leveraging video processing for remote learning, telemedicine, and digital collaboration .

The APAC Video Processing Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as Akamai Technologies, Inc., Amazon Web Services, Inc., Alibaba Cloud (Alibaba Group Holding Limited), Tencent Cloud (Tencent Holdings Limited), Harmonic Inc., Brightcove Inc., Kaltura, Inc., Wowza Media Systems, LLC, Blackmagic Design Pty Ltd, Panasonic Corporation, IBM Corporation, Microsoft Corporation, Google LLC, Telestream, LLC, DaVinci Resolve (Blackmagic Design Pty Ltd) contribute to innovation, geographic expansion, and service delivery in this space .

The APAC video processing platform market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As 5G networks expand, enabling faster data transmission, the demand for real-time video processing will increase. Furthermore, the integration of AI technologies will enhance user experiences through personalized content delivery. Companies that adapt to these trends and invest in innovative solutions will likely capture significant market share, positioning themselves favorably in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based Solutions On-Premises Solutions Hybrid Solutions Edge-based Solutions |

| By End-User | Media & Entertainment Education Corporate/Enterprise Government & Public Sector Healthcare & Life Sciences Retail & E-commerce Others |

| By Region | East Asia (China, Japan, South Korea) Southeast Asia (Singapore, Indonesia, Malaysia, Thailand, Vietnam, Philippines, Others) South Asia (India, Bangladesh, Sri Lanka, Others) Oceania (Australia, New Zealand, Others) |

| By Application | Live Streaming Video Editing & Post-Production Video Transcoding & Encoding Video Analytics & AI-based Processing Video Distribution & Delivery Security & Surveillance Others |

| By Sales Channel | Direct Sales Online Sales Distributors/Resellers System Integrators Others |

| By Pricing Model | Subscription-based Pay-per-use One-time License Fee Freemium/Ad-supported Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Individual Content Creators Broadcasters & OTT Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Broadcasting Sector Video Processing | 100 | Broadcast Engineers, Technical Directors |

| OTT Platform Video Solutions | 90 | Product Managers, Content Delivery Network Specialists |

| Gaming Industry Video Processing | 80 | Game Developers, Technical Artists |

| Corporate Video Production | 60 | Video Production Managers, Marketing Directors |

| Educational Video Content Providers | 50 | Instructional Designers, E-learning Developers |

The APAC Video Processing Platform Market is valued at approximately USD 2.5 billion, driven by the increasing demand for high-quality video content, the rise of streaming services, and advancements in video processing technologies across various sectors.