Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0274

Pages:87

Published On:August 2025

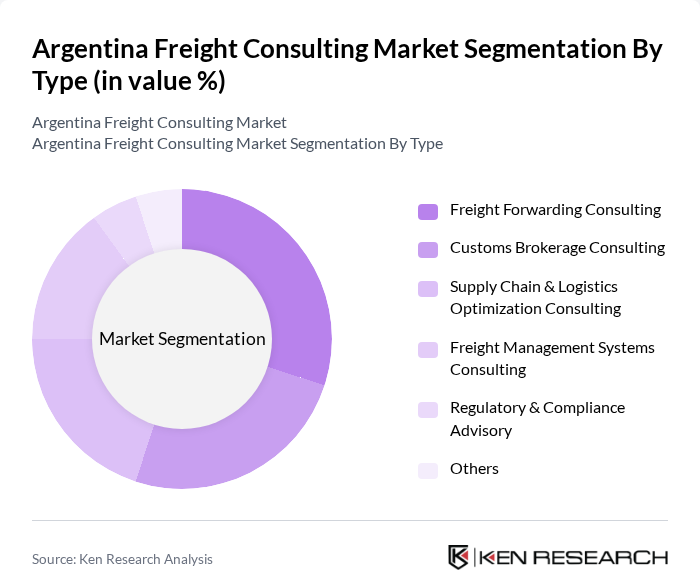

By Type:The market is segmented into various consulting types, including Freight Forwarding Consulting, Customs Brokerage Consulting, Supply Chain & Logistics Optimization Consulting, Freight Management Systems Consulting, Regulatory & Compliance Advisory, and Others. Each of these segments addresses specific needs such as optimizing freight movement, navigating customs regulations, enhancing supply chain efficiency, implementing technology-driven management systems, and ensuring adherence to evolving regulatory requirements .

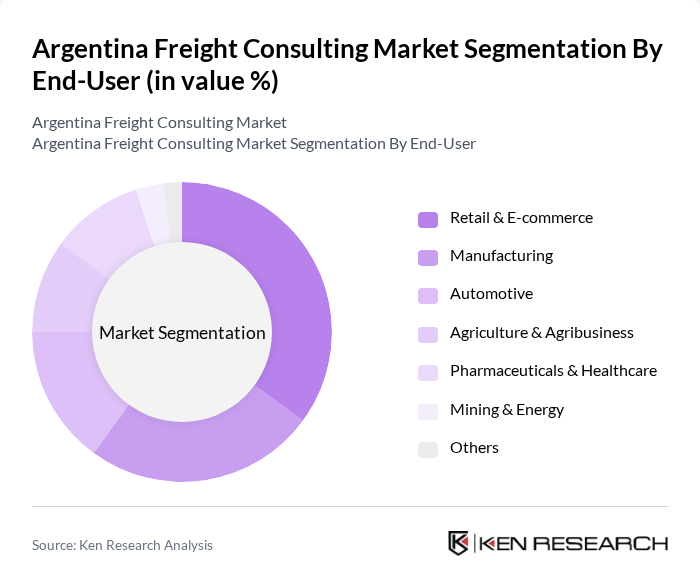

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Automotive, Agriculture & Agribusiness, Pharmaceuticals & Healthcare, Mining & Energy, and Others. Each sector has distinct requirements for freight consulting services: Retail & E-commerce demands rapid delivery and last-mile optimization; Manufacturing and Automotive focus on supply chain efficiency and cost control; Agriculture & Agribusiness prioritize export logistics; Pharmaceuticals & Healthcare require regulatory compliance and cold chain solutions; Mining & Energy need specialized transport and safety compliance; while Others cover a range of niche logistics needs .

The Argentina Freight Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Andreani Logística S.A., TASA Logística, Rivas S.A., Transfarmaco S.A., Clover Logística, DHL Supply Chain Argentina, Kuehne + Nagel Argentina, DB Schenker Argentina, CEVA Logistics Argentina, Geodis Argentina, DSV Argentina, Expeditors International Argentina, C.H. Robinson Argentina, Panalpina (now DSV Panalpina), XPO Logistics Argentina, Agility Logistics Argentina, Toll Group Argentina, SEKO Logistics Argentina contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Argentina freight consulting market appears promising, driven by ongoing trends in digital transformation and sustainability. As companies increasingly adopt advanced technologies like AI and data analytics, the demand for consulting services that facilitate these transitions will grow. Additionally, the focus on sustainable logistics practices will encourage firms to seek expert guidance on implementing green solutions, ensuring compliance with environmental regulations while enhancing operational efficiency and customer satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Consulting Customs Brokerage Consulting Supply Chain & Logistics Optimization Consulting Freight Management Systems Consulting Regulatory & Compliance Advisory Others |

| By End-User | Retail & E-commerce Manufacturing Automotive Agriculture & Agribusiness Pharmaceuticals & Healthcare Mining & Energy Others |

| By Service Model | Full-Service Consulting Project-Based Consulting On-Demand/Advisory Consulting Digital Transformation Consulting Others |

| By Industry Vertical | Consumer Goods Electronics & High-Tech Food & Beverage Chemicals & Petrochemicals Construction & Infrastructure Others |

| By Geographic Coverage | Domestic Freight International Freight Regional/Interprovincial Freight Cross-Border (Mercosur) Freight Others |

| By Technology Utilization | Traditional Methods Digital Platforms & SaaS Solutions Automated & AI-Driven Solutions IoT & Telematics Integration Others |

| By Customer Segment | SMEs Large Enterprises Government Agencies Multinational Corporations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Services | 100 | Logistics Coordinators, Fleet Managers |

| Rail Freight Operations | 60 | Railway Operations Managers, Freight Planners |

| Air Cargo Logistics | 40 | Air Freight Managers, Customs Brokers |

| Maritime Freight Handling | 40 | Port Operations Managers, Shipping Agents |

| Cold Chain Logistics | 40 | Supply Chain Directors, Temperature-Controlled Logistics Managers |

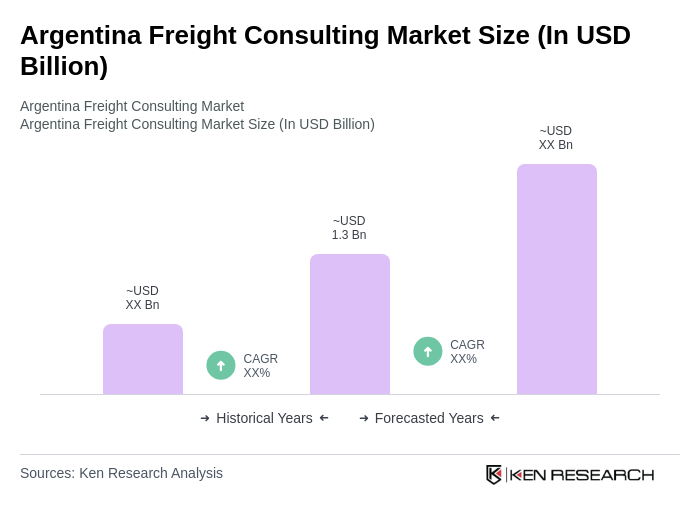

The Argentina Freight Consulting Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the expansion of e-commerce, demand for efficient logistics solutions, and the complexities of regulatory compliance in international trade.