Region:Europe

Author(s):Shubham

Product Code:KRAA1097

Pages:94

Published On:August 2025

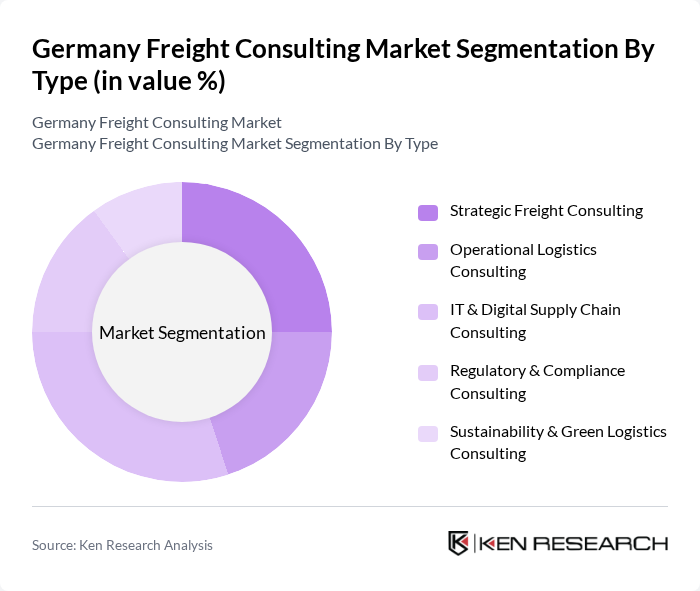

By Type:The market is segmented into various types of consulting services that cater to different aspects of freight management. The primary subsegments include Strategic Freight Consulting, Operational Logistics Consulting, IT & Digital Supply Chain Consulting, Regulatory & Compliance Consulting, and Sustainability & Green Logistics Consulting. Each of these subsegments plays a crucial role in addressing specific challenges faced by businesses in the freight sector .

The IT & Digital Supply Chain Consulting subsegment is currently dominating the market due to the increasing reliance on technology in logistics operations. Companies are investing heavily in digital solutions to enhance visibility, streamline processes, and improve decision-making. The demand for data analytics, automation, and real-time tracking solutions is driving growth in this area, as businesses seek to optimize their supply chains and reduce operational costs .

By End-User:The market is segmented based on the end-users of freight consulting services, which include Manufacturing & Industrial, Retail & E-commerce, Automotive & Mobility, Pharmaceuticals & Healthcare, Food & Beverage, Chemicals, and Others. Each end-user segment has unique requirements and challenges that consulting services aim to address .

The Manufacturing & Industrial segment is the largest end-user of freight consulting services, driven by the need for efficient supply chain management and cost reduction. As manufacturers face increasing pressure to optimize their logistics operations, they turn to consulting services for strategic insights and operational improvements. The growth of Industry 4.0 and automation further fuels the demand for specialized consulting in this sector .

The Germany Freight Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Consulting, Kuehne + Nagel Management AG, DB Schenker Consulting, Accenture Germany, PwC Advisory Germany, EY (Ernst & Young) Germany, Roland Berger, McKinsey & Company Germany, Capgemini Invent Germany, Oliver Wyman Germany, Boston Consulting Group (BCG) Germany, Kearney Germany, Simon-Kucher & Partners, AlixPartners Germany, FTI Consulting Germany contribute to innovation, geographic expansion, and service delivery in this space.

The future of the freight consulting market in Germany appears promising, driven by ongoing digital transformation and a heightened focus on sustainability. As companies increasingly adopt green logistics practices, the demand for consulting services that facilitate eco-friendly operations will rise. Additionally, the integration of AI and data analytics will enhance decision-making processes, allowing firms to optimize supply chains effectively. These trends indicate a robust growth trajectory for the freight consulting sector, positioning it as a critical component of the logistics industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Freight Consulting Operational Logistics Consulting IT & Digital Supply Chain Consulting Regulatory & Compliance Consulting Sustainability & Green Logistics Consulting |

| By End-User | Manufacturing & Industrial Retail & E-commerce Automotive & Mobility Pharmaceuticals & Healthcare Food & Beverage Chemicals Others |

| By Service Model | Project-Based Consulting Retainer-Based Consulting On-Demand/Advisory Consulting Managed Services |

| By Geographic Focus | Domestic (Germany) Intra-European International/Global Logistics Cross-Border/EU Corridor Consulting |

| By Industry Vertical | Consumer Goods & FMCG Electronics & High-Tech Food & Beverage Automotive Chemicals Others |

| By Consulting Duration | Short-Term Engagements Long-Term Partnerships Project-Based Assignments Interim Management |

| By Pricing Model | Fixed Fee Hourly/Time-Based Value-Based Pricing Performance-Based/Success Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 120 | Logistics Managers, Fleet Supervisors |

| Rail Freight Services | 60 | Operations Directors, Rail Network Planners |

| Air Cargo Management | 40 | Air Freight Managers, Cargo Operations Heads |

| Maritime Freight Solutions | 40 | Shipping Line Executives, Port Authority Managers |

| Logistics Technology Providers | 40 | IT Managers, Product Development Leads |

The Germany Freight Consulting Market is valued at approximately EUR 1.3 billion, reflecting a significant growth driven by the complexities of supply chains, the rise of e-commerce, and the demand for sustainable logistics solutions.