Region:Global

Author(s):Shubham

Product Code:KRAA0945

Pages:99

Published On:August 2025

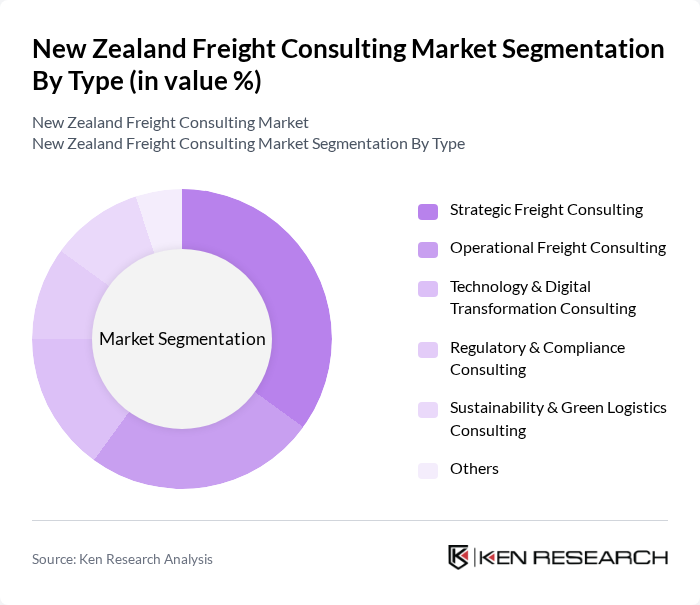

By Type:

The freight consulting market is segmented into various types, including Strategic Freight Consulting, Operational Freight Consulting, Technology & Digital Transformation Consulting, Regulatory & Compliance Consulting, Sustainability & Green Logistics Consulting, and Others. Among these, Strategic Freight Consulting is currently the leading sub-segment, driven by businesses' need for long-term planning and optimization of their supply chains. Companies are increasingly focusing on strategic initiatives to enhance their competitive edge, which has led to a higher demand for expert consulting services in this area .

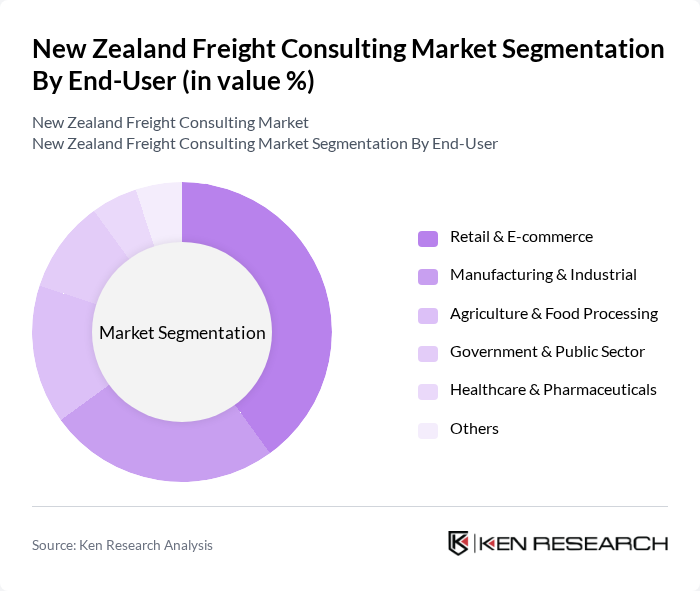

By End-User:

This market is also segmented by end-users, including Retail & E-commerce, Manufacturing & Industrial, Agriculture & Food Processing, Government & Public Sector, Healthcare & Pharmaceuticals, and Others. The Retail & E-commerce segment is the dominant force, fueled by the rapid growth of online shopping and the need for efficient logistics solutions to meet consumer demands. As e-commerce continues to expand, the demand for specialized consulting services to streamline operations and enhance customer satisfaction is expected to grow significantly .

The New Zealand Freight Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mainfreight Limited, Freightways Limited, Toll Group (New Zealand), Kuehne + Nagel New Zealand, DB Schenker New Zealand, DHL Supply Chain (New Zealand), C3S Logistics, Nexus Logistics, Qube Holdings (New Zealand), PBT Transport, Fliway Group, Mainstream Group, New Zealand Post Ltd., FedEx Express New Zealand, Linfox New Zealand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand freight consulting market appears promising, driven by ongoing digital transformation and a heightened focus on supply chain resilience. As businesses increasingly adopt technology-driven solutions, including automation and data analytics, consulting firms will play a crucial role in guiding these transitions. Additionally, the emphasis on sustainable practices will likely lead to new consulting opportunities, as firms seek to align with environmental regulations and consumer expectations for greener logistics solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Freight Consulting Operational Freight Consulting Technology & Digital Transformation Consulting Regulatory & Compliance Consulting Sustainability & Green Logistics Consulting Others |

| By End-User | Retail & E-commerce Manufacturing & Industrial Agriculture & Food Processing Government & Public Sector Healthcare & Pharmaceuticals Others |

| By Service Model | Project-Based Consulting Retainer-Based Consulting On-Demand/Advisory Consulting Training & Implementation Support Others |

| By Geographic Focus | Auckland Region Wellington Region Christchurch/Canterbury Region Regional & Rural Areas Others |

| By Industry Vertical | Food and Beverage Pharmaceuticals Automotive Construction & Infrastructure Forestry & Primary Industries Others |

| By Consulting Duration | Short-Term Engagements (<6 months) Long-Term Engagements (>6 months) Project-Based Consulting Ongoing Advisory Others |

| By Pricing Model | Fixed Fee Hourly/Day Rate Performance-Based Pricing Subscription/Retainer Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 120 | Fleet Managers, Operations Directors |

| Rail Freight Services | 60 | Logistics Coordinators, Rail Operations Managers |

| Maritime Freight Logistics | 50 | Port Authorities, Shipping Line Executives |

| Air Cargo Management | 40 | Air Freight Managers, Customs Compliance Officers |

| Freight Forwarding Services | 70 | Freight Forwarders, Supply Chain Analysts |

The New Zealand Freight Consulting Market is valued at approximately USD 18 billion, reflecting a significant growth driven by the demand for efficient logistics solutions, e-commerce expansion, and sustainable freight management practices.