Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0206

Pages:81

Published On:August 2025

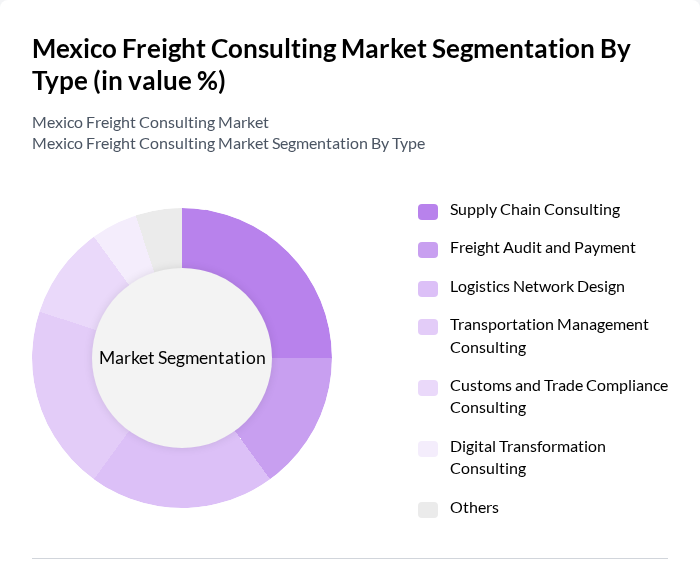

By Type:The freight consulting market is segmented into various types, including Supply Chain Consulting, Freight Audit and Payment, Logistics Network Design, Transportation Management Consulting, Customs and Trade Compliance Consulting, Digital Transformation Consulting, and Others. Each of these segments plays a crucial role in addressing specific client needs and enhancing operational efficiencies. Supply Chain Consulting and Logistics Network Design are particularly prominent due to the complexity of cross-border trade and the need for network optimization in Mexico’s rapidly evolving logistics landscape .

The Supply Chain Consulting segment is currently the dominant force in the market, driven by the increasing complexity of global supply chains and the need for businesses to optimize their logistics operations. Companies are increasingly seeking expert advice to enhance their supply chain efficiency, reduce costs, and improve service levels. The growing trend of digital transformation in logistics is also contributing to the rise of this segment, as businesses look to integrate advanced technologies into their supply chain processes .

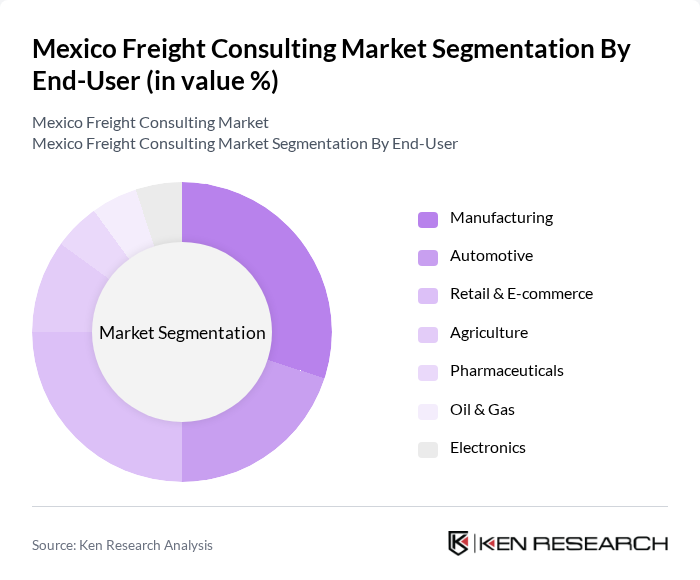

By End-User:The market is also segmented by end-user industries, including Manufacturing, Automotive, Retail & E-commerce, Agriculture, Pharmaceuticals, Oil & Gas, Electronics, and Others. Each sector has unique logistics needs that drive demand for specialized consulting services. Manufacturing and Automotive remain leading end-users due to Mexico’s strong industrial base, while Retail & E-commerce is rapidly expanding, reflecting the surge in online shopping and demand for last-mile delivery solutions .

The Manufacturing sector is the leading end-user in the freight consulting market, as it requires efficient logistics solutions to manage complex supply chains and production schedules. The automotive industry also plays a significant role, driven by the need for timely delivery of parts and finished vehicles. Retail and e-commerce are rapidly growing segments, reflecting the increasing demand for efficient distribution channels and last-mile delivery solutions .

The Mexico Freight Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deloitte, PwC, KPMG, EY, Accenture, Boston Consulting Group (BCG), McKinsey & Company, Capgemini, A.T. Kearney, Roland Berger, Transplace (now part of Uber Freight), C.H. Robinson, DHL Consulting, Kuehne + Nagel Management Consulting, DB Schenker Consulting, FedEx Logistics Consulting, Grupo Traxión, Solistica, TIBA México, XPO Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico Freight Consulting Market is poised for transformative growth, driven by technological advancements and evolving consumer behaviors. As companies increasingly adopt digital freight solutions, the demand for consulting services will rise, particularly in areas like AI integration and real-time tracking. Additionally, the focus on sustainability will shape logistics strategies, prompting firms to develop eco-friendly practices. These trends indicate a dynamic market landscape where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Supply Chain Consulting Freight Audit and Payment Logistics Network Design Transportation Management Consulting Customs and Trade Compliance Consulting Digital Transformation Consulting Others |

| By End-User | Manufacturing Automotive Retail & E-commerce Agriculture Pharmaceuticals Oil & Gas Electronics Others |

| By Service Model | Project-Based Consulting Retainer-Based Consulting On-Demand Consulting Hybrid Consulting Models Others |

| By Geographic Coverage | National Coverage Regional Coverage (Northern, Central, Southern Mexico) Cross-Border (US-Mexico) Local Coverage Others |

| By Industry Vertical | Consumer Goods Electronics Food and Beverage Chemicals Oil & Gas Others |

| By Consulting Focus | Operational Efficiency Cost Reduction Risk Management Sustainability & Green Logistics Technology Integration Others |

| By Technology Utilization | Data Analytics Cloud Solutions IoT Integration Automation & Robotics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 100 | Logistics Managers, Fleet Operations Directors |

| Rail Freight Services | 60 | Rail Operations Managers, Supply Chain Analysts |

| Air Cargo Logistics | 50 | Air Freight Managers, Customs Compliance Officers |

| Maritime Freight Solutions | 40 | Port Operations Managers, Shipping Coordinators |

| Freight Forwarding Services | 45 | Freight Forwarding Managers, Business Development Executives |

The Mexico Freight Consulting Market is valued at approximately USD 14 billion, reflecting a significant growth driven by the demand for efficient logistics solutions, e-commerce expansion, and supply chain optimization across various industries.