Region:Asia

Author(s):Dev

Product Code:KRAA0471

Pages:98

Published On:August 2025

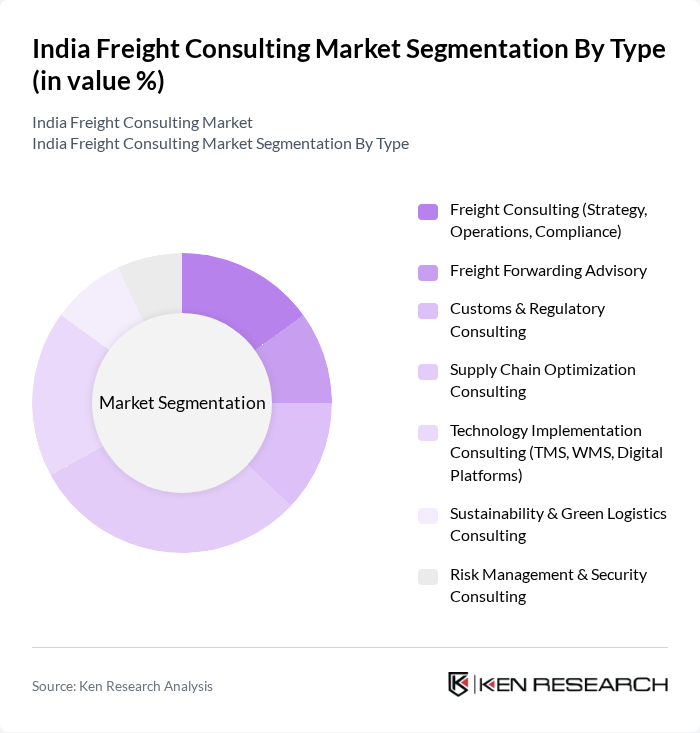

By Type:The freight consulting market is segmented into various types, including Freight Consulting (Strategy, Operations, Compliance), Freight Forwarding Advisory, Customs & Regulatory Consulting, Supply Chain Optimization Consulting, Technology Implementation Consulting (TMS, WMS, Digital Platforms), Sustainability & Green Logistics Consulting, and Risk Management & Security Consulting. Among these, Supply Chain Optimization Consulting is currently the leading sub-segment, driven by the increasing need for businesses to enhance operational efficiency and reduce costs. Companies are increasingly investing in technology and analytics to optimize their supply chains, making this sub-segment a focal point for consulting services.

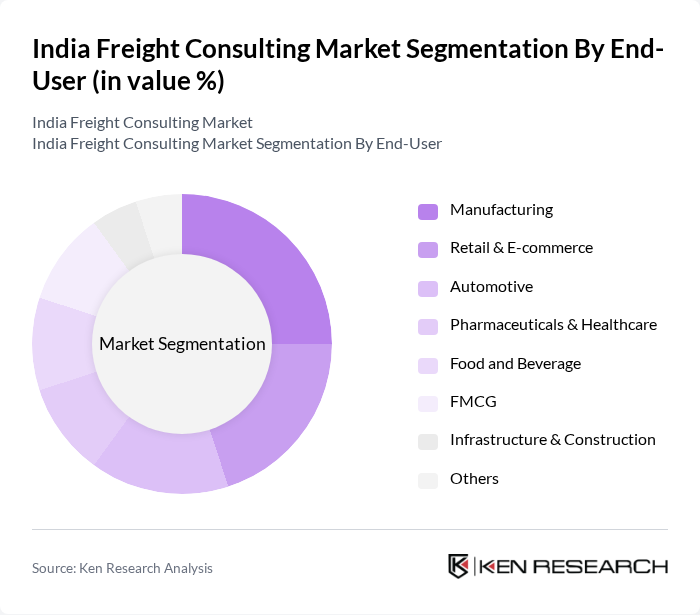

By End-User:The end-user segmentation of the freight consulting market includes Manufacturing, Retail & E-commerce, Automotive, Pharmaceuticals & Healthcare, Food and Beverage, FMCG, Infrastructure & Construction, and Others. The Manufacturing sector is the dominant end-user, as companies in this industry are increasingly seeking consulting services to streamline their logistics and supply chain processes. The push for efficiency and cost reduction in manufacturing operations has led to a heightened demand for specialized consulting services tailored to this sector.

The India Freight Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deloitte India (Deloitte Touche Tohmatsu India LLP), KPMG India, EY India (Ernst & Young LLP), PwC India (PricewaterhouseCoopers Pvt. Ltd.), Mahindra Logistics Ltd., Allcargo Logistics Ltd., TCI Supply Chain Solutions (Transport Corporation of India Ltd.), Gati Ltd., Blue Dart Express Ltd., DHL Supply Chain India Pvt. Ltd., FedEx Express Transportation and Supply Chain Services (India) Pvt. Ltd., Delhivery Ltd., Xpressbees (BusyBees Logistics Solutions Pvt. Ltd.), Ecom Express Ltd., Om Logistics Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India freight consulting market appears promising, driven by ongoing digital transformation and the integration of advanced technologies. As companies increasingly adopt AI and big data analytics, the demand for specialized consulting services will rise. Furthermore, the shift towards sustainable logistics practices will create new opportunities for consultants to guide businesses in reducing their carbon footprint while optimizing supply chains, ensuring compliance with evolving regulations and market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Consulting (Strategy, Operations, Compliance) Freight Forwarding Advisory Customs & Regulatory Consulting Supply Chain Optimization Consulting Technology Implementation Consulting (TMS, WMS, Digital Platforms) Sustainability & Green Logistics Consulting Risk Management & Security Consulting |

| By End-User | Manufacturing Retail & E-commerce Automotive Pharmaceuticals & Healthcare Food and Beverage FMCG Infrastructure & Construction Others |

| By Region | North India South India East India West India |

| By Service Model | Full-Service Consulting Firms Boutique/Niche Consulting Firms Technology-Led Consulting Providers In-house Consulting Divisions |

| By Freight Mode | Road Freight Consulting Rail Freight Consulting Air Freight Consulting Ocean Freight Consulting Multimodal/Intermodal Consulting |

| By Project Scope | Network Design & Optimization Cost Reduction & Efficiency Projects Regulatory Compliance Projects Digital Transformation Projects Sustainability Initiatives Risk Management Projects Others |

| By Technology Utilization | Freight Management Systems Consulting Real-Time Tracking & Visibility Solutions Blockchain & Digital Ledger Consulting Automation & Robotics Consulting Data Analytics & AI Consulting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Services | 100 | Logistics Coordinators, Fleet Managers |

| Rail Freight Operations | 60 | Operations Managers, Rail Network Planners |

| Air Cargo Management | 50 | Air Freight Managers, Cargo Operations Supervisors |

| Maritime Freight Solutions | 40 | Port Authorities, Shipping Line Executives |

| Cold Chain Logistics | 40 | Supply Chain Directors, Temperature-Controlled Logistics Managers |

The India Freight Consulting Market is valued at approximately USD 1.6 billion, reflecting significant growth driven by the expansion of e-commerce, demand for efficient supply chain solutions, and government infrastructure initiatives.