Region:Europe

Author(s):Shubham

Product Code:KRAA0878

Pages:99

Published On:August 2025

By Type:The market is segmented into Strategic Consulting, Operational Consulting, IT Consulting, Compliance Consulting, Financial Consulting, Risk Management Consulting, Sustainability & Green Logistics Consulting, Digital Transformation Consulting, and Others. Each segment addresses specific client needs, such as network design, process optimization, regulatory compliance, technology integration, financial planning, risk mitigation, sustainability strategies, and digital transformation. The growing emphasis on digitalization and sustainability is increasing demand for IT, digital transformation, and green logistics consulting services .

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Automotive, Pharmaceuticals & Healthcare, Food and Beverage, Agriculture, Construction & Infrastructure, Energy & Utilities, and Others. Each sector has unique logistics requirements, driving demand for specialized consulting services. The rapid growth of e-commerce and retail, ongoing expansion in manufacturing and automotive, and the need for temperature-controlled logistics in pharmaceuticals and food are key demand drivers. Construction, infrastructure, and energy sectors also require tailored freight solutions due to project complexity and regulatory requirements .

The Spain Freight Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, Deloitte, PwC, KPMG, EY, Roland Berger, McKinsey & Company, Boston Consulting Group, Capgemini, A.T. Kearney, Oliver Wyman, Bain & Company, Transporeon, C.H. Robinson, XPO Logistics, DHL Consulting (DHL Supply Chain Spain), DB Schenker Consulting, Alfil Logistics, Grupo Sesé, Logista contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain freight consulting market appears promising, driven by ongoing digital transformation and a heightened focus on sustainability. As companies increasingly adopt green logistics practices, the demand for consulting services that facilitate this transition will grow. Additionally, the integration of AI and data analytics is expected to enhance operational efficiencies, allowing firms to offer more tailored solutions. These trends will likely create a dynamic environment for consulting firms, fostering innovation and collaboration in the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Consulting Operational Consulting IT Consulting Compliance Consulting Financial Consulting Risk Management Consulting Sustainability & Green Logistics Consulting Digital Transformation Consulting Others |

| By End-User | Retail & E-commerce Manufacturing Automotive Pharmaceuticals & Healthcare Food and Beverage Agriculture Construction & Infrastructure Energy & Utilities Others |

| By Service Model | Project-Based Consulting Retainer-Based Consulting Hourly Consulting Performance-Based Consulting Hybrid/Custom Engagements Others |

| By Geographic Focus | Domestic Market Focus (Spain) International Market Focus (EU/Global) Regional Market Focus (Catalonia, Madrid, Valencia, Andalusia, etc.) Port-Centric Consulting (Barcelona, Valencia, Algeciras, Bilbao) Others |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises Startups Public Sector/Institutions Others |

| By Consulting Duration | Short-Term Consulting Long-Term Consulting Ongoing Support Project-Based Duration Others |

| By Industry Focus | Transportation and Logistics Wholesale and Retail Trade E-commerce Logistics Cold Chain & Temperature-Controlled Logistics Courier, Express, and Parcel (CEP) Maritime & Port Logistics Rail & Intermodal Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Services | 100 | Logistics Coordinators, Fleet Managers |

| Maritime Freight Operations | 60 | Port Managers, Shipping Line Executives |

| Air Cargo Logistics | 50 | Air Freight Managers, Customs Brokers |

| Rail Freight Transportation | 40 | Rail Operations Managers, Supply Chain Analysts |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Distribution Supervisors |

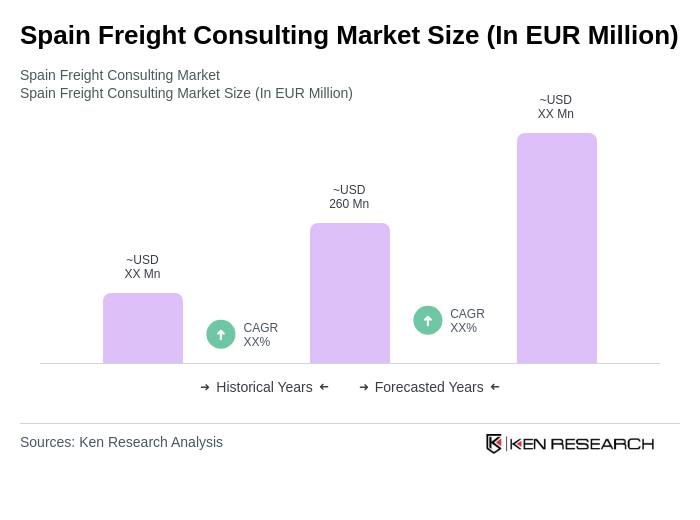

The Spain Freight Consulting Market is valued at approximately EUR 260 million, reflecting the segment's share within the broader freight logistics sector. This valuation is based on a five-year historical analysis of market trends and growth drivers.