Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0229

Pages:100

Published On:August 2025

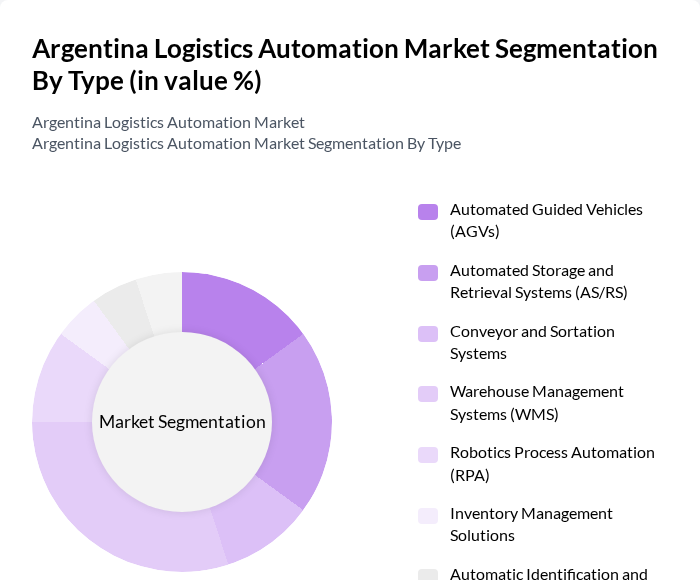

By Type:The logistics automation market can be segmented into Automated Guided Vehicles (AGVs), Automated Storage and Retrieval Systems (AS/RS), Conveyor and Sortation Systems, Warehouse Management Systems (WMS), Robotic Process Automation (RPA), Inventory Management Solutions, Automatic Identification and Data Capture (AIDC), and Others. Among these, Warehouse Management Systems (WMS) are currently leading the market due to their essential role in optimizing warehouse operations, real-time inventory tracking, and integration with other automation technologies, which are critical for businesses aiming to improve efficiency and reduce operational costs .

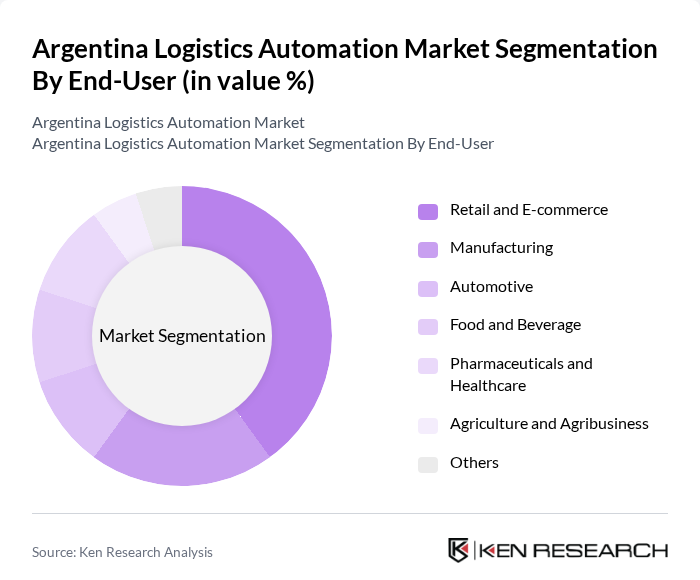

By End-User:The end-user segmentation includes Retail and E-commerce, Manufacturing, Automotive, Food and Beverage, Pharmaceuticals and Healthcare, Agriculture and Agribusiness, and Others. The Retail and E-commerce sector is the dominant segment, driven by the rapid growth of online shopping, increased consumer demand for fast and accurate order fulfillment, and the need for advanced inventory management solutions to support omnichannel logistics .

The Argentina Logistics Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Logistics, Dematic (KION Group), SSI SCHÄFER, Vanderlande Industries, Swisslog (KUKA Group), Honeywell Intelligrated, Grupo Logístico Andreani, DHL Supply Chain Argentina, Yusen Logistics Argentina, Celsur Logística, Grupo Logístico Cruz del Sur, Toyota Tsusho Argentina, Panalpina (DSV Argentina), GXO Logistics, Grupo Cargo contribute to innovation, geographic expansion, and service delivery in this space.

The future of logistics automation in Argentina appears promising, driven by ongoing technological advancements and government support. As e-commerce continues to expand, logistics companies are likely to invest more in automation to meet rising consumer demands. Additionally, the integration of AI and machine learning will enhance operational efficiencies, while sustainability initiatives will shape logistics practices. Overall, the sector is poised for significant transformation, with automation playing a crucial role in driving growth and competitiveness in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Automated Storage and Retrieval Systems (AS/RS) Conveyor and Sortation Systems Warehouse Management Systems (WMS) Robotics Process Automation (RPA) Inventory Management Solutions Automatic Identification and Data Capture (AIDC) Others |

| By End-User | Retail and E-commerce Manufacturing Automotive Food and Beverage Pharmaceuticals and Healthcare Agriculture and Agribusiness Others |

| By Industry Vertical | Automotive Consumer Goods Pharmaceuticals Electronics Agriculture Others |

| By Automation Level | Fully Automated Semi-Automated Manual with Automation Support Others |

| By Technology | Internet of Things (IoT) Artificial Intelligence (AI) Machine Learning (ML) Blockchain Technology Radio Frequency Identification (RFID) Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | Buenos Aires Córdoba Mendoza Santa Fe Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Automation | 100 | Logistics Managers, Supply Chain Analysts |

| Manufacturing Process Automation | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Automation | 90 | E-commerce Directors, Warehouse Operations Managers |

| Transportation Management Systems | 60 | Fleet Managers, IT Managers |

| Supply Chain Optimization Technologies | 50 | Supply Chain Managers, Business Development Managers |

The Argentina Logistics Automation Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for efficient supply chain solutions and advancements in technology such as robotics and IoT integration.