Region:Asia

Author(s):Geetanshi

Product Code:KRAA2082

Pages:90

Published On:August 2025

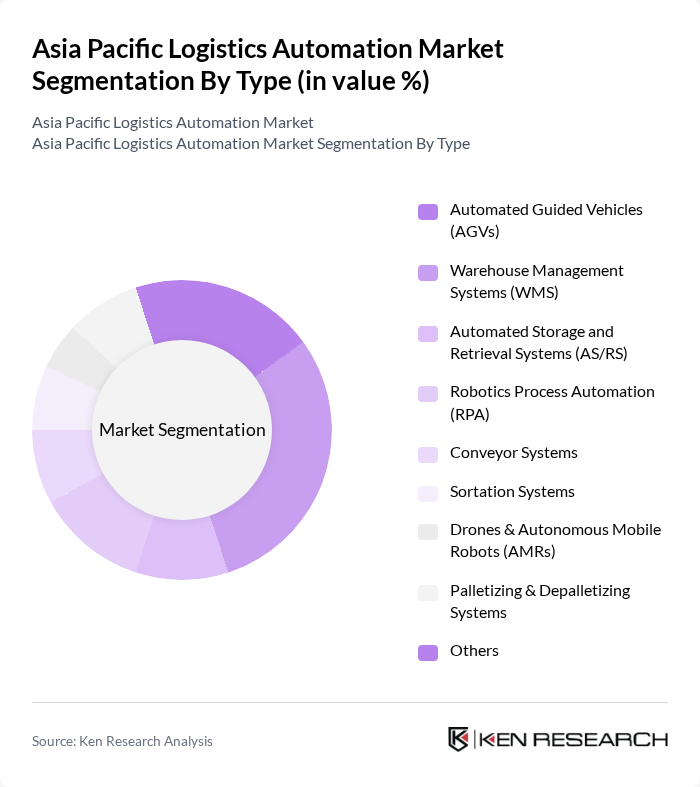

By Type:The logistics automation market is segmented into various types, including Automated Guided Vehicles (AGVs), Warehouse Management Systems (WMS), Automated Storage and Retrieval Systems (AS/RS), Robotics Process Automation (RPA), Conveyor Systems, Sortation Systems, Drones & Autonomous Mobile Robots (AMRs), Palletizing & Depalletizing Systems, and Others. Among these, Warehouse Management Systems (WMS) are currently leading the market due to their critical role in optimizing warehouse operations and inventory management. The increasing complexity of supply chains and the need for real-time data analytics are driving the adoption of WMS solutions.

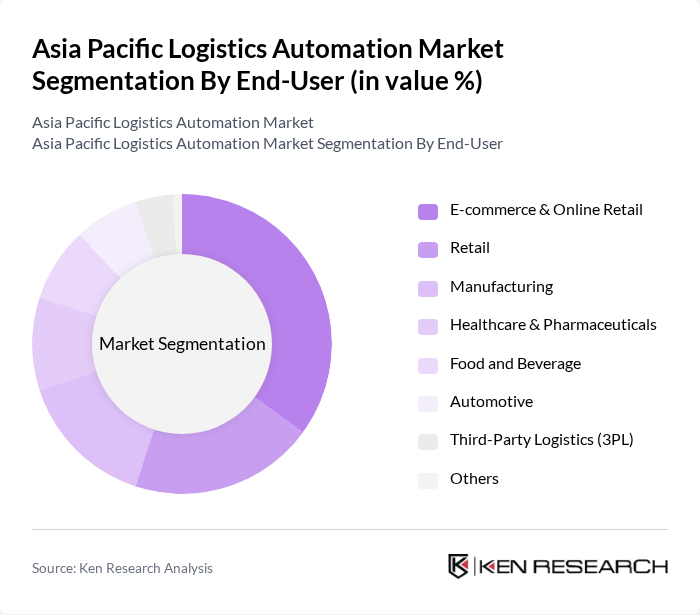

By End-User:The logistics automation market is also segmented by end-user industries, including E-commerce & Online Retail, Retail, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, Third-Party Logistics (3PL), and Others. The E-commerce & Online Retail sector is currently the dominant segment, driven by the rapid growth of online shopping and the need for efficient order fulfillment and inventory management solutions. The increasing consumer demand for faster delivery times is pushing retailers to adopt automation technologies.

The Asia Pacific Logistics Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., KION Group AG, Daifuku Co., Ltd., Dematic, Zebra Technologies Corporation, Mitsubishi Logisnext Co., Ltd., Swisslog Holding AG, CMC Machinery, JBT Corporation, Blue Yonder, 6 River Systems, Fetch Robotics, GreyOrange, RightHand Robotics, ST Engineering, Toshiba Global Logistics, Yaskawa Electric Corporation (Yaskawa Motoman), Godrej Consoveyo Logistics Automation Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics automation market in Asia Pacific appears promising, driven by ongoing technological advancements and increasing demand for efficiency. As companies continue to embrace digital transformation, the integration of AI and machine learning will play a pivotal role in optimizing logistics operations. Furthermore, the expansion of smart warehousing and autonomous delivery systems is expected to reshape the logistics landscape, enhancing operational capabilities and customer satisfaction while addressing sustainability concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Warehouse Management Systems (WMS) Automated Storage and Retrieval Systems (AS/RS) Robotics Process Automation (RPA) Conveyor Systems Sortation Systems Drones & Autonomous Mobile Robots (AMRs) Palletizing & Depalletizing Systems Others |

| By End-User | E-commerce & Online Retail Retail Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive Third-Party Logistics (3PL) Others |

| By Region | China Japan India Southeast Asia Australia and New Zealand South Korea Others |

| By Technology | Internet of Things (IoT) Artificial Intelligence (AI) Machine Learning (ML) Blockchain Cloud Computing Others |

| By Application | Order Fulfillment Inventory Management Transportation Management Supply Chain Visibility Last Mile Delivery Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships (PPP) Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Automation Solutions | 100 | Warehouse Managers, Automation Engineers |

| Transportation Management Systems | 60 | Logistics Coordinators, Fleet Managers |

| Robotics in Logistics | 50 | Operations Managers, Robotics Specialists |

| Supply Chain Visibility Tools | 70 | IT Managers, Supply Chain Analysts |

| Last-Mile Delivery Innovations | 55 | Delivery Managers, E-commerce Operations Managers |

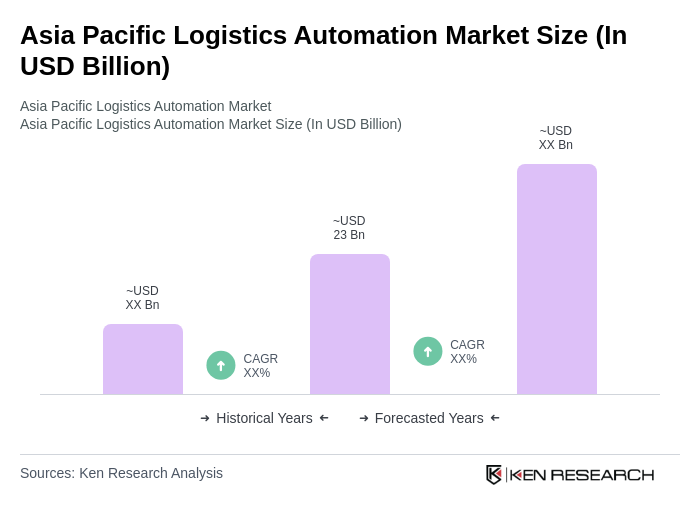

The Asia Pacific Logistics Automation Market is valued at approximately USD 23 billion, driven by the increasing demand for efficient supply chain management, rapid e-commerce expansion, and advancements in technologies like AI and robotics.