Region:Global

Author(s):Shubham

Product Code:KRAA1000

Pages:82

Published On:August 2025

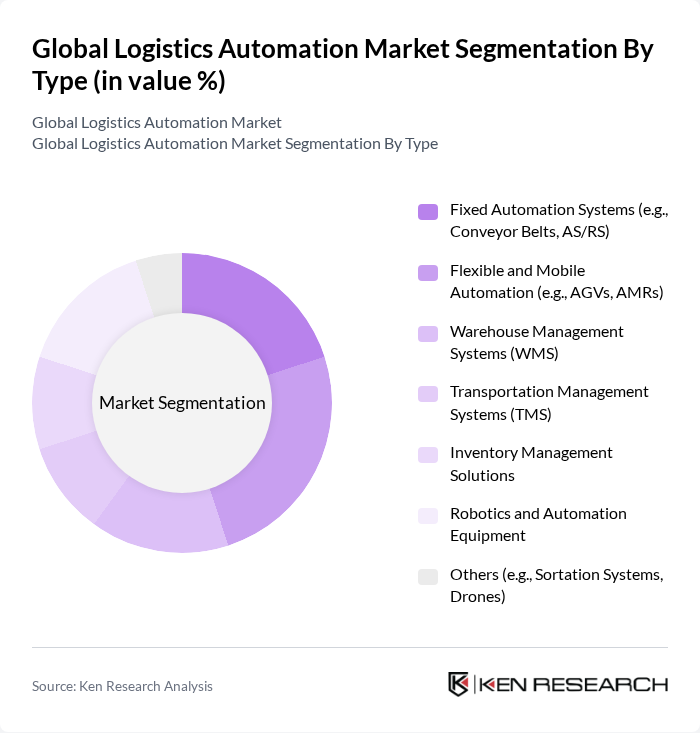

By Type:The market is segmented into various types, including Fixed Automation Systems, Flexible and Mobile Automation, Warehouse Management Systems, Transportation Management Systems, Inventory Management Solutions, Robotics and Automation Equipment, and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency and streamlining logistics processes .

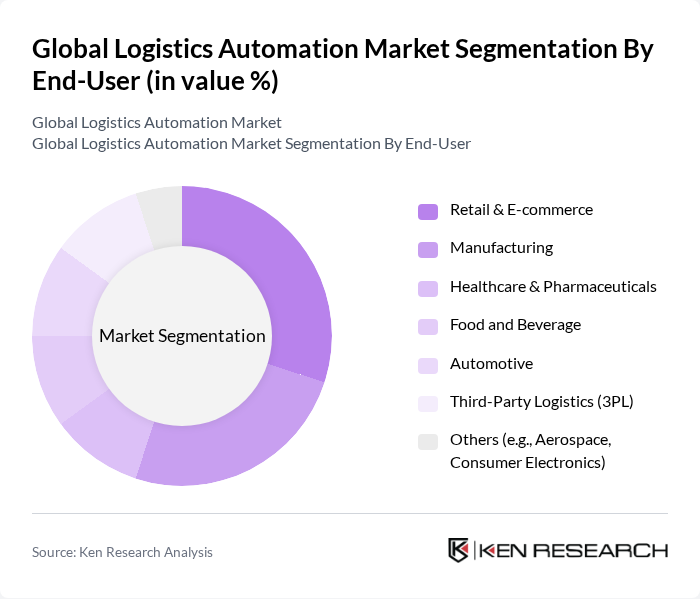

By End-User:The logistics automation market is also segmented by end-user industries, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, Third-Party Logistics (3PL), and Others. Each sector has unique requirements and benefits from automation technologies .

The Global Logistics Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, XPO Logistics, FedEx Logistics, UPS Supply Chain Solutions, DB Schenker, C.H. Robinson, J.B. Hunt Transport Services, Ryder Supply Chain Solutions, Geodis, Panasonic Connect (formerly Panasonic Logistics), Siemens Logistics, Honeywell Intelligrated, Zebra Technologies, Blue Yonder, Swisslog Holding AG, KNAPP AG, TGW Logistics Group, Dematic (a KION Group company), and Vanderlande Industries contribute to innovation, geographic expansion, and service delivery in this space .

The future of logistics automation is poised for transformative growth, driven by the increasing adoption of autonomous vehicles and advanced robotics. As companies seek to enhance efficiency and reduce costs, the integration of real-time data analytics will become essential for optimizing supply chain operations. Furthermore, the emphasis on sustainability will push logistics providers to adopt greener technologies, aligning with global environmental goals. This evolution will create a more agile and responsive logistics landscape, catering to the dynamic needs of consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed Automation Systems (e.g., Conveyor Belts, AS/RS) Flexible and Mobile Automation (e.g., AGVs, AMRs) Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Inventory Management Solutions Robotics and Automation Equipment Others (e.g., Sortation Systems, Drones) |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive Third-Party Logistics (3PL) Others (e.g., Aerospace, Consumer Electronics) |

| By Component | Hardware (Robotics, Conveyors, AS/RS, Sensors, etc.) Software (WMS, TMS, Control Systems, Analytics) Services (Consulting, Integration, Maintenance) |

| By Sales Channel | Direct Sales Distributors/VARs Online Sales |

| By Distribution Mode | Road Rail Air Sea |

| By Price Range | Low Medium High |

| By Application | Supply Chain Management Order Processing & Fulfillment Inventory Control & Optimization Transportation & Fleet Management Last-Mile Delivery Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Automation | 100 | Logistics Directors, Supply Chain Analysts |

| Manufacturing Automation Solutions | 80 | Operations Managers, Production Supervisors |

| Healthcare Supply Chain Automation | 60 | Pharmacy Managers, Supply Chain Coordinators |

| Warehouse Management Systems | 90 | Warehouse Managers, IT Directors |

| Transportation Management Automation | 70 | Fleet Managers, Logistics Coordinators |

The Global Logistics Automation Market is valued at approximately USD 82 billion, driven by the increasing demand for efficient supply chain management, the rise of e-commerce, and advancements in technologies such as AI, robotics, and IoT.