Region:Europe

Author(s):Geetanshi

Product Code:KRAA0266

Pages:89

Published On:August 2025

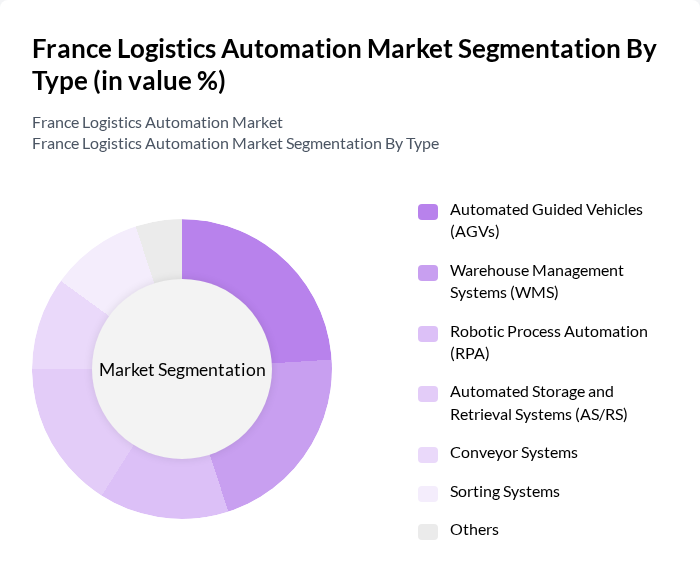

By Type:The market is segmented into various types, including Automated Guided Vehicles (AGVs), Warehouse Management Systems (WMS), Robotic Process Automation (RPA), Automated Storage and Retrieval Systems (AS/RS), Conveyor Systems, Sorting Systems, and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency, enabling real-time inventory management, and streamlining logistics processes through automation and digitalization .

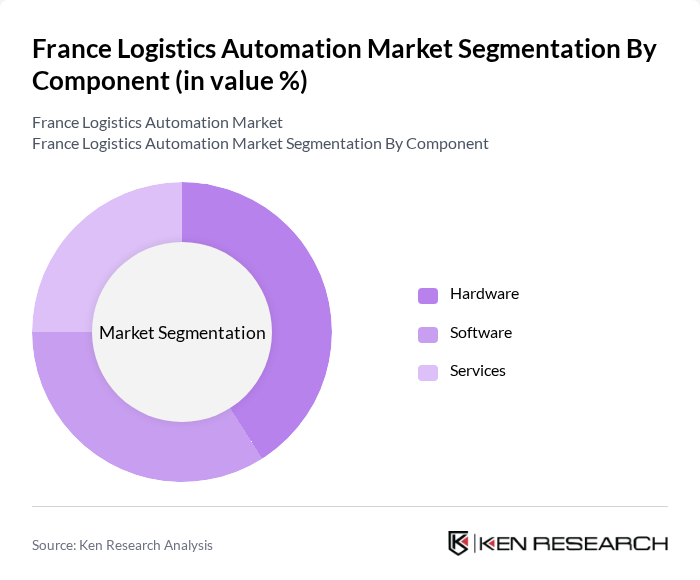

By Component:The market is also segmented by components, which include Hardware, Software, and Services. Each component is essential for the effective implementation and operation of logistics automation systems, with hardware comprising robotics and material handling equipment, software enabling process management and analytics, and services covering integration, maintenance, and consulting .

The France Logistics Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., Kuehne + Nagel International AG, Dematic (a KION Group company), Swisslog Holding AG, Vanderlande Industries, Zebra Technologies Corporation, Blue Yonder (formerly JDA Software), SSI SCHÄFER, Mecalux S.A., Savoye (France), Alstef Group (France), Locus Robotics, Exotec (France), and Infor contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics automation market in France appears promising, driven by technological advancements and increasing demand for efficiency. As companies continue to embrace automation, the integration of AI and machine learning will enhance operational capabilities, enabling predictive analytics and improved decision-making. Additionally, the focus on sustainability will drive innovations in green logistics, aligning with government initiatives aimed at reducing carbon footprints and promoting eco-friendly practices within the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Warehouse Management Systems (WMS) Robotics Process Automation (RPA) Automated Storage and Retrieval Systems (AS/RS) Conveyor Systems Sorting Systems Others |

| By Component | Hardware Software Services |

| By Mode of Transportation | Road Rail Air Sea |

| By Application | Inventory Management Order Fulfillment Shipping and Receiving Returns Management Transportation Management Warehouse and Storage Management Others |

| By End-User Industry | Retail and E-commerce Manufacturing Automotive Healthcare and Pharmaceuticals Food and Beverage Consumer Electronics Others |

| By Region | Île-de-France Auvergne-Rhône-Alpes Nouvelle-Aquitaine Occitanie Northern France Southern France Central France Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Automation | 100 | Logistics Managers, Supply Chain Analysts |

| Manufacturing Automation Solutions | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Automation | 90 | eCommerce Directors, Warehouse Operations Managers |

| Cold Chain Logistics Automation | 60 | Logistics Coordinators, Quality Assurance Managers |

| Last-Mile Delivery Automation | 60 | Delivery Managers, Fleet Operations Managers |

The France Logistics Automation Market is valued at approximately USD 7.5 billion, reflecting significant growth driven by the demand for efficient supply chain management, e-commerce expansion, and advancements in automation technologies like robotics and IoT integration.