Region:Middle East

Author(s):Rebecca

Product Code:KRAA0366

Pages:89

Published On:August 2025

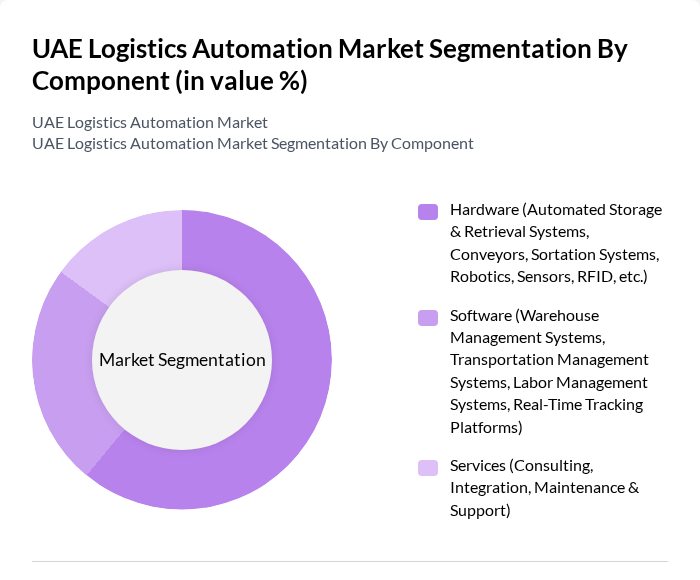

By Component:

The components of the UAE Logistics Automation Market include Hardware, Software, and Services. Among these, Hardware, which encompasses Automated Storage & Retrieval Systems, Conveyors, Sortation Systems, Robotics, Sensors, and RFID, is currently dominating the market. The increasing demand for automation in warehouses and distribution centers is driving the adoption of these technologies. The trend towards e-commerce has further accelerated the need for efficient logistics solutions, making Hardware a critical component in the logistics automation landscape .

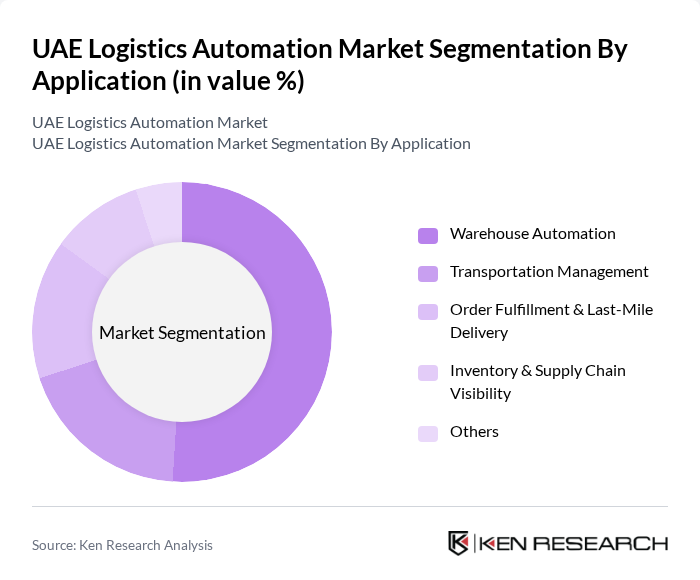

By Application:

The applications in the UAE Logistics Automation Market include Warehouse Automation, Transportation Management, Order Fulfillment & Last-Mile Delivery, Inventory & Supply Chain Visibility, and Others. Warehouse Automation is the leading application segment, driven by the need for efficient inventory management and faster order processing. The rise of e-commerce has significantly increased the volume of goods that need to be stored and retrieved quickly, making Warehouse Automation essential for logistics providers to meet customer demands .

The UAE Logistics Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as DP World, Emirates Logistics, Aramex, Agility Logistics, Al-Futtaim Logistics, GAC Group, DHL Supply Chain, Kuehne + Nagel, CEVA Logistics, FedEx, UPS, Menzies Aviation, Al Naboodah Group, XPO Logistics, Hellmann Worldwide Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE logistics automation market appears promising, driven by ongoing technological advancements and government support. As e-commerce continues to expand, logistics companies are likely to invest in automation to enhance efficiency and meet consumer demands. Additionally, the focus on sustainability will push firms to adopt eco-friendly logistics solutions. Overall, the market is expected to evolve rapidly, with increased collaboration between logistics providers and technology firms to innovate and optimize supply chain processes.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Automated Storage & Retrieval Systems, Conveyors, Sortation Systems, Robotics, Sensors, RFID, etc.) Software (Warehouse Management Systems, Transportation Management Systems, Labor Management Systems, Real-Time Tracking Platforms) Services (Consulting, Integration, Maintenance & Support) |

| By Application | Warehouse Automation Transportation Management Order Fulfillment & Last-Mile Delivery Inventory & Supply Chain Visibility Others |

| By Logistics Type | Sale Logistics Production Logistics Recovery Logistics Others |

| By Industry Vertical | Retail & E-commerce Food & Beverage Healthcare & Pharmaceuticals Automotive Electronics Aerospace & Defense Energy & Utilities Others |

| By Mode of Transport | Road Logistics Air Logistics Sea Logistics Rail Logistics |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Automation | 60 | Logistics Managers, Supply Chain Analysts |

| Manufacturing Automation Solutions | 50 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Automation | 70 | eCommerce Directors, Warehouse Operations Managers |

| Cold Chain Logistics Automation | 40 | Logistics Coordinators, Quality Assurance Managers |

| Last-Mile Delivery Automation | 50 | Delivery Managers, Fleet Operations Directors |

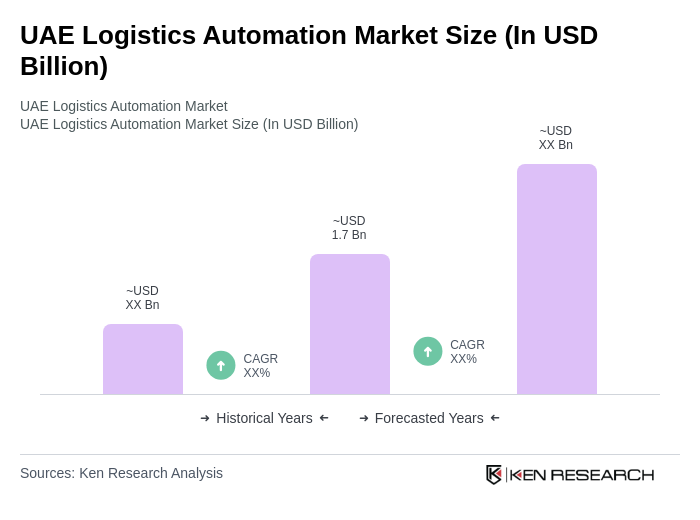

The UAE Logistics Automation Market is valued at approximately USD 1.7 billion, reflecting significant growth driven by the adoption of advanced technologies such as robotics, AI, and IoT, alongside increasing e-commerce demands.