Region:Asia

Author(s):Shubham

Product Code:KRAA0837

Pages:92

Published On:August 2025

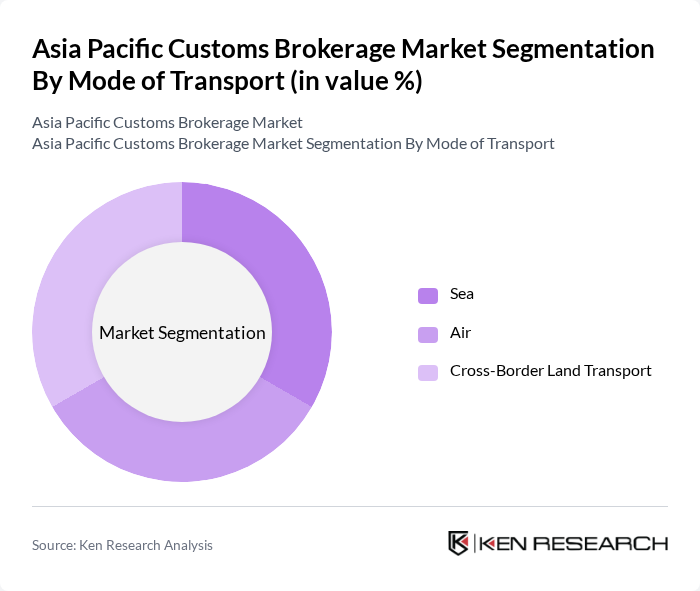

By Mode of Transport:

The customs brokerage market is significantly dominated by the sea transport segment, which accounts for the largest portion of the market share. This dominance is attributed to the high volume of goods transported via maritime shipping, which is the most cost-effective mode for bulk shipments. The expansion of global trade, the prominence of major Asian ports, and the increasing frequency of containerized shipments further reinforce the importance of sea transport in customs brokerage services .

By Type of Service:

In terms of service type, import customs clearance is the leading segment, driven by the increasing volume of goods entering the Asia Pacific region. Businesses are increasingly relying on customs brokers to navigate complex and frequently changing import regulations and ensure compliance. The rapid growth of e-commerce and cross-border retail has further contributed to the rise in import activities, reinforcing this segment’s dominance. Consulting and compliance services are also gaining traction due to heightened regulatory scrutiny and the need for specialized expertise .

The Asia Pacific Customs Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, Expeditors International, C.H. Robinson, Geodis, Agility Logistics, Toll Group, Sinotrans Limited, Nippon Express, Yusen Logistics, Kerry Logistics Network, JAS Worldwide, DSV A/S, CJ Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Asia Pacific customs brokerage market appears promising, driven by ongoing technological advancements and increasing trade liberalization. As businesses continue to embrace digital solutions, the integration of AI and machine learning will enhance customs processes, improving efficiency and compliance. Additionally, the expansion of free trade agreements will further facilitate cross-border trade, creating a more favorable environment for customs brokerage services. Companies that adapt to these trends will likely gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Sea Air Cross-Border Land Transport |

| By Type of Service | Import Customs Clearance Export Customs Clearance Consulting & Compliance Services Freight Forwarding Services Others |

| By End-User | Retail Manufacturing E-commerce Automotive Pharmaceuticals Electronics Food and Beverage Others |

| By Geography | China Japan India Australia Malaysia South Korea Rest of Asia-Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Customs Brokerage Services for Electronics | 100 | Customs Brokers, Logistics Coordinators |

| Textile Import Compliance | 80 | Import Managers, Compliance Officers |

| Pharmaceuticals Customs Clearance | 70 | Regulatory Affairs Managers, Supply Chain Directors |

| Automotive Parts Importation | 50 | Procurement Managers, Customs Compliance Specialists |

| E-commerce Logistics and Customs | 90 | E-commerce Managers, Operations Supervisors |

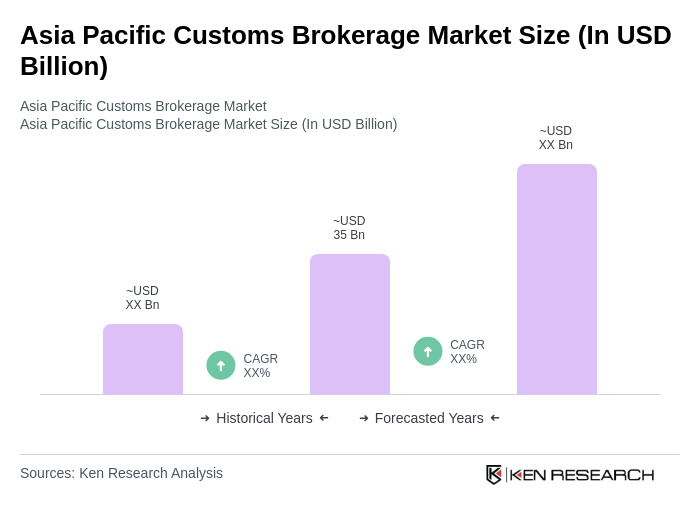

The Asia Pacific Customs Brokerage Market is valued at approximately USD 35 billion, driven by increasing international trade, the rise of e-commerce, and the demand for efficient customs clearance processes.