Middle East Customs Brokerage Market Overview

- The Middle East Customs Brokerage Market is valued at USD 2.1 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing volume of international trade, rapid expansion of e-commerce, and the adoption of advanced digital logistics solutions. The rise in cross-border transactions, coupled with more complex regulatory frameworks, has heightened the demand for customs brokers to ensure compliance and efficient clearance, thereby boosting market demand .

- Key players in this market include the UAE, Saudi Arabia, and Egypt, which dominate due to their strategic geographic locations, advanced trade infrastructure, and government-led trade facilitation initiatives. The UAE, especially Dubai, serves as a major logistics and re-export hub, while Saudi Arabia's Vision 2030 program emphasizes economic diversification and trade growth, further solidifying its position in the customs brokerage sector .

- In 2023, the Saudi Arabian government implemented new customs regulations focused on streamlining the import process. These regulations mandate the use of electronic documentation for all imports, significantly reducing processing times and enhancing transparency. This initiative is part of broader efforts to modernize the customs framework and improve the overall efficiency of trade operations in the region .

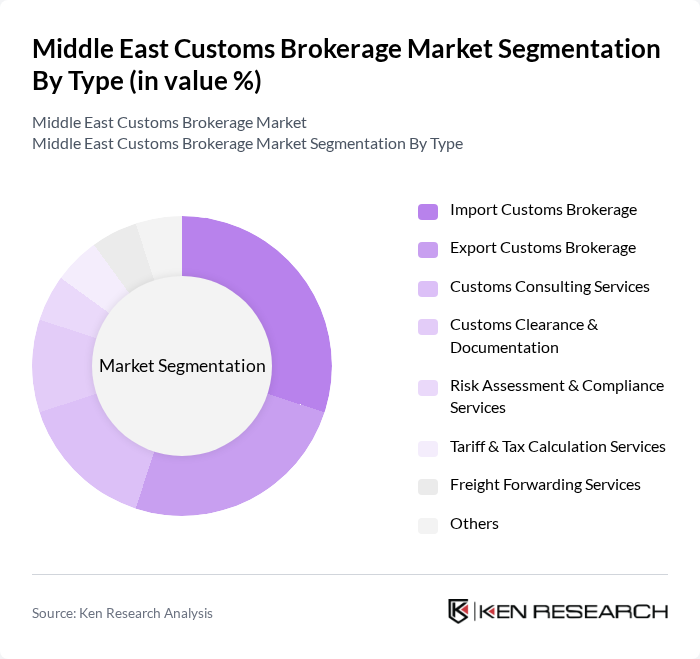

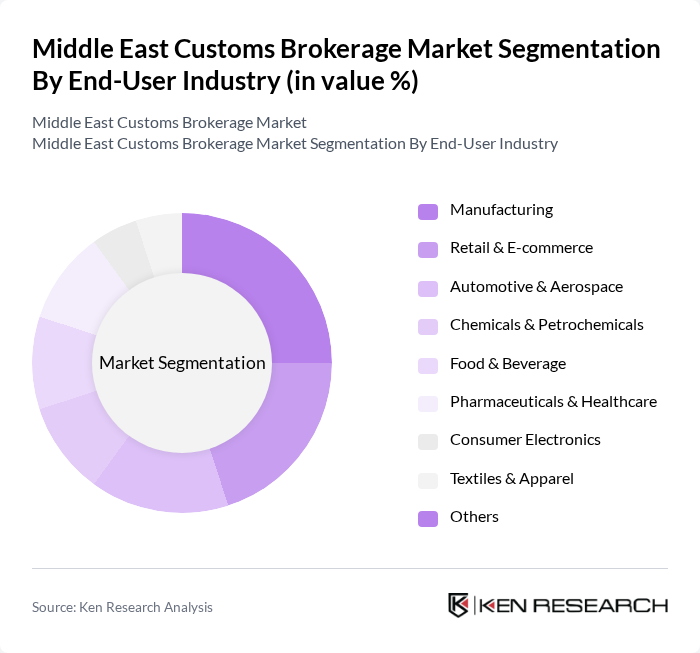

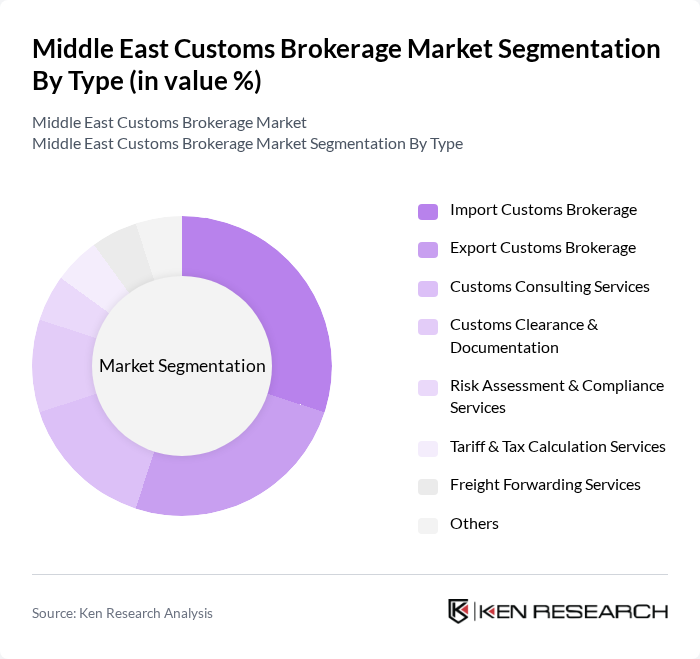

Middle East Customs Brokerage Market Segmentation

By Type:The customs brokerage market can be segmented into Import Customs Brokerage, Export Customs Brokerage, Customs Consulting Services, Customs Clearance & Documentation, Risk Assessment & Compliance Services, Tariff & Tax Calculation Services, Freight Forwarding Services, and Others. Each of these subsegments is integral to facilitating international trade by ensuring regulatory compliance, optimizing logistics, and providing specialized expertise in documentation, risk management, and tariff calculation. The adoption of digital platforms and automation is increasingly prominent across these segments, enhancing efficiency and transparency .

By End-User Industry:The customs brokerage market is also segmented by end-user industries, including Manufacturing, Retail & E-commerce, Automotive & Aerospace, Chemicals & Petrochemicals, Food & Beverage, Pharmaceuticals & Healthcare, Consumer Electronics, Textiles & Apparel, and Others. Each industry segment has distinct customs requirements and compliance challenges, influencing the demand for specialized brokerage services. The surge in e-commerce and manufacturing exports, along with regulatory changes in sectors like pharmaceuticals and chemicals, are key demand drivers .

Middle East Customs Brokerage Market Competitive Landscape

The Middle East Customs Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agility Logistics, DB Schenker, DHL Global Forwarding, Kuehne + Nagel, Expeditors International, CEVA Logistics, FedEx Trade Networks, UPS Supply Chain Solutions, Maersk Logistics, Aramex, Bahri Logistics, GAC Group, Al-Futtaim Logistics, Hellmann Worldwide Logistics, and DSV contribute to innovation, geographic expansion, and service delivery in this space .

Middle East Customs Brokerage Market Industry Analysis

Growth Drivers

- Increasing Trade Volume:The Middle East has witnessed a significant increase in trade volume, with total trade reaching approximately $1.2 trillion in recent periods, according to the World Bank. This growth is driven by the region's strategic location as a global trade hub, facilitating the movement of goods between Europe, Asia, and Africa. The expansion of trade agreements, such as the Gulf Cooperation Council (GCC) initiatives, further enhances trade activities, creating a robust demand for customs brokerage services to navigate complex regulations and ensure compliance.

- Regulatory Changes Favoring Trade Facilitation:Recent regulatory reforms in the Middle East have streamlined customs processes, significantly reducing clearance times. For instance, the UAE implemented a new customs law that cut average clearance times from 48 hours to approximately 24 hours. Such changes not only enhance efficiency but also attract foreign investment, as businesses seek to capitalize on the improved trade environment. This regulatory landscape fosters a growing need for customs brokerage services to assist companies in navigating these evolving regulations effectively.

- Technological Advancements in Logistics:The adoption of advanced technologies in logistics, such as blockchain and IoT, is transforming the customs brokerage landscape in the Middle East. Investments in logistics technology have reached approximately $1.5 billion in recent periods, reflecting a growing trend towards automation and digitalization. These technologies enhance transparency, reduce fraud, and improve tracking capabilities, making customs processes more efficient. As logistics firms increasingly integrate these technologies, the demand for skilled customs brokers who can leverage these tools is expected to rise significantly.

Market Challenges

- Complex Regulatory Environment:The Middle East's customs brokerage market faces challenges due to a complex regulatory environment. Each country has its own set of customs regulations, which can vary significantly. For example, Saudi Arabia's customs regulations are often seen as more stringent compared to those in the UAE. This complexity can lead to delays and increased costs for businesses, as they must navigate multiple regulatory frameworks. Consequently, customs brokers must invest in compliance expertise to effectively manage these challenges.

- High Competition Among Service Providers:The customs brokerage market in the Middle East is characterized by intense competition, with over 1,000 registered customs brokers operating in the region. This saturation leads to price wars and reduced profit margins, making it challenging for smaller firms to sustain operations. Additionally, larger firms often leverage economies of scale to offer lower prices, further intensifying competition. As a result, many brokers are compelled to differentiate their services through value-added offerings, such as consulting and technology integration.

Middle East Customs Brokerage Market Future Outlook

The future of the Middle East customs brokerage market appears promising, driven by ongoing technological advancements and regulatory reforms. As countries in the region continue to enhance their trade facilitation measures, customs brokers will play a crucial role in ensuring compliance and efficiency. The integration of AI and data analytics into customs processes is expected to streamline operations further, while the rise of e-commerce will create new opportunities for brokers to expand their service offerings. Overall, the market is poised for growth as it adapts to evolving trade dynamics.

Market Opportunities

- Expansion of Free Trade Zones:The establishment of new free trade zones in the Middle East presents significant opportunities for customs brokers. These zones, which facilitate duty-free trade, are expected to attract foreign investment, leading to increased demand for customs services. For instance, the Dubai Free Zone Authority reported a double-digit percentage increase in new business registrations in recent periods, indicating a growing trend that brokers can capitalize on by offering specialized services tailored to these zones.

- Growth in Cross-Border E-commerce:The surge in cross-border e-commerce is creating new avenues for customs brokerage services. The value of cross-border e-commerce in the Middle East has reached approximately $25 billion in recent periods, driven by increased consumer demand for international products. Customs brokers can leverage this trend by providing tailored solutions that simplify the customs clearance process for e-commerce businesses, ensuring compliance and timely delivery of goods to consumers across borders.