Region:North America

Author(s):Shubham

Product Code:KRAA0716

Pages:99

Published On:August 2025

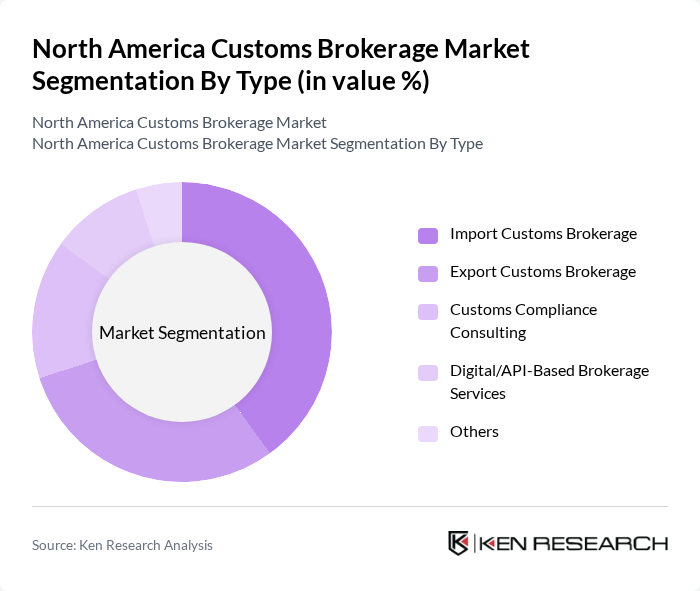

By Type:The customs brokerage market can be segmented into various types, including Import Customs Brokerage, Export Customs Brokerage, Customs Compliance Consulting, Digital/API-Based Brokerage Services, and Others. Import Customs Brokerage is crucial for businesses bringing goods into the country, while Export Customs Brokerage facilitates the shipment of goods abroad. Customs Compliance Consulting helps companies navigate regulatory requirements, and Digital/API-Based Brokerage Services are increasingly popular due to technological advancements .

The Import Customs Brokerage segment is currently the leading sub-segment, driven by the increasing volume of imports into North America, particularly from Asia and Europe. Businesses are increasingly relying on customs brokers to ensure compliance with complex regulations and to expedite the clearance process. The rise of e-commerce and digital trade platforms has further fueled this demand, as more companies seek to import goods efficiently to meet consumer expectations .

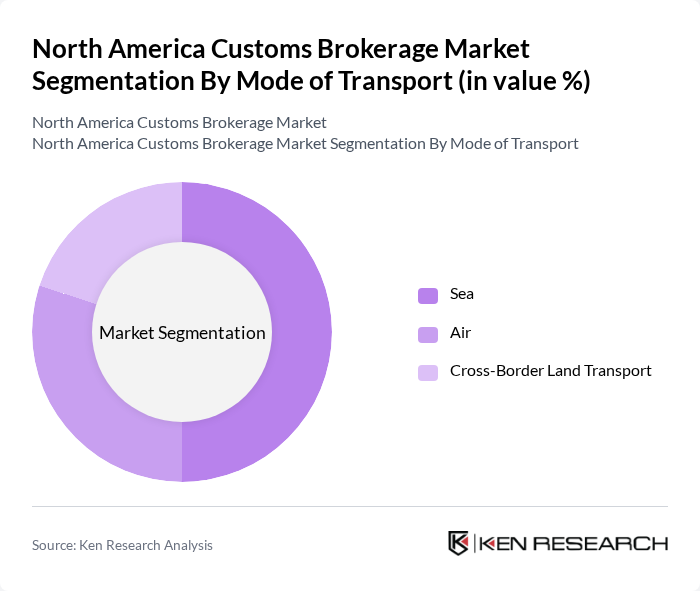

By Mode of Transport:The customs brokerage market can also be segmented by mode of transport, including Sea, Air, and Cross-Border Land Transport. Each mode has its unique advantages and challenges, with sea transport being the most cost-effective for bulk shipments, air transport offering speed for urgent deliveries, and land transport facilitating cross-border trade between the U.S., Canada, and Mexico .

The Sea transport segment dominates the market due to its cost-effectiveness for large shipments, making it the preferred choice for many businesses engaged in international trade. The growth of global supply chains has led to an increase in container shipping, further solidifying the importance of customs brokerage services in this segment. Air transport, while more expensive, is gaining traction for time-sensitive shipments, particularly in the e-commerce sector .

The North America Customs Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Expeditors International of Washington, Inc., C.H. Robinson Worldwide, Inc., DB Schenker (Schenker AG), Kuehne + Nagel International AG, DSV A/S (DSV Panalpina), UPS Supply Chain Solutions, Inc., FedEx Trade Networks Transport & Brokerage, Inc., DHL Global Forwarding (Deutsche Post AG), Geodis (Geodis Wilson USA, Inc.), Livingston International Inc., APL Logistics Ltd., C.H. Powell Company, CEVA Logistics (CMA CGM Group), SEKO Logistics, XPO Logistics, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The North America customs brokerage market is poised for significant transformation in the coming years, driven by technological advancements and evolving trade dynamics. As businesses increasingly adopt digital solutions, the integration of AI and automation will streamline customs processes, enhancing efficiency. Additionally, the growing emphasis on sustainability will prompt customs brokers to adopt eco-friendly practices, aligning with global environmental standards. These trends will shape the market landscape, fostering innovation and creating new opportunities for growth and collaboration among industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Import Customs Brokerage Export Customs Brokerage Customs Compliance Consulting Digital/API-Based Brokerage Services Others |

| By Mode of Transport | Sea Air Cross-Border Land Transport |

| By End-User Industry | Manufacturing Automotive Retail and Consumer Goods Healthcare & Pharmaceuticals Electronics Food and Beverage Chemicals Others |

| By Region | United States (by sub-region: West, Southeast, Great Lakes, etc.) Canada Mexico |

| By Service Model | Full-Service Brokerage Self-Service Brokerage Hybrid Brokerage |

| By Compliance Type | Standard Compliance Enhanced Compliance Risk Management Compliance |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Logistics Providers (3PLs) |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Customs Brokerage | 100 | Import Managers, Compliance Officers |

| Manufacturing Sector Brokerage | 80 | Logistics Directors, Supply Chain Managers |

| Pharmaceutical Imports | 60 | Regulatory Affairs Managers, Quality Control Officers |

| Automotive Parts Customs Clearance | 50 | Procurement Managers, Operations Supervisors |

| Technology Goods Brokerage | 40 | Product Managers, Shipping Coordinators |

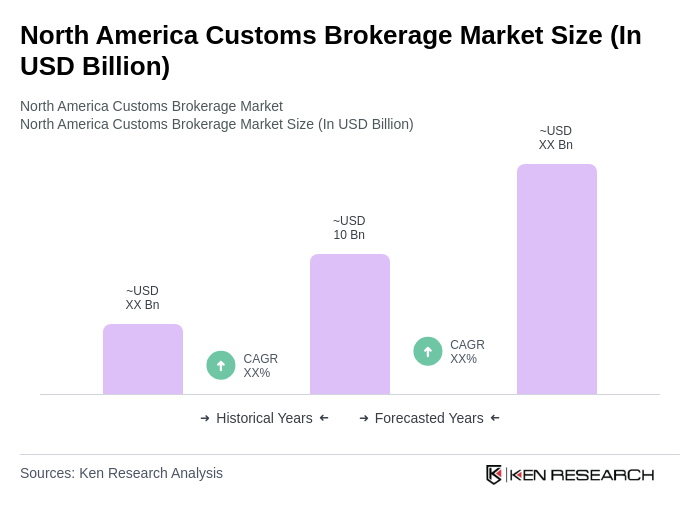

The North America Customs Brokerage Market is valued at approximately USD 10 billion, reflecting a significant growth driven by the complexities of international trade regulations, the rise of e-commerce, and the demand for efficient supply chain management.