Region:Asia

Author(s):Geetanshi

Product Code:KRAA2080

Pages:99

Published On:August 2025

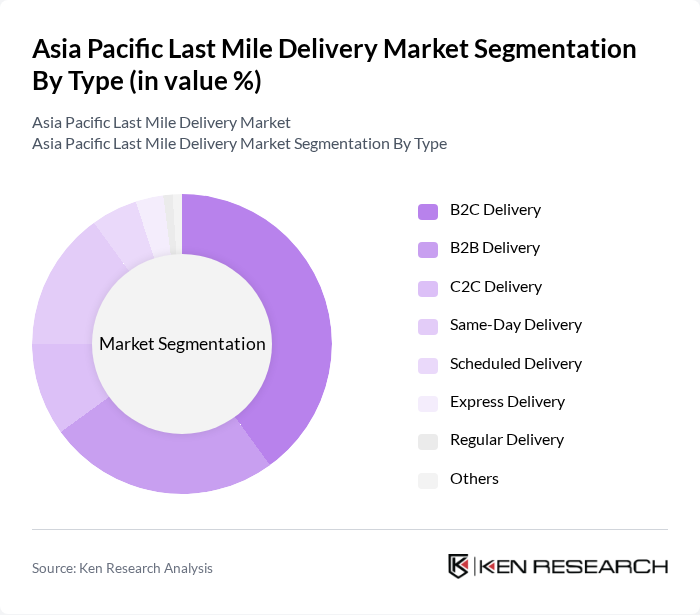

By Type:The last mile delivery market is segmented into B2C Delivery, B2B Delivery, C2C Delivery, Same-Day Delivery, Scheduled Delivery, Express Delivery, Regular Delivery, and Others. B2C Delivery remains the largest segment, driven by the dominance of e-commerce and the growing expectation for rapid delivery. Same-day and express delivery services are expanding quickly, supported by investments in automation and route optimization technologies. Scheduled and regular deliveries cater to specific business and consumer needs, while C2C and other segments address niche markets such as peer-to-peer and specialized logistics.

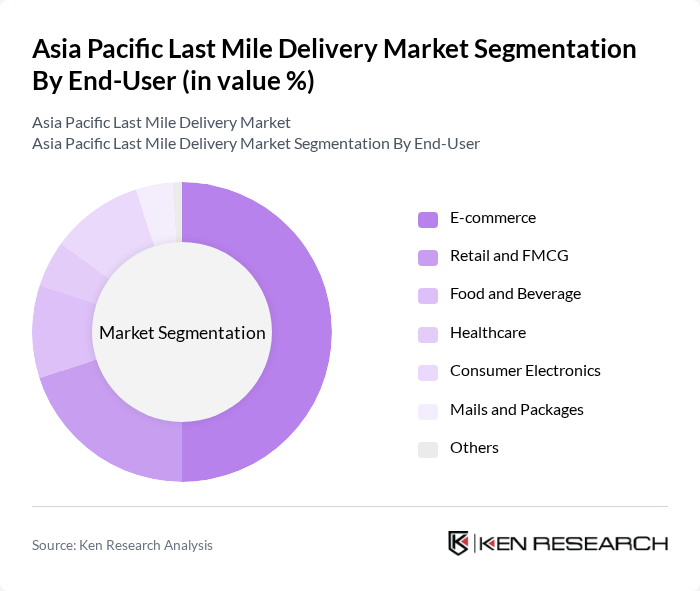

By End-User:The market is segmented by end-user categories: E-commerce, Retail and FMCG, Food and Beverage, Healthcare, Consumer Electronics, Mails and Packages, and Others. E-commerce is the leading segment, propelled by the rapid increase in online shoppers and the demand for quick, reliable delivery. Retail and FMCG leverage last-mile delivery for omnichannel fulfillment, while Food and Beverage and Healthcare segments are growing due to the need for temperature-controlled and time-sensitive deliveries. Consumer Electronics and Mails and Packages continue to represent significant volumes, with specialized logistics providers serving these sectors.

The Asia Pacific Last Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Express, FedEx Corporation, UPS Supply Chain Solutions, Blue Dart Express Limited, Ninja Van, Lalamove, GrabExpress, Gojek, Delhivery, ZTO Express, Qxpress, J&T Express, SF Express, JD Logistics, Tiki contribute to innovation, geographic expansion, and service delivery in this space.

The future of the last mile delivery market in Asia Pacific appears promising, driven by ongoing technological innovations and evolving consumer preferences. As urban populations grow, the demand for efficient delivery solutions will continue to rise. Companies are likely to invest in sustainable practices and advanced logistics technologies, such as AI and automation, to enhance service quality. Additionally, partnerships with local businesses may emerge as a strategic approach to expand delivery networks and improve customer reach, fostering a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C Delivery B2B Delivery C2C Delivery Same-Day Delivery Scheduled Delivery Express Delivery Regular Delivery Others |

| By End-User | E-commerce Retail and FMCG Food and Beverage Healthcare Consumer Electronics Mails and Packages Others |

| By Region | China India (North, South, East, West) Southeast Asia Australia and New Zealand Others |

| By Delivery Mode | Road Delivery Air Delivery Rail Delivery Maritime Delivery Last Mile Delivery Hubs Others |

| By Service Type | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Curbside Pickup Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Government Agencies Others |

| By Pricing Model | Flat Rate Pricing Variable Pricing Subscription-Based Pricing Pay-Per-Delivery Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Last Mile Delivery Services | 100 | Logistics Managers, Urban Delivery Coordinators |

| Rural Delivery Challenges | 60 | Supply Chain Analysts, Rural Logistics Experts |

| E-commerce Fulfillment Strategies | 80 | E-commerce Operations Managers, Warehouse Supervisors |

| Technology Integration in Delivery | 50 | IT Managers, Technology Officers in Logistics |

| Consumer Behavior in Delivery Preferences | 40 | Market Researchers, Customer Experience Managers |

The Asia Pacific Last Mile Delivery Market is valued at approximately USD 31 billion, reflecting significant growth driven by the expansion of e-commerce and increasing demand for fast delivery services.