Region:Europe

Author(s):Geetanshi

Product Code:KRAA1945

Pages:94

Published On:August 2025

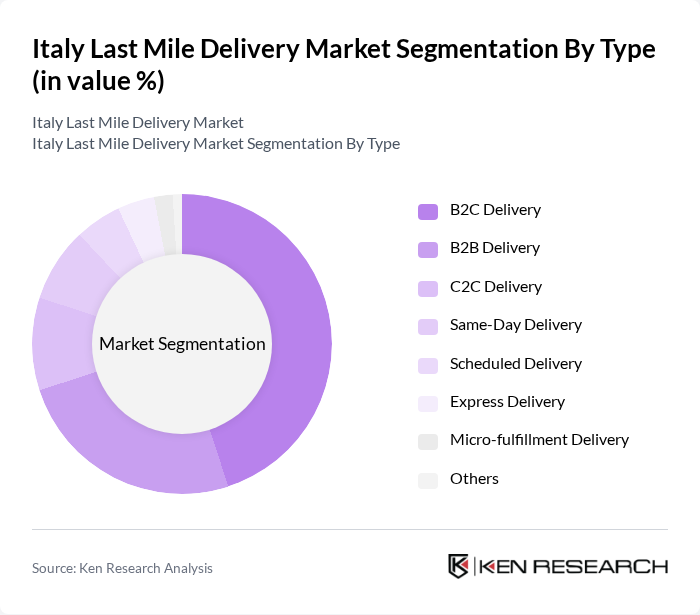

By Type:The last mile delivery market can be segmented into various types, includingB2C Delivery, B2B Delivery, C2C Delivery, Same-Day Delivery, Scheduled Delivery, Express Delivery, Micro-fulfillment Delivery, and Others. Each of these segments caters to different consumer needs and preferences, with B2C Delivery being the most prominent due to the rise of online shopping and the growing demand for fast, flexible, and trackable delivery options. Same-day and express delivery are gaining traction, particularly in urban areas, as logistics providers invest in technology and micro-fulfillment to meet consumer expectations for speed and convenience .

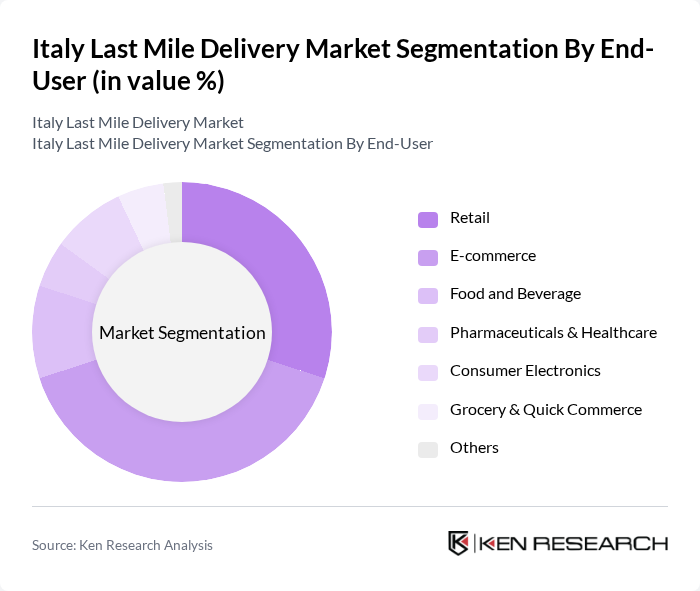

By End-User:The end-user segmentation includesRetail, E-commerce, Food and Beverage, Pharmaceuticals & Healthcare, Consumer Electronics, Grocery & Quick Commerce, and Others. E-commerce is the leading segment, driven by the increasing number of online shoppers and the demand for quick delivery services. Food and beverage, as well as grocery and quick commerce, are also expanding rapidly due to the proliferation of app-based delivery platforms and consumer preference for convenience .

The Italy Last Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Express, UPS Italia S.R.L., FedEx Express, GLS Italy, TNT Express, Poste Italiane S.p.A., Amazon Logistics, Bring Frigo S.r.l., DPD Italia S.r.l., Soget S.p.A., BRT S.p.A. (Bartolini), Aramex, Glovo, Just Eat, Uber Eats, Milkman S.p.A., Sendabox S.r.l., PonyU S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the last mile delivery market in Italy appears promising, driven by ongoing technological innovations and evolving consumer preferences. As urbanization continues, logistics companies are likely to invest in sustainable delivery solutions, including electric vehicles and eco-friendly packaging. Additionally, the integration of AI and automation will enhance operational efficiency, allowing for faster and more reliable deliveries. These trends indicate a dynamic market landscape that is responsive to both consumer demands and environmental considerations.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C Delivery B2B Delivery C2C Delivery Same-Day Delivery Scheduled Delivery Express Delivery Micro-fulfillment Delivery Others |

| By End-User | Retail E-commerce Food and Beverage Pharmaceuticals & Healthcare Consumer Electronics Grocery & Quick Commerce Others |

| By Delivery Mode | Motorized Vehicles (Vans, Cars, Scooters) Cargo Bikes & Bicycles Walking Couriers Drones & Autonomous Vehicles Others |

| By Service Type | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Contactless Delivery Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Government Agencies Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Pricing Model | Pay-Per-Delivery Subscription-Based Tiered Pricing Dynamic Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Last-Mile Delivery Services | 100 | Logistics Coordinators, Urban Delivery Managers |

| Rural Delivery Challenges | 60 | Operations Managers, Regional Logistics Managers |

| E-commerce Fulfillment Strategies | 80 | E-commerce Operations Managers, Supply Chain Analysts |

| Consumer Delivery Preferences | 50 | Marketing Managers, Customer Experience Specialists |

| Technology Adoption in Delivery | 40 | IT Managers, Innovation Leads in Logistics |

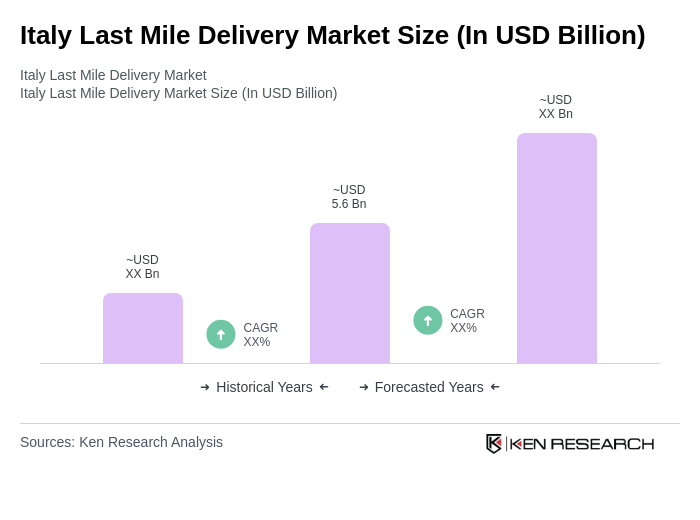

The Italy Last Mile Delivery Market is valued at approximately USD 5.6 billion, reflecting significant growth driven by increased e-commerce activities and consumer demand for faster delivery options, particularly during the pandemic.