Region:Africa

Author(s):Geetanshi

Product Code:KRAA2018

Pages:87

Published On:August 2025

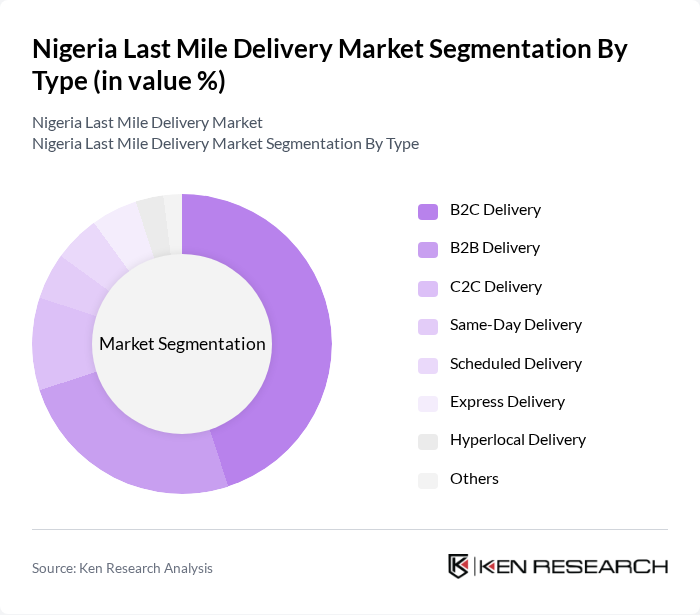

By Type:The last mile delivery market can be segmented into various types, including B2C Delivery, B2B Delivery, C2C Delivery, Same-Day Delivery, Scheduled Delivery, Express Delivery, Hyperlocal Delivery, and Others. Among these, B2C Delivery is the most dominant segment, driven by the surge in online shopping and consumer demand for quick and reliable delivery services. The convenience of receiving goods directly at home has led to increased adoption of B2C delivery solutions, making it a key driver of market growth. Recent trends also show a rise in hyperlocal and express delivery models, especially in urban centers, as consumers increasingly expect faster and more flexible delivery options .

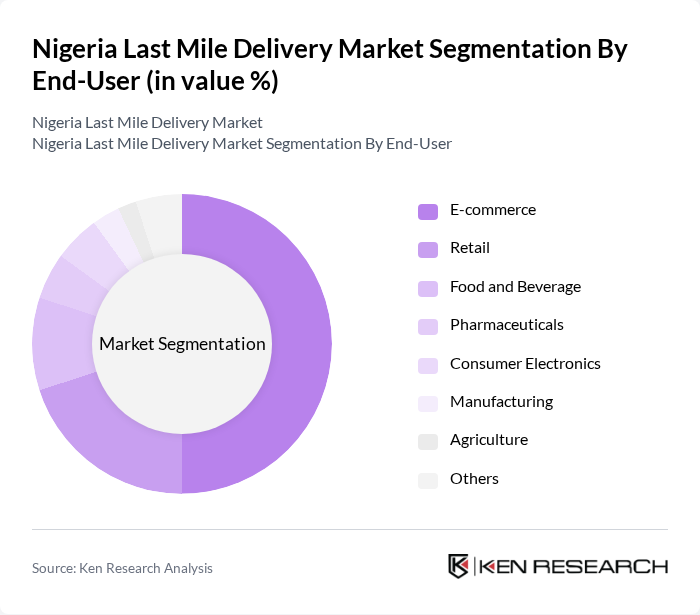

By End-User:The end-user segmentation includes Retail, E-commerce, Food and Beverage, Pharmaceuticals, Consumer Electronics, Manufacturing, Agriculture, and Others. The E-commerce segment is leading this market due to the exponential growth of online shopping platforms and the increasing consumer preference for home delivery services. Retailers are increasingly partnering with logistics providers to enhance their delivery capabilities, further solidifying the E-commerce segment's dominance. Additionally, food and beverage delivery has seen notable growth, driven by the expansion of online food ordering platforms and changing consumer lifestyles .

The Nigeria Last Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumia Logistics, GIG Logistics, DHL Nigeria, FedEx Nigeria, UPS Nigeria, Konga Express, Sendbox, Max.ng, OPay Logistics, Kwik Delivery, TSL Logistics, Red Star Express, Aramex Nigeria, Transport Services Limited, Errand360 contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's last mile delivery market appears promising, driven by urbanization and the rapid growth of e-commerce. As consumer preferences shift towards faster delivery options, companies are likely to invest in innovative technologies and partnerships to enhance service efficiency. Additionally, the increasing adoption of mobile payment solutions will facilitate smoother transactions, further boosting market growth. However, addressing infrastructure challenges and operational costs will be crucial for sustaining this momentum and ensuring long-term success in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C Delivery B2B Delivery C2C Delivery Same-Day Delivery Scheduled Delivery Express Delivery Hyperlocal Delivery Others |

| By End-User | Retail E-commerce Food and Beverage Pharmaceuticals Consumer Electronics Manufacturing Agriculture Others |

| By Delivery Mode | Motorbike Delivery Van Delivery Bicycle Delivery Foot Delivery Drone Delivery Electric Vehicle Delivery Others |

| By Payment Method | Cash on Delivery Mobile Payments Credit/Debit Cards Bank Transfers Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Cross-Border Deliveries Others |

| By Delivery Speed | Standard Delivery Express Delivery Same-Day Delivery Next-Day Delivery Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Last Mile Delivery Services | 100 | Logistics Managers, Operations Directors |

| Rural Delivery Challenges | 60 | Supply Chain Coordinators, Regional Managers |

| E-commerce Delivery Solutions | 80 | eCommerce Executives, Fulfillment Managers |

| Consumer Delivery Preferences | 120 | End Consumers, Customer Experience Managers |

| Technology Adoption in Delivery | 40 | IT Managers, Innovation Officers |

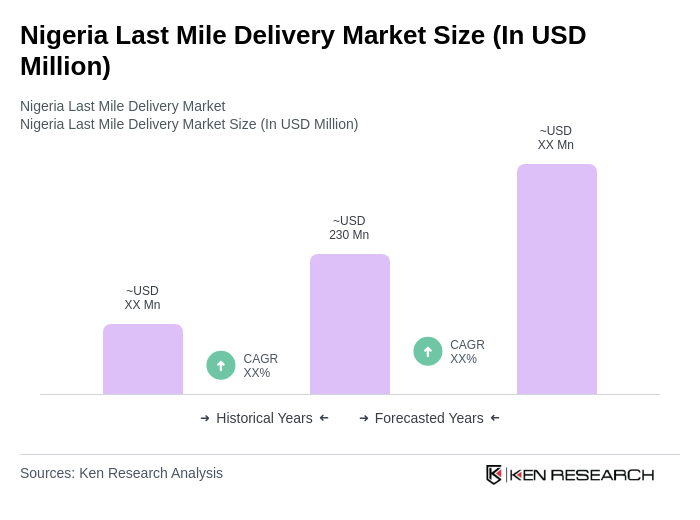

The Nigeria Last Mile Delivery Market is valued at approximately USD 230 million, driven by the rapid growth of e-commerce, urbanization, and the demand for efficient logistics solutions. This market is expected to continue expanding as consumer preferences evolve.