Region:Europe

Author(s):Shubham

Product Code:KRAA1057

Pages:80

Published On:August 2025

By Type:The last mile delivery market can be segmented into various types, including B2C Delivery, B2B Delivery, C2C Delivery, Same-Day Delivery, Scheduled Delivery, Express Delivery, Large Item Delivery, Grocery and Food Delivery, and Others. Among these, B2C Delivery is the most prominent segment, driven by the surge in online shopping and consumer preference for home delivery services. The demand for Same-Day and Express Delivery has also increased significantly, reflecting consumer expectations for faster service .

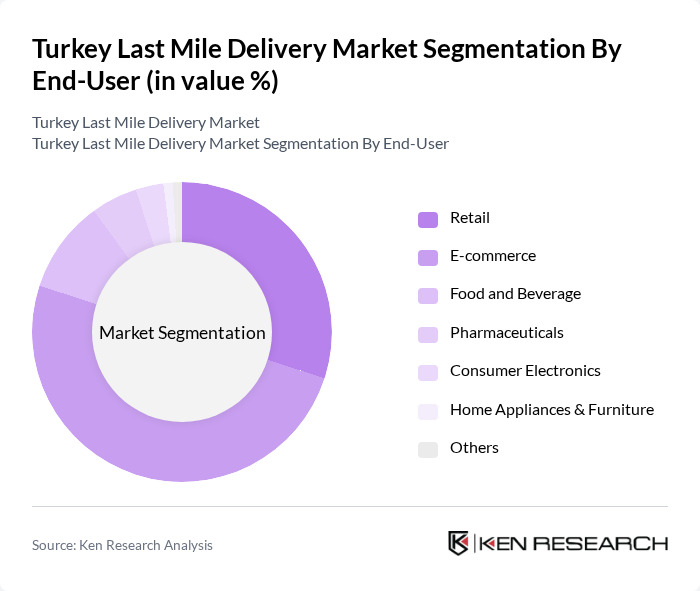

By End-User:The end-user segmentation includes Retail, E-commerce, Food and Beverage, Pharmaceuticals, Consumer Electronics, Home Appliances & Furniture, and Others. The E-commerce sector is the leading end-user, as the growth of online shopping has significantly increased the demand for last mile delivery services. Retail and Food and Beverage sectors also contribute substantially, driven by the need for timely deliveries to consumers .

The Turkey Last Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aras Kargo, Yurtiçi Kargo, MNG Kargo, PTT Kargo, Hepsijet, Getir, Trendyol Express, Sürat Kargo, DHL Express Turkey, UPS Turkey, FedEx Turkey, TNT Express Turkey, Scotty, PaketTaxi, Ekol Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey last mile delivery market is poised for significant transformation, driven by evolving consumer expectations and technological advancements. As urbanization continues, companies will increasingly adopt innovative delivery solutions, including drones and automated vehicles, to enhance efficiency. Additionally, the focus on sustainability will lead to the adoption of eco-friendly delivery methods, aligning with global trends. The integration of AI and data analytics will further optimize logistics operations, ensuring that businesses can meet the growing demand for fast and reliable delivery services.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C Delivery B2B Delivery C2C Delivery Same-Day Delivery Scheduled Delivery Express Delivery Large Item Delivery Grocery and Food Delivery Others |

| By End-User | Retail E-commerce Food and Beverage Pharmaceuticals Consumer Electronics Home Appliances & Furniture Others |

| By Delivery Mode | Motorized Vehicles (Vans, Cars, Motorcycles) Bicycles & E-bikes Walking Couriers Drones & Autonomous Vehicles Others |

| By Service Type | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery White-Glove Delivery Others |

| By Packaging Type | Standard Packaging Temperature-Controlled Packaging Fragile Packaging Bulk Packaging Sustainable/Eco-Friendly Packaging Others |

| By Pricing Model | Flat Rate Variable Rate Subscription-Based Pay-per-Use Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Last Mile Delivery Services | 100 | Logistics Managers, Operations Directors |

| E-commerce Fulfillment Strategies | 60 | eCommerce Managers, Supply Chain Analysts |

| Local Courier Operations | 40 | Business Owners, Delivery Coordinators |

| Consumer Preferences in Delivery | 80 | Marketing Managers, Customer Experience Leads |

| Technology Adoption in Logistics | 50 | IT Managers, Innovation Officers |

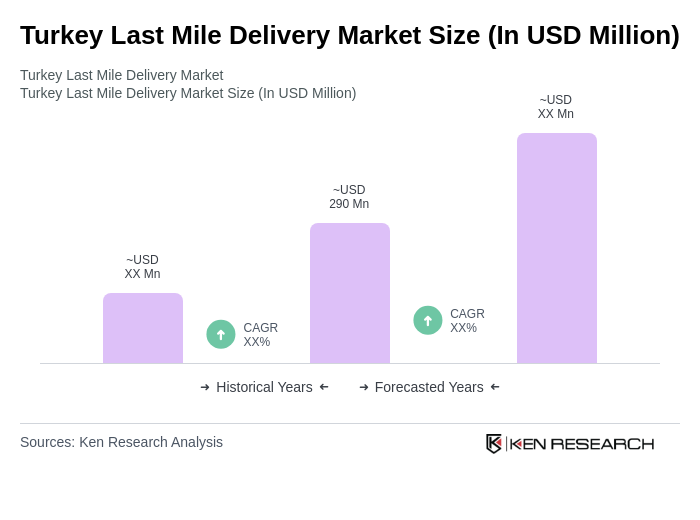

The Turkey Last Mile Delivery Market is valued at approximately USD 290 million, reflecting significant growth driven by the expansion of e-commerce, consumer demand for fast delivery, and advancements in logistics technology.