Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2077

Pages:82

Published On:August 2025

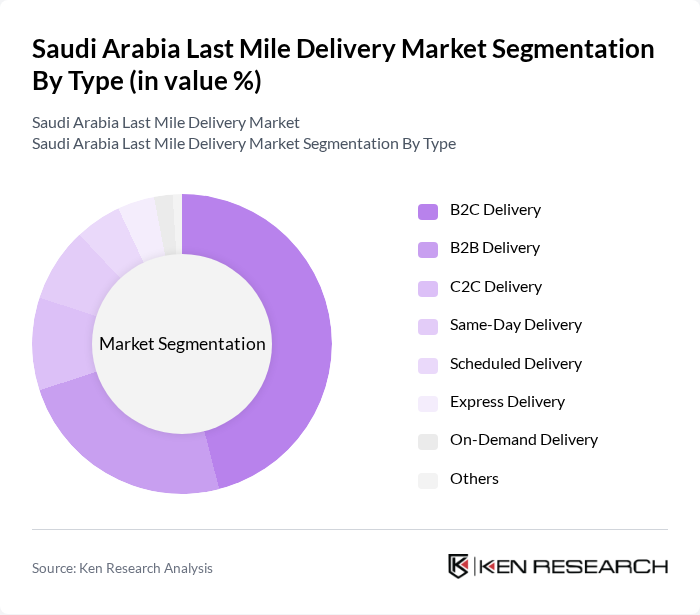

By Type:The last mile delivery market can be segmented into various types, including B2C Delivery, B2B Delivery, C2C Delivery, Same-Day Delivery, Scheduled Delivery, Express Delivery, On-Demand Delivery, and Others. Among these, B2C Delivery is the most dominant segment, driven by the surge in online shopping and consumer preferences for home delivery services. The convenience and speed offered by B2C services have made them a preferred choice for consumers, leading to increased market share .

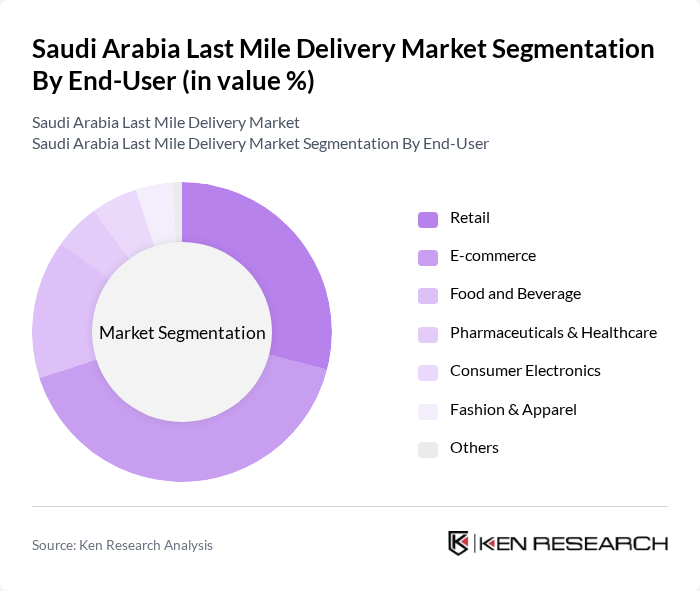

By End-User:The end-user segmentation includes Retail, E-commerce, Food and Beverage, Pharmaceuticals & Healthcare, Consumer Electronics, Fashion & Apparel, and Others. The E-commerce segment is leading this category, as the growth of online shopping has significantly increased the demand for last mile delivery services. Retailers are increasingly adopting efficient delivery solutions to meet consumer expectations for quick and reliable service .

The Saudi Arabia Last Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Express, FedEx, Zajil Express, Naqel Express, SMSA Express, Fetchr, Talabat, Careem NOW, Noon Express, Jahez, Diggipacks, Barq, Safe Arrival, AJEX (Ajlan & Bros Holding Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the last mile delivery market in Saudi Arabia appears promising, driven by the increasing integration of technology and evolving consumer expectations. As urbanization continues, logistics providers are likely to enhance their delivery networks, focusing on efficiency and speed. Additionally, the growing emphasis on sustainability will push companies to adopt eco-friendly practices, aligning with global trends. Overall, the market is set to evolve, presenting new opportunities for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C Delivery B2B Delivery C2C Delivery Same-Day Delivery Scheduled Delivery Express Delivery On-Demand Delivery Others |

| By End-User | Retail E-commerce Food and Beverage Pharmaceuticals & Healthcare Consumer Electronics Fashion & Apparel Others |

| By Delivery Mode | Motorbike Delivery Van Delivery Bicycle Delivery Drone Delivery Autonomous Vehicle Delivery Walk Delivery Others |

| By Service Type | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Reverse Logistics (Returns) Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Remote Areas Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Government Agencies Others |

| By Pricing Model | Flat Rate Variable Rate Subscription-Based Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Last Mile Delivery | 120 | Logistics Managers, Operations Directors |

| Rural Delivery Challenges | 60 | Supply Chain Coordinators, Regional Managers |

| E-commerce Fulfillment Strategies | 100 | eCommerce Operations Managers, Customer Experience Leads |

| Consumer Delivery Preferences | 50 | End Consumers, Market Research Participants |

| Technology Adoption in Delivery | 40 | IT Managers, Innovation Officers |

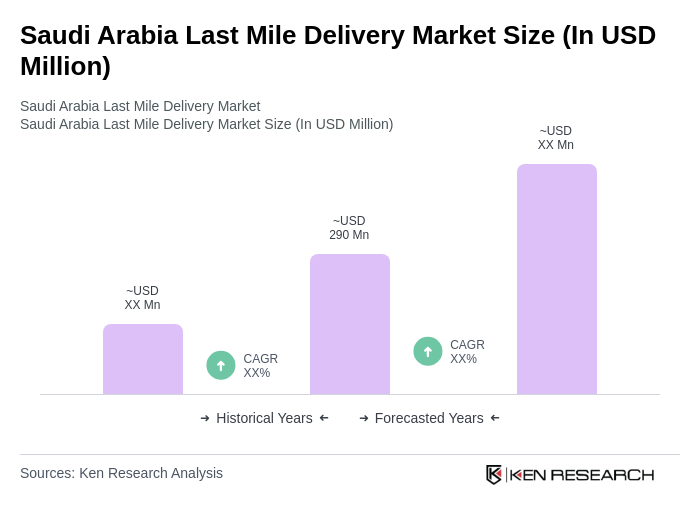

The Saudi Arabia Last Mile Delivery Market is valued at approximately USD 290 million, driven by the rapid growth of e-commerce, consumer demand for fast delivery services, and advancements in logistics technology.