Region:Middle East

Author(s):Dev

Product Code:KRAA8349

Pages:98

Published On:November 2025

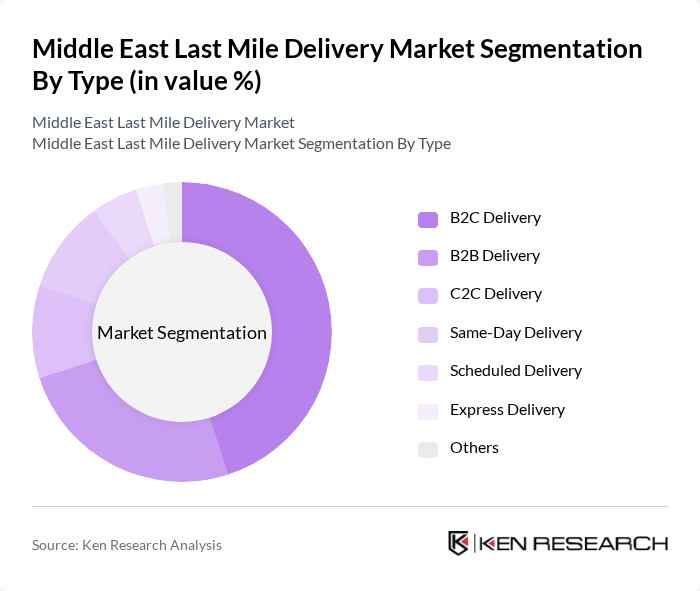

By Type:The last mile delivery market is segmented into various types, including B2C Delivery, B2B Delivery, C2C Delivery, Same-Day Delivery, Scheduled Delivery, Express Delivery, and Others. Among these, B2C Delivery is the most dominant segment, driven by the surge in online shopping and consumer demand for quick and reliable delivery services. The convenience of home delivery has led to increased investments in technology and infrastructure to support this segment. B2C accounts for the largest share, as e-commerce platforms prioritize customer experience and rapid fulfillment .

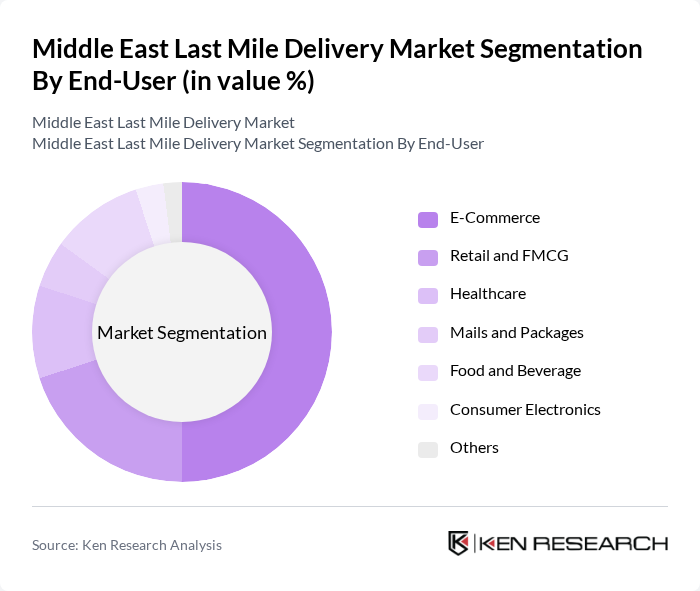

By End-User:The end-user segmentation includes E-Commerce, Retail and FMCG, Healthcare, Mails and Packages, Food and Beverage, Consumer Electronics, and Others. The E-Commerce segment is the leading end-user, fueled by the increasing number of online shoppers and the growing trend of home delivery services. Retail and FMCG also contribute significantly, as consumers prefer the convenience of having products delivered directly to their homes. The healthcare segment is expanding due to rising demand for timely delivery of medical supplies and pharmaceuticals .

The Middle East Last Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Express, FedEx, UPS, Zajil Express, Fetchr, Talabat, Noon, Careem NOW, Jumia, Q-Express, PostaPlus, MENA Logistics, TCS, Lalamove, Marsool, HungerStation, Tawseel, Carriage, Mrsool contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East last mile delivery market appears promising, driven by technological innovations and evolving consumer preferences. As urbanization continues, logistics companies are likely to invest in smart delivery solutions, including AI and automation, to enhance efficiency. Additionally, the increasing focus on sustainability will push companies to adopt eco-friendly practices, such as electric vehicles and green packaging, aligning with global trends towards environmental responsibility and consumer demand for sustainable options.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C Delivery B2B Delivery C2C Delivery Same-Day Delivery Scheduled Delivery Express Delivery Others |

| By End-User | E-Commerce Retail and FMCG Healthcare Mails and Packages Food and Beverage Consumer Electronics Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Delivery Method | Road Delivery Air Delivery Sea Delivery Drone Delivery Others |

| By Service Type | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Government Agencies Others |

| By Technology Utilization | Route Optimization Software Real-Time Tracking Systems Automated Delivery Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Last Mile Delivery Services | 100 | Logistics Managers, Operations Directors |

| Rural Delivery Challenges | 60 | Supply Chain Coordinators, Regional Managers |

| E-commerce Delivery Trends | 80 | eCommerce Executives, Marketing Managers |

| Consumer Preferences in Delivery | 50 | End Consumers, Customer Experience Managers |

| Technology Adoption in Logistics | 40 | IT Managers, Innovation Officers |

The Middle East Last Mile Delivery Market is valued at approximately USD 3 billion, driven by the rapid growth of e-commerce, urbanization, and the demand for faster delivery services, particularly accelerated during the pandemic.