Region:Asia

Author(s):Dev

Product Code:KRAA0466

Pages:87

Published On:August 2025

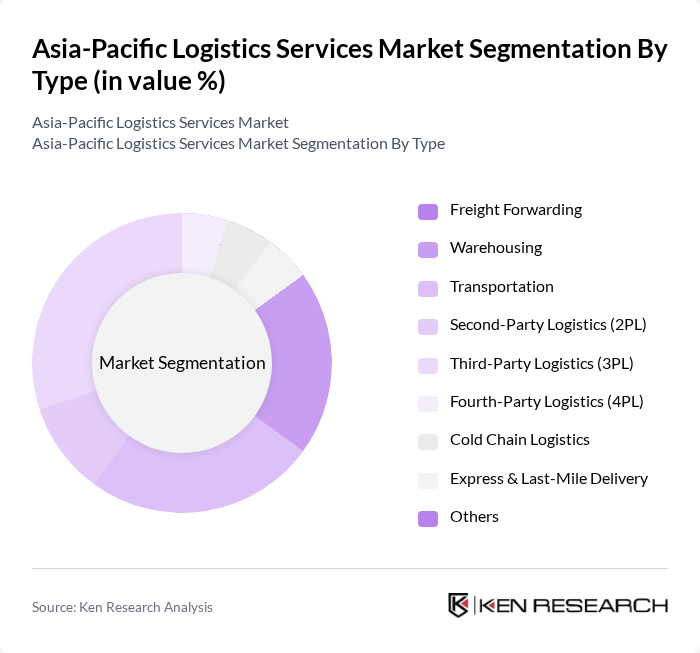

By Type:The logistics services market is segmented into various types, including Freight Forwarding, Warehousing, Transportation, Second-Party Logistics (2PL), Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), Cold Chain Logistics, Express & Last-Mile Delivery, and Others. Among these, Third-Party Logistics (3PL) is the leading sub-segment, driven by the increasing outsourcing of logistics functions by businesses seeking to enhance efficiency and reduce costs. The demand for integrated logistics solutions has surged, with 3PL providers playing a critical role in enabling companies to scale operations, optimize inventory, and improve delivery performance, especially in the context of rising e-commerce and cross-border trade .

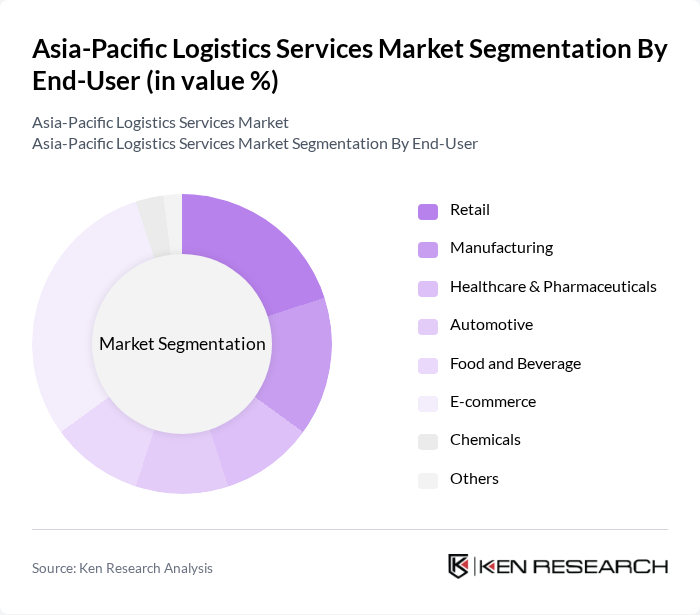

By End-User:The logistics services market is also segmented by end-user industries, including Retail, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food and Beverage, E-commerce, Chemicals, and Others. The E-commerce sector is currently the dominant end-user, fueled by the exponential growth of online shopping and the need for efficient delivery solutions. This trend has led to increased demand for logistics services that can handle high volumes of orders, support omnichannel fulfillment, and ensure timely deliveries, particularly in urban and semi-urban areas .

The Asia-Pacific Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, CEVA Logistics, Nippon Express, Sinotrans Limited, Yusen Logistics, Agility Logistics, Kerry Logistics Network, CJ Logistics, Toll Group, SF Express, Yamato Holdings, JD Logistics, and Linfox contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Asia-Pacific logistics services market is poised for transformation, driven by technological advancements and evolving consumer expectations. As digital transformation accelerates, logistics providers will increasingly adopt automation and AI-driven solutions to enhance operational efficiency. Additionally, sustainability initiatives will gain traction, with companies focusing on reducing carbon footprints and implementing eco-friendly practices. These trends will shape the logistics landscape, fostering innovation and competitiveness in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing Transportation Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Cold Chain Logistics Express & Last-Mile Delivery Others |

| By End-User | Retail Manufacturing Healthcare & Pharmaceuticals Automotive Food and Beverage E-commerce Chemicals Others |

| By Region | China Japan India South Korea Southeast Asia Australia & New Zealand Rest of Asia-Pacific |

| By Service Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport Others |

| By Technology Adoption | IoT in Logistics Blockchain Technology AI and Machine Learning Robotics Process Automation Automated Storage & Retrieval Systems (AS/RS) Others |

| By Customer Type | B2B B2C C2C Others |

| By Policy Support | Subsidies Tax Incentives Trade Agreements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Third-Party Logistics Providers | 60 | Operations Managers, Business Development Executives |

| Last-Mile Delivery Services | 50 | Logistics Coordinators, Fleet Managers |

| Cold Chain Logistics | 40 | Supply Chain Analysts, Quality Control Managers |

| Freight Forwarding Services | 55 | Import/Export Managers, Compliance Officers |

| Warehouse Management Solutions | 45 | Warehouse Managers, IT Systems Analysts |

The Asia-Pacific Logistics Services Market is valued at approximately USD 4.6 trillion, driven by factors such as the rapid growth of e-commerce, demand for efficient supply chain solutions, and significant infrastructure investments in the region.