Region:North America

Author(s):Shubham

Product Code:KRAA0703

Pages:93

Published On:August 2025

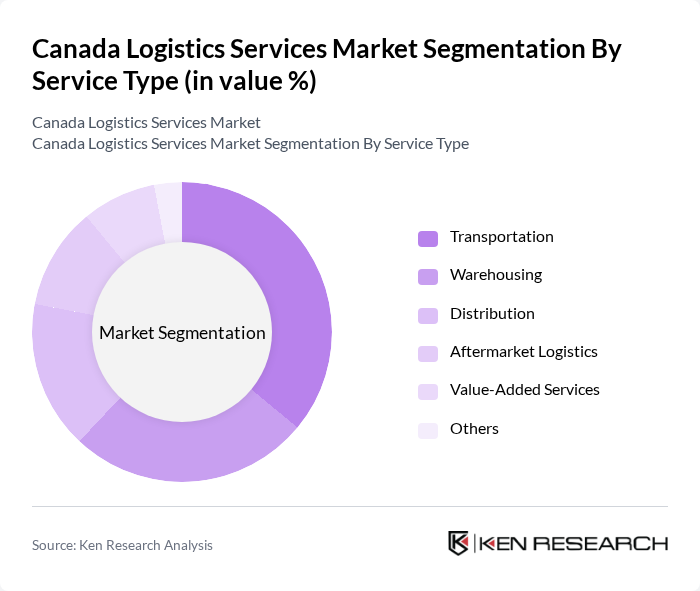

By Service Type:The logistics services market is segmented into various service types, including Transportation, Warehousing, Distribution, Aftermarket Logistics, Value-Added Services, and Others. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different customer needs and operational requirements .

The Transportation segment is the dominant force in the logistics services market, accounting for the largest portion of the overall market share. This is largely due to the increasing demand for efficient and timely delivery of goods, driven by the growth of e-commerce and consumer expectations for fast shipping. The rise in online shopping has led to a surge in freight movement, making transportation services essential for businesses to meet customer demands. Additionally, advancements in technology, such as AI-driven routing, GPS tracking, and route optimization, have further enhanced the efficiency of transportation services .

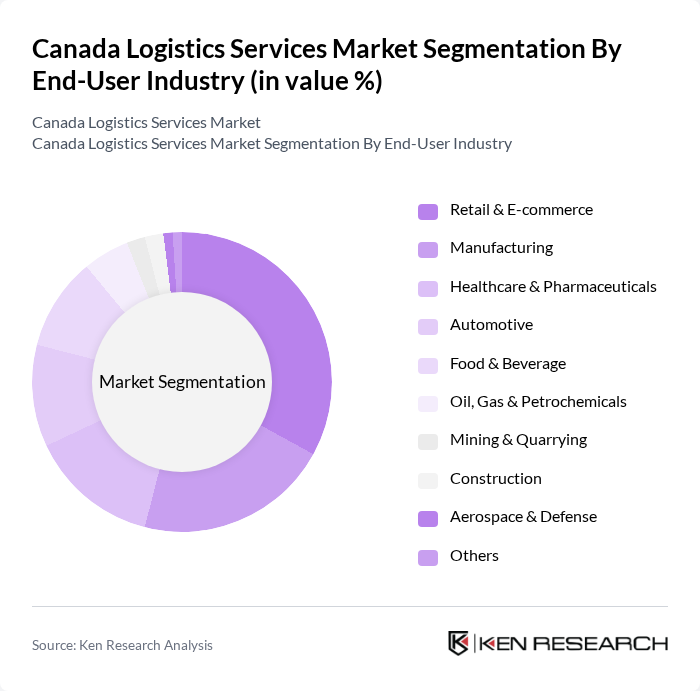

By End-User Industry:The logistics services market is also segmented by end-user industries, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, Oil, Gas & Petrochemicals, Mining & Quarrying, Construction, Aerospace & Defense, and Others. Each industry has unique logistics requirements that influence the demand for specific services .

The Retail & E-commerce sector is the leading end-user industry in the logistics services market, driven by the rapid growth of online shopping and consumer demand for quick delivery. This sector's logistics needs are characterized by high volume and frequency of shipments, necessitating efficient warehousing and transportation solutions. The increasing reliance on digital platforms for shopping has compelled logistics providers to innovate and enhance their service offerings to meet the evolving expectations of consumers .

The Canada Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canadian National Railway (CN), Canadian Pacific Kansas City (CPKC), Purolator Inc., FedEx Canada, DHL Supply Chain Canada, Kuehne + Nagel Canada, XPO Logistics Canada, TFI International, Ryder Canada, C.H. Robinson Canada, DB Schenker Canada, UPS Canada, UniUni, A.P. Moller-Maersk Canada, Metro Supply Chain Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Canada logistics services market appears promising, driven by ongoing digital transformation and a heightened focus on supply chain resilience. As companies increasingly adopt data analytics and automation, operational efficiencies are expected to improve significantly. Furthermore, the shift towards omnichannel logistics solutions will enable businesses to meet diverse consumer demands effectively. These trends indicate a robust evolution in logistics operations, positioning the sector for sustained growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Warehousing Distribution Aftermarket Logistics Value-Added Services Others |

| By End-User Industry | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food & Beverage Oil, Gas & Petrochemicals Mining & Quarrying Construction Aerospace & Defense Others |

| By Mode of Transport | Road Rail Air Sea Intermodal Others |

| By Delivery Type | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Others |

| By Temperature Control | Cold Chain Logistics Ambient Logistics Others |

| By Distribution Channel | Direct Sales Online Sales Retail Sales Wholesale Distribution Others |

| By Pricing Strategy | Competitive Pricing Value-Based Pricing Dynamic Pricing Penetration Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Coordinators, Supply Chain Analysts |

| Manufacturing Supply Chain Management | 80 | Operations Managers, Production Supervisors |

| Third-Party Logistics Providers | 60 | Business Development Managers, Account Executives |

| Cold Chain Logistics | 50 | Warehouse Managers, Quality Control Officers |

| E-commerce Fulfillment Strategies | 60 | eCommerce Operations Managers, Logistics Directors |

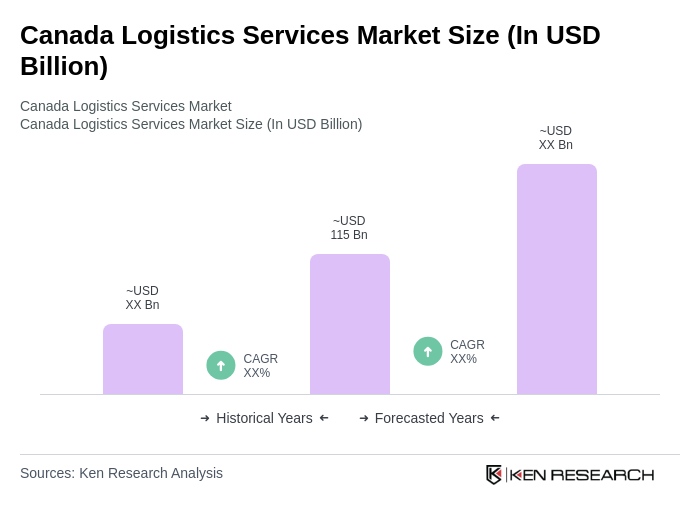

The Canada Logistics Services Market is valued at approximately USD 115 billion, reflecting significant growth driven by the demand for efficient supply chain solutions, e-commerce expansion, and the adoption of advanced technologies in logistics operations.