Region:Europe

Author(s):Dev

Product Code:KRAA0424

Pages:85

Published On:August 2025

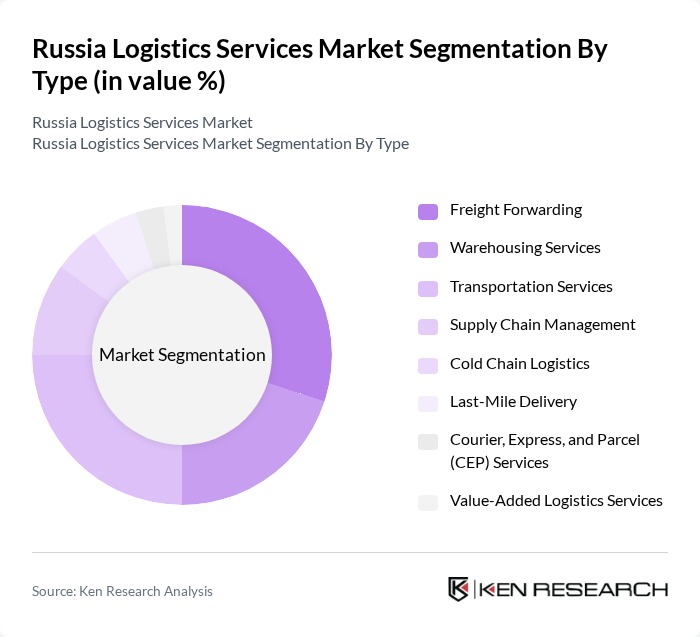

By Type:The logistics services market can be segmented into various types, including Freight Forwarding, Warehousing Services, Transportation Services, Supply Chain Management, Cold Chain Logistics, Last-Mile Delivery, Courier, Express, and Parcel (CEP) Services, and Value-Added Logistics Services. Among these, Freight Forwarding and Transportation Services are particularly significant due to the increasing demand for efficient movement of goods across vast distances. The rise of e-commerce has also led to a surge in Last-Mile Delivery services, catering to consumer expectations for quick and reliable deliveries .

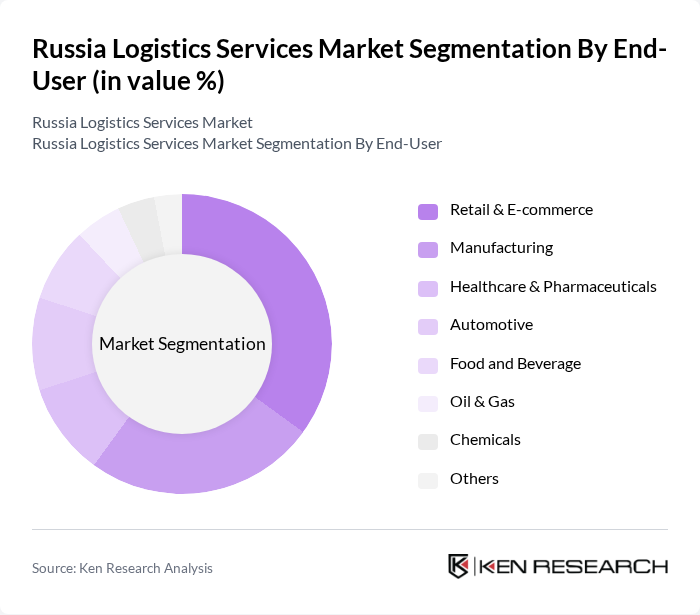

By End-User:The logistics services market is segmented by end-users, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food and Beverage, Oil & Gas, Chemicals, and Others. The Retail & E-commerce sector is the leading end-user, driven by the rapid growth of online shopping and the need for efficient distribution networks. Manufacturing and Automotive sectors also significantly contribute to logistics demand due to their complex supply chains and the necessity for timely delivery of components and finished goods .

The Russia Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Russian Railways (RZD), DPD Russia, CDEK, Kuehne + Nagel, DB Schenker, TransContainer, Pochta Rossii (Russian Post), FM Logistic Russia, PEC (First Expeditionary Company), Major Express, DHL Supply Chain Russia, RZD Logistics, Itella Russia, Globaltruck, GEFCO Russia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics services market in Russia appears promising, driven by the ongoing digital transformation and increasing demand for efficient supply chain solutions. As companies continue to invest in technology and infrastructure, the logistics sector is expected to adapt to evolving consumer preferences, particularly in e-commerce. Furthermore, the emphasis on sustainability and green logistics practices will likely shape operational strategies, fostering innovation and enhancing service delivery in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing Services Transportation Services Supply Chain Management Cold Chain Logistics Last-Mile Delivery Courier, Express, and Parcel (CEP) Services Value-Added Logistics Services |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food and Beverage Oil & Gas Chemicals Others |

| By Service Mode | Road Transport Rail Transport Air Transport Sea and Inland Waterways Pipeline Transport Intermodal Transport Others |

| By Region | Central Federal District Northwestern Federal District Southern Federal District Volga Federal District Ural Federal District Siberian Federal District Far Eastern Federal District |

| By Technology | Automated Warehousing Fleet Management Systems Tracking and Visibility Solutions Robotics in Logistics Digital Freight Platforms Others |

| By Customer Type | B2B B2C Government Non-Profit Organizations Others |

| By Policy Support | Subsidies for Logistics Companies Tax Incentives Infrastructure Development Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Services | 100 | Logistics Coordinators, Supply Chain Managers |

| Manufacturing Supply Chain Logistics | 80 | Operations Directors, Procurement Managers |

| Third-Party Logistics Providers | 60 | Business Development Managers, Account Executives |

| Cold Chain Logistics | 50 | Warehouse Supervisors, Quality Control Managers |

| Last-Mile Delivery Services | 70 | Delivery Managers, Customer Experience Leads |

The Russia Logistics Services Market is valued at approximately USD 71 billion, driven by the increasing demand for efficient supply chain solutions, e-commerce expansion, and infrastructure improvements. This valuation is based on a five-year historical analysis of the market.