Region:Central and South America

Author(s):Dev

Product Code:KRAA0408

Pages:98

Published On:August 2025

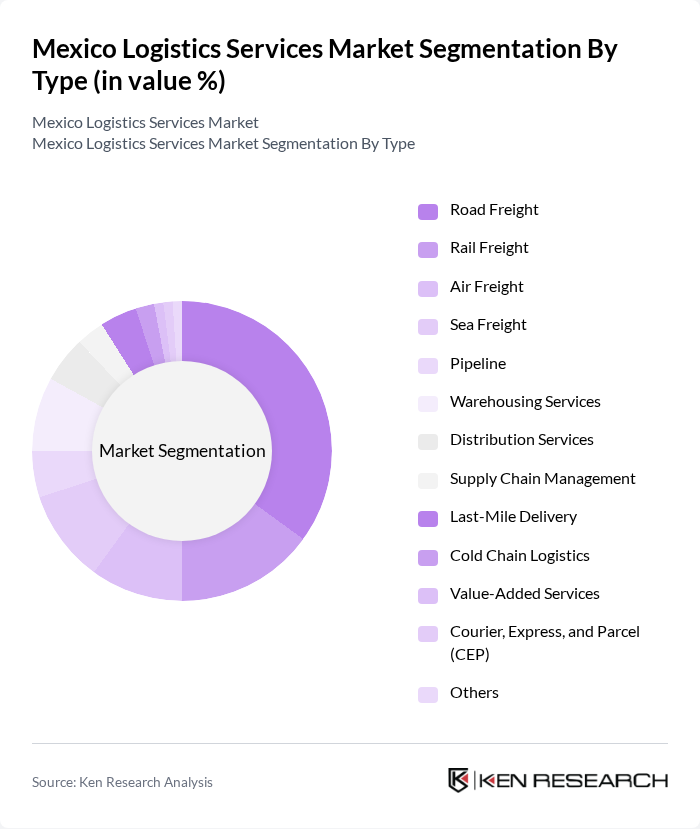

By Type:The logistics services market can be segmented into Road Freight, Rail Freight, Air Freight, Sea Freight, Pipeline, Warehousing Services, Distribution Services, Supply Chain Management, Last-Mile Delivery, Cold Chain Logistics, Value-Added Services, Courier, Express, and Parcel (CEP), and Others. Road Freight is the most dominant segment due to its flexibility, extensive national coverage, and ability to serve both urban and rural areas. The surge in e-commerce and demand for rapid deliveries have further strengthened the role of road freight in the market .

By End-User:The logistics services market is also segmented by end-users, including Manufacturing, Automotive, Agriculture, Retail, Oil & Gas, Electronics, Pharmaceuticals, Food and Beverage, E-commerce, Consumer Electronics, Construction, and Others. The E-commerce sector is a leading end-user, fueled by the rapid growth of online shopping and increased consumer expectations for fast, reliable delivery. This trend has prompted logistics providers to expand last-mile delivery capabilities and invest in digital solutions to optimize service levels .

The Mexico Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Grupo TMM, Estafeta, Kuehne + Nagel, FedEx, UPS, XPO Logistics, C.H. Robinson, CEVA Logistics, Traxión, Maersk, DB Schenker, Rhenus Logistics, Agility Logistics, Redpack contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics services market in Mexico appears promising, driven by ongoing investments in infrastructure and technology. As e-commerce continues to expand, logistics providers will increasingly focus on enhancing last-mile delivery capabilities and integrating advanced technologies. Additionally, the emphasis on sustainability will likely shape operational strategies, with companies adopting greener practices to meet consumer expectations. Overall, the logistics sector is poised for transformation, adapting to new market dynamics and consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Pipeline Warehousing Services Distribution Services Supply Chain Management Last-Mile Delivery Cold Chain Logistics Value-Added Services Courier, Express, and Parcel (CEP) Others |

| By End-User | Manufacturing Automotive Agriculture Retail Oil & Gas Electronics Pharmaceuticals Food and Beverage E-commerce Consumer Electronics Construction Others |

| By Service Mode | Road Transport Rail Transport Air Freight Sea Freight Intermodal Transport Dedicated Fleet Services Shared Fleet Services Others |

| By Region | Mexico City Metropolitan Area Northern Mexico Central Mexico Southern Mexico Baja California Yucatán Peninsula Gulf Coast Others |

| By Technology | Automated Warehousing Fleet Management Software Tracking and Visibility Solutions Robotics in Logistics Blockchain for Supply Chain AI and Machine Learning Applications Internet of Things (IoT) Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Venture Capital Private Equity Others |

| By Policy Support | Tax Incentives Subsidies for Infrastructure Development Regulatory Support for Innovation Trade Facilitation Measures Environmental Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Forwarding Services | 60 | Logistics Managers, Operations Directors |

| Warehousing Solutions | 50 | Warehouse Managers, Supply Chain Analysts |

| Last-Mile Delivery Services | 45 | Delivery Operations Managers, eCommerce Executives |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Supply Chain Coordinators |

| Logistics Technology Solutions | 55 | IT Managers, Logistics Software Developers |

The Mexico Logistics Services Market is valued at approximately USD 87 billion, driven by the growth of e-commerce, nearshoring, and modernization of transport infrastructure. This market has seen significant investments in digital technologies and sustainable operations, enhancing efficiency and service delivery.