Region:Asia

Author(s):Dev

Product Code:KRAA0396

Pages:95

Published On:August 2025

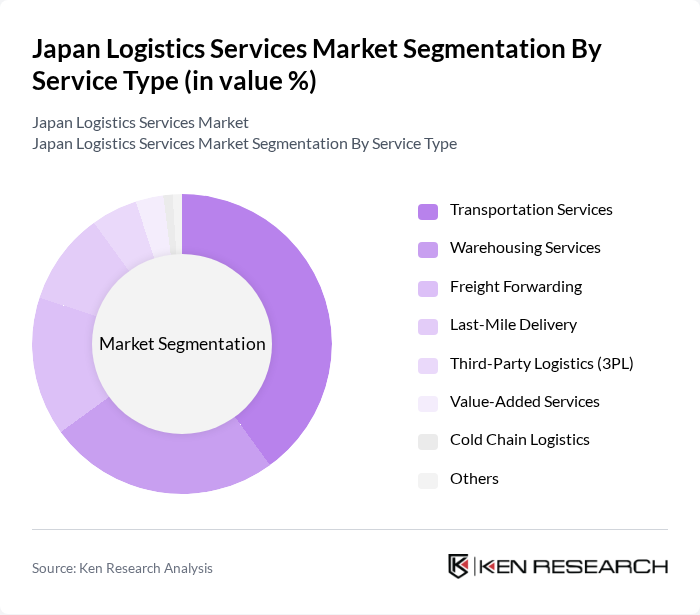

By Service Type:

The service type segmentation of the logistics market includes Transportation Services, Warehousing Services, Freight Forwarding, Last-Mile Delivery, Third-Party Logistics (3PL), Value-Added Services, Cold Chain Logistics, and Others. Transportation Services dominate the market, driven by the increasing demand for efficient and timely delivery solutions. The surge in e-commerce has significantly boosted the need for reliable transportation networks, leading to heightened investments in this segment. Additionally, the growing trend of just-in-time delivery and the adoption of advanced fleet management technologies have further solidified the importance of transportation services in the logistics landscape .

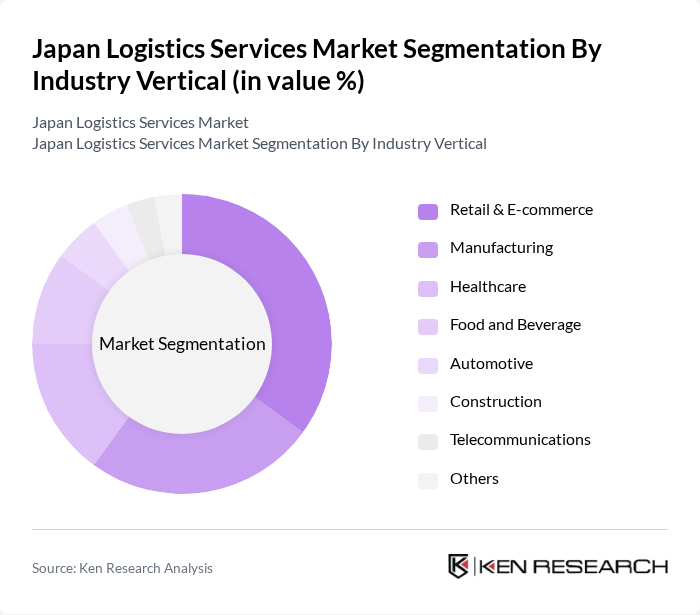

By Industry Vertical:

The industry vertical segmentation encompasses Retail & E-commerce, Manufacturing, Healthcare, Food and Beverage, Automotive, Construction, Telecommunications, and Others. The Retail & E-commerce sector is the leading segment, propelled by the rapid growth of online shopping and consumer demand for fast, reliable delivery services. This trend has prompted logistics providers to enhance their capabilities in order fulfillment, automation, and last-mile delivery, making it a critical area for investment and innovation within the logistics market .

The Japan Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express, Yamato Holdings, Sagawa Express, Hitachi Transport System, Seino Holdings, Kintetsu World Express, Mitsui-Soko Holdings, Marubeni Logistics, Japan Post Holdings, Sankyu Inc., SG Holdings (Sagawa Group), Kuehne + Nagel, DB Schenker, CEVA Logistics, DSV contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan logistics services market is poised for transformation, driven by digitalization and sustainability initiatives. As companies increasingly adopt smart logistics solutions, the integration of AI and big data analytics will enhance operational efficiency and decision-making. Furthermore, the focus on environmental sustainability will lead to the development of greener logistics practices, aligning with global trends. These advancements will not only improve service delivery but also position the industry for long-term growth and resilience in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Services Warehousing Services Freight Forwarding Last-Mile Delivery Third-Party Logistics (3PL) Value-Added Services Cold Chain Logistics Others |

| By Industry Vertical | Retail & E-commerce Manufacturing Healthcare Food and Beverage Automotive Construction Telecommunications Others |

| By Mode of Transport | Road Rail Air Sea Intermodal Others |

| By Customer Type | B2B B2C C2C Government Others |

| By Technology Adoption | Automated Warehousing IoT in Logistics Blockchain for Supply Chain AI and Machine Learning Robotics Process Automation Others |

| By Region | Kanto Kansai Chubu Kyushu Hokkaido Shikoku Tohoku Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Logistics Services | 60 | Logistics Coordinators, Supply Chain Analysts |

| Retail Supply Chain Management | 70 | Operations Managers, Retail Logistics Managers |

| Pharmaceutical Distribution | 40 | Warehouse Managers, Compliance Officers |

| E-commerce Fulfillment Solutions | 50 | eCommerce Operations Managers, Logistics Supervisors |

| Cold Chain Logistics | 45 | Temperature Control Specialists, Supply Chain Managers |

The Japan Logistics Services Market is valued at approximately USD 337 billion, reflecting significant growth driven by the demand for efficient supply chain solutions, e-commerce expansion, and technological advancements in logistics operations.