Region:Asia

Author(s):Rebecca

Product Code:KRAA2165

Pages:91

Published On:August 2025

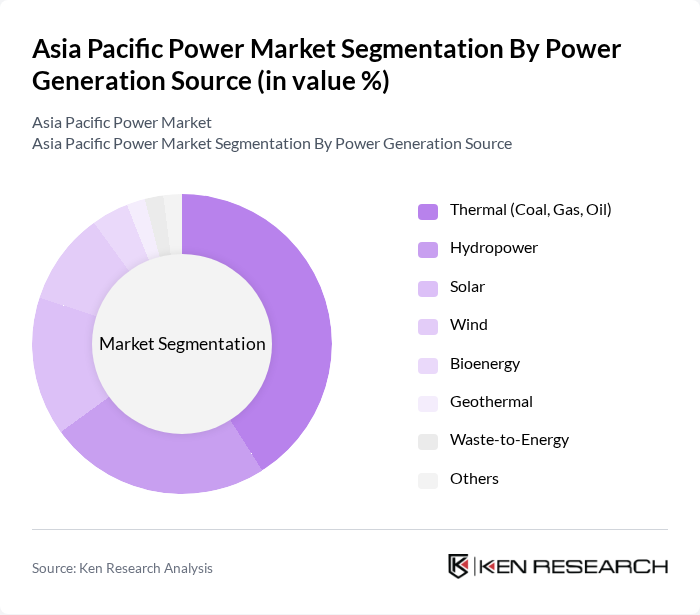

By Power Generation Source:The power generation source segment includes various methods of generating electricity, such as thermal, hydropower, solar, wind, bioenergy, geothermal, waste-to-energy, and others. Among these, thermal power generation remains a significant contributor due to its established infrastructure and reliability. However, renewable sources like solar and wind are rapidly gaining traction, driven by technological advancements, government incentives, and large-scale investments in grid integration and storage solutions .

By Transmission & Distribution:This segment encompasses the systems and technologies used to transmit and distribute electricity from generation points to end-users. The high voltage transmission segment is crucial for long-distance electricity transport, while low voltage distribution is essential for delivering power to residential and commercial consumers. The increasing demand for reliable electricity supply, grid modernization, and rural electrification is driving investments in both segments, with a notable emphasis on advanced cable solutions and digital monitoring systems .

The Asia Pacific Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as State Grid Corporation of China, Electric Power Development Co., Ltd. (J-POWER), Tokyo Electric Power Company Holdings, Inc. (TEPCO), Korea Electric Power Corporation (KEPCO), CLP Holdings Limited, SP Group (Singapore Power Limited), AGL Energy Limited, ENGIE SA, Tata Power Company Limited, Adani Green Energy Limited, First Solar, Inc., Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy, S.A., Brookfield Renewable Partners L.P., JinkoSolar Holding Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific power market is poised for transformative growth, driven by a shift towards sustainable energy solutions and technological innovations. In future, the region is expected to see a significant increase in decentralized energy systems, enhancing energy access and reliability. Additionally, the rise of digital transformation in energy management will streamline operations and improve efficiency, paving the way for a more resilient energy infrastructure. As governments continue to prioritize renewable energy, the market will likely attract increased investments and private sector participation.

| Segment | Sub-Segments |

|---|---|

| By Power Generation Source | Thermal (Coal, Gas, Oil) Hydropower Solar Wind Bioenergy Geothermal Waste-to-Energy Others |

| By Transmission & Distribution | High Voltage Transmission Low Voltage Distribution |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Country/Region | China India Japan South Korea Australia Southeast Asia Rest of Asia Pacific |

| By Technology | Photovoltaic (PV) Concentrated Solar Power (CSP) Onshore Wind Offshore Wind Biomass Gasification Advanced Grid Technologies |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnership (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Renewable Energy Projects | 100 | Project Managers, Renewable Energy Analysts |

| Power Distribution Networks | 70 | Distribution Managers, Operations Directors |

| Energy Policy Impact Studies | 50 | Policy Makers, Regulatory Affairs Specialists |

| Fossil Fuel Market Dynamics | 60 | Market Analysts, Financial Officers |

| Energy Efficiency Programs | 80 | Sustainability Managers, Energy Auditors |

The Asia Pacific Power Market is valued at approximately USD 1,100 billion, driven by increasing energy demand from urbanization, industrialization, and government initiatives promoting renewable energy sources.