Region:Asia

Author(s):Shubham

Product Code:KRAB0575

Pages:83

Published On:August 2025

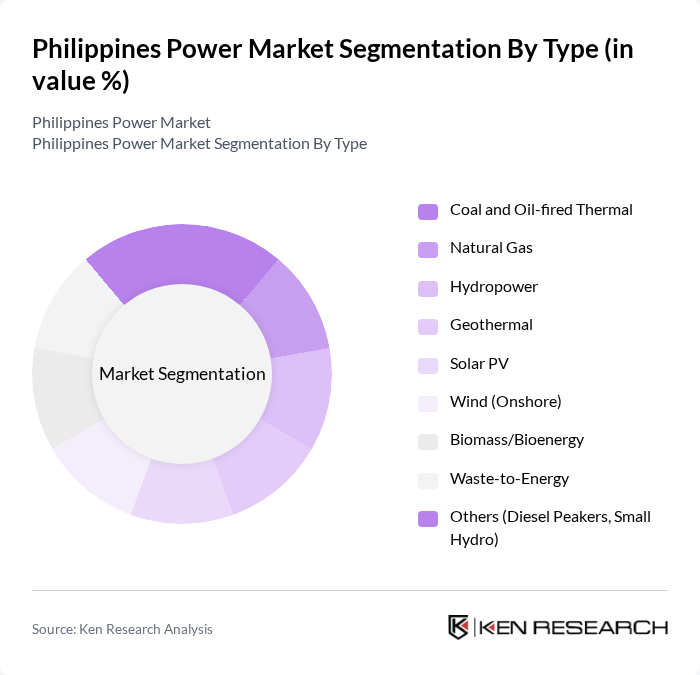

By Type:The market is segmented into various types of energy sources, including coal and oil-fired thermal, natural gas, hydropower, geothermal, solar PV, wind (onshore), biomass/bioenergy, waste-to-energy, and others such as diesel peakers and small hydro. Each of these segments plays a crucial role in meeting the energy demands of the country.

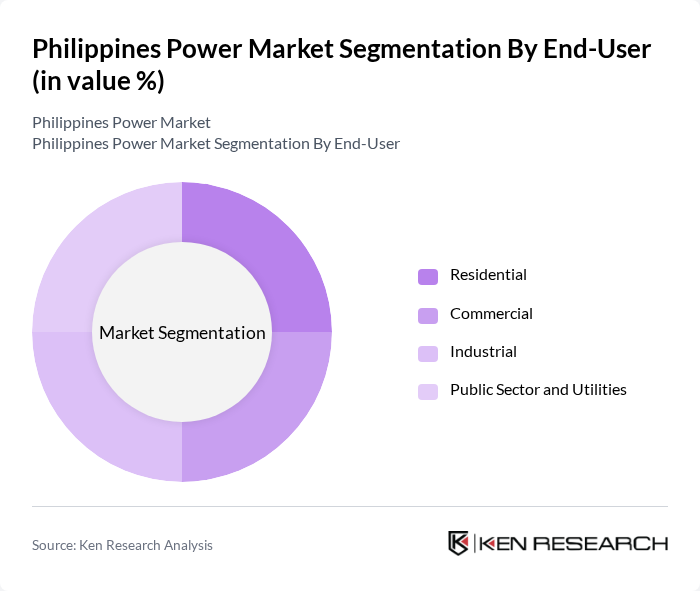

By End-User:The end-user segmentation includes residential, commercial, industrial, and public sector and utilities. Each segment has distinct energy consumption patterns and requirements, influencing the overall demand for electricity in the Philippines.

The Philippines Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as Manila Electric Company (Meralco), Aboitiz Power Corporation, First Gen Corporation, Energy Development Corporation (EDC), National Power Corporation (NPC), San Miguel Global Power Holdings Corp., ACEN Corporation, MERALCO PowerGen Corporation (MGen), Global Business Power Corporation (GBP), SMC Power Holdings (Consolidated within San Miguel Global Power), FDC Utilities, Inc. (Filinvest), Solar Philippines (SP New Energy Corporation), Philippine National Oil Company (PNOC), Cebu Energy Development Corporation (CEDC), Vena Energy Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines power market is poised for transformative growth, driven by increasing energy demand and a strong push towards renewable energy. In future, the integration of smart grid technologies and energy storage solutions will enhance efficiency and reliability. Additionally, the electrification of rural areas will expand access to electricity, fostering economic development. As the government continues to implement supportive policies, the market will likely attract further investments, paving the way for a more sustainable energy future.

| Segment | Sub-Segments |

|---|---|

| By Type | Coal and Oil-fired Thermal Natural Gas Hydropower Geothermal Solar PV Wind (Onshore) Biomass/Bioenergy Waste-to-Energy Others (Diesel Peakers, Small Hydro) |

| By End-User | Residential Commercial Industrial Public Sector and Utilities |

| By Investment Source | Domestic Private Foreign Direct Investment (FDI) Public-Private Partnership (PPP) Government Programs and Financing |

| By Application | Grid-Connected Utility-Scale Grid-Connected Distributed (Rooftop/Embedded) Off-Grid and Missionary Electrification Energy Storage-Integrated Projects |

| By Policy Support | Renewable Portfolio Standards (RPS) Green Energy Auction Program (GEAP) Net Metering Feed-in Tariffs (Legacy) Fiscal Incentives (Tax Holidays, Duty Exemptions) |

| By Technology | Solar Photovoltaic (Crystalline, Thin-Film) Onshore Wind Turbines Run-of-River Hydro Reservoir Hydro Geothermal Flash/Binary Biomass Combustion and Gasification Battery Energy Storage Systems (BESS) |

| By Distribution Mode | Wholesale Electricity Spot Market (WESM) Distribution Utilities (DUs) and Electric Cooperatives (ECs) Retail Competition and Open Access (RCOA) – Retail Electricity Suppliers (RES) Direct Power Purchase/Contestable Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Electricity Consumers | 150 | Homeowners, Renters |

| Commercial Energy Users | 100 | Facility Managers, Business Owners |

| Industrial Power Consumers | 80 | Plant Managers, Operations Directors |

| Renewable Energy Stakeholders | 70 | Project Developers, Investors |

| Energy Policy Makers | 50 | Government Officials, Regulatory Agencies |

The Philippines Power Market is valued at approximately USD 12 billion, driven by increasing energy demand from urbanization, industrial growth, and government initiatives aimed at enhancing energy security and integrating renewable energy sources into the generation mix.