Region:Europe

Author(s):Shubham

Product Code:KRAB0563

Pages:83

Published On:August 2025

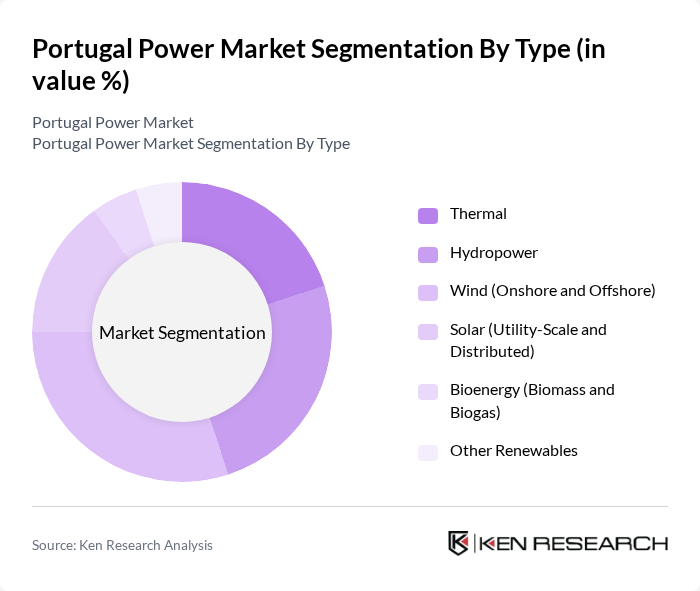

By Type:The power market in Portugal can be segmented into various types, including Thermal, Hydropower, Wind (Onshore and Offshore), Solar (Utility-Scale and Distributed), Bioenergy (Biomass and Biogas), and Other Renewables. Each of these segments plays a crucial role in meeting the country's energy demands and sustainability goals. Among these, the Wind segment has shown significant growth due to favorable geographic conditions and government incentives, with renewables providing the majority share of electricity generation in recent periods.

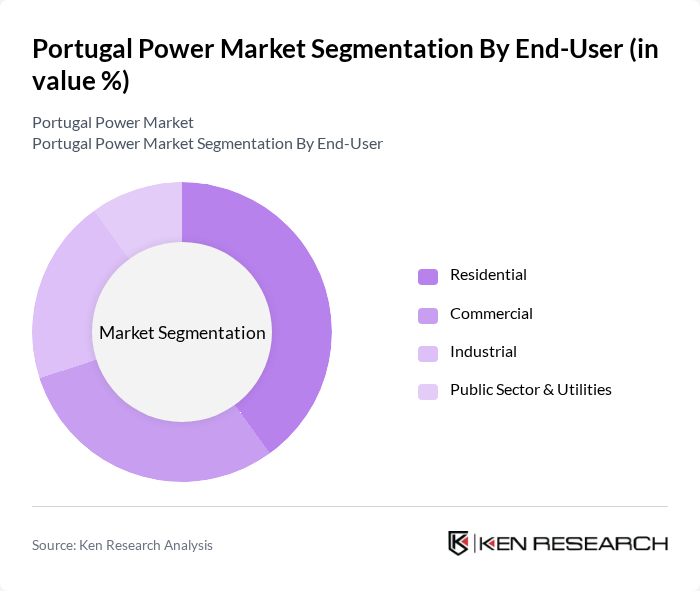

By End-User:The end-user segmentation of the power market in Portugal includes Residential, Commercial, Industrial, and Public Sector & Utilities. Each segment has distinct energy consumption patterns and requirements. The Industrial segment typically accounts for the highest share of electricity consumption nationally, while residential and commercial demand remain significant and increasingly shaped by energy-efficiency and self-consumption trends.

The Portugal Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as EDP – Energias de Portugal, S.A., EDP Renováveis, S.A. (EDPR), REN – Redes Energéticas Nacionais, S.A., Iberdrola, S.A., Endesa, S.A., Galp Energia, S.G.P.S., S.A., Finerge, S.A., Acciona Energía, S.A., Voltalia, S.A., Aquila Clean Energy, Enel Green Power S.p.A., Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy, S.A., Neoen S.A., Engie S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Portugal power market appears promising, driven by a strong commitment to renewable energy and sustainability. With the government targeting a 50% reduction in greenhouse gas emissions by future, investments in innovative technologies such as smart grids and energy storage are expected to rise. Furthermore, the integration of artificial intelligence in energy management systems will enhance efficiency and reliability, positioning Portugal as a leader in the renewable energy transition within Europe.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermal Hydropower Wind (Onshore and Offshore) Solar (Utility-Scale and Distributed) Bioenergy (Biomass and Biogas) Other Renewables |

| By End-User | Residential Commercial Industrial Public Sector & Utilities |

| By Application | Grid-Connected Off-Grid and Microgrids Distributed Generation (Rooftop PV, C&I) Utility-Scale Projects |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Programs & EU Funds |

| By Policy Support | Auctions and Contracts-for-Difference (CfDs) Tax Incentives and Accelerated Depreciation Guarantees of Origin (GOs) and Green Tariffs |

| By Market Segment | Generation Transmission Distribution & Retail Energy Services (Storage, Aggregation, ESCOs) |

| By Grid & Flexibility | Transmission & Distribution Upgrades Energy Storage (Utility and Behind-the-Meter) Demand Response & Aggregation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Electricity Consumers | 150 | Homeowners, Renters |

| Commercial Power Users | 120 | Facility Managers, Business Owners |

| Renewable Energy Developers | 80 | Project Managers, Investment Analysts |

| Utility Company Executives | 60 | CEOs, CFOs, Operations Directors |

| Energy Policy Makers | 50 | Government Officials, Regulatory Analysts |

The Portugal Power Market is valued at approximately USD 1113 billion, driven by the increasing penetration of renewable energy sources, strong policy support, and ongoing investments in grid and storage infrastructure.