Region:Europe

Author(s):Dev

Product Code:KRAB0450

Pages:83

Published On:August 2025

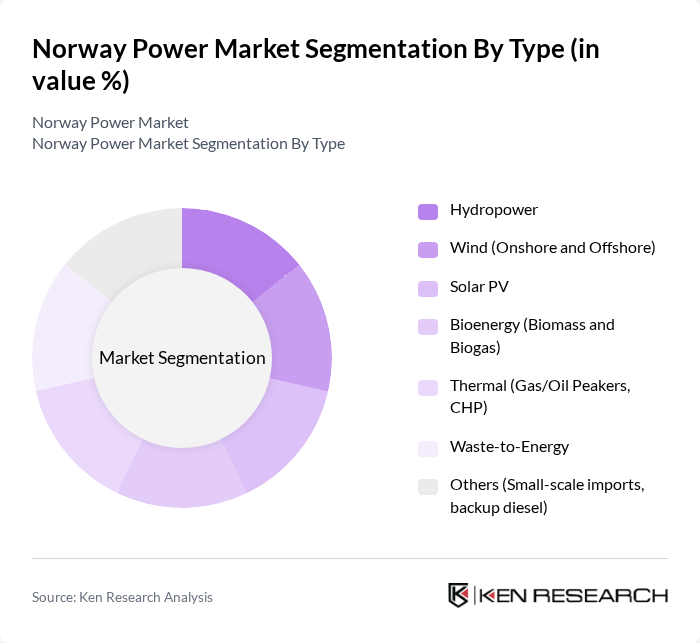

By Type:The power market in Norway is segmented into various types, including hydropower, wind (both onshore and offshore), solar PV, bioenergy (biomass and biogas), thermal (gas/oil peakers, CHP), waste-to-energy, and others (small-scale imports, backup diesel). Hydropower remains the dominant source due to Norway's abundant water resources and established infrastructure. Wind energy is rapidly growing, driven by technological advancements and government support .

Notes: Norway’s electricity generation is overwhelmingly hydropower with growing wind; solar and thermal remain marginal in the national mix .

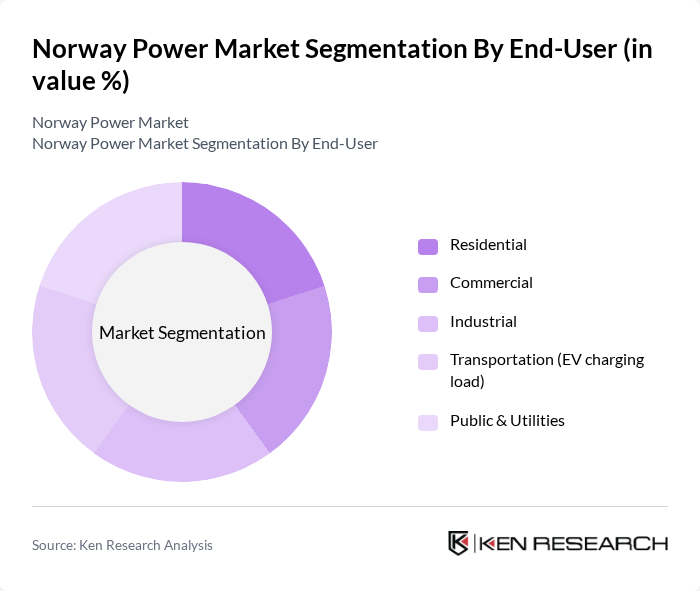

By End-User:The end-user segmentation of the Norway Power Market includes residential, commercial, industrial, transportation (EV charging load), and public & utilities. The residential sector is a large consumer driven by widespread electric heating (including heat pumps), while industry and services also represent significant shares. Rapid EV adoption is adding measurable load growth, though it remains a modest share of total electricity consumption .

The Norway Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as Statkraft AS, Hafslund Eco Vannkraft AS, Equinor ASA, BKK AS (Eviny AS), Lyse Energi AS (Lyse AS), Skagerak Energi AS, Agder Energi AS (Å Energi AS), Troms Kraft AS, TrønderEnergi AS (Aneo AS), Eidsiva Energi AS, Glitre Energi AS, Scatec ASA, Hydro Energi AS (Norsk Hydro), Elvia AS (DSO), Statnett SF (TSO) contribute to innovation, geographic expansion, and service delivery in this space .

Enhancements and recent drivers:

The future of Norway's power market is poised for transformative growth, driven by the increasing integration of renewable energy sources and advancements in energy storage technologies. As consumer demand for sustainable energy solutions rises, the market is likely to see enhanced investments in smart grid technologies and electric vehicle infrastructure. Additionally, the government's commitment to emission reduction targets will further stimulate innovation and collaboration among industry stakeholders, fostering a more resilient and sustainable energy ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydropower Wind (Onshore and Offshore) Solar PV Bioenergy (Biomass and Biogas) Thermal (Gas/Oil Peakers, CHP) Waste-to-Energy Others (Small-scale imports, backup diesel) |

| By End-User | Residential Commercial Industrial Transportation (EV charging load) Public & Utilities |

| By Application | Grid-Connected Utility-Scale Distributed Generation (C&I, prosumers) Off-Grid/Isolated Grids Cross-Border Interconnectors and Trade |

| By Investment Source | Domestic (State-owned and Private) Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Programs and Green Bonds |

| By Policy Support | Subsidies and Enova Grants Tax Exemptions/Depreciation Guarantees of Origin (GOs) EU/EEA Market Coupling & Emissions Trading |

| By Distribution Mode | Wholesale Market (Nord Pool) Retail Supply (Suppliers to End-Users) Bilateral PPAs and Corporate Sourcing |

| By Price Range | Regulated Network Tariffs Spot and Forward Prices Fixed-Price Contracts and Hedging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydropower Generation Insights | 100 | Plant Managers, Energy Analysts |

| Wind Energy Project Development | 80 | Project Managers, Environmental Consultants |

| Electricity Distribution Challenges | 90 | Utility Executives, Grid Operators |

| Regulatory Impact on Energy Market | 70 | Policy Makers, Regulatory Affairs Managers |

| Consumer Energy Usage Patterns | 100 | Residential Customers, Commercial Energy Managers |

The Norway Power Market is valued at approximately USD 21 billion, reflecting the significant revenues generated by the country's electricity sector, primarily driven by its reliance on renewable energy sources, particularly hydropower.