Region:North America

Author(s):Shubham

Product Code:KRAC0810

Pages:84

Published On:August 2025

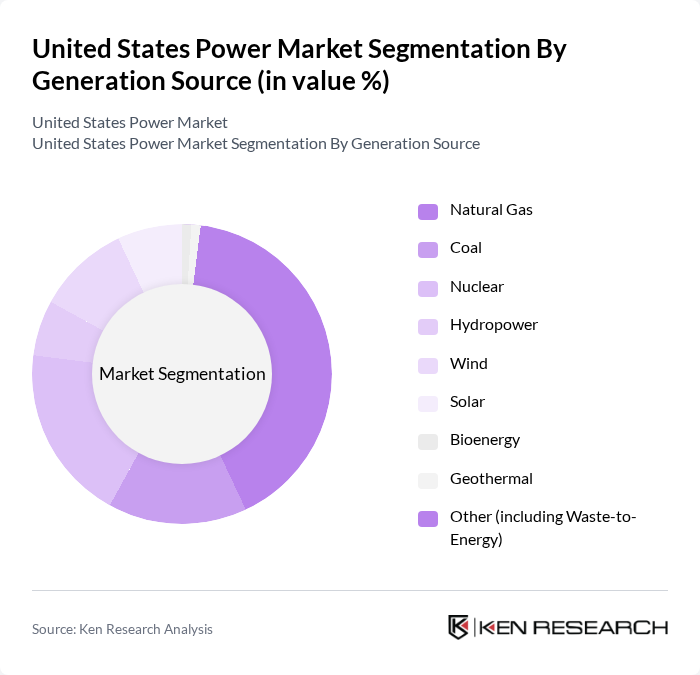

By Generation Source:The generation sources in the United States Power Market include Natural Gas, Coal, Nuclear, Hydropower, Wind, Solar, Bioenergy, Geothermal, and Other (including Waste-to-Energy).Natural Gasremains the dominant source, supplying over two-fifths of total generation due to its cost-effectiveness, reliability, and lower emissions compared to coal. However, the rapid growth of renewables—particularly wind and solar—has shifted the generation mix, with wind and solar now collectively surpassing coal’s share. Grid-scale battery storage is increasingly integrated to support renewable penetration and grid reliability .

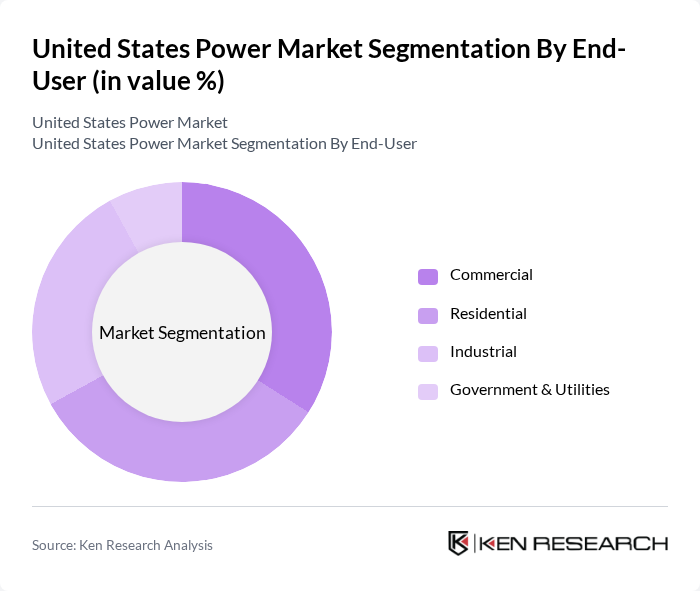

By End-User:The end-user segments in the United States Power Market include Residential, Commercial, Industrial, and Government & Utilities. TheCommercialsector is now the largest, driven by data center expansion, electrification of commercial buildings, and increased business activity. The Residential segment follows, with continued growth in household electricity demand for heating, cooling, and appliances. Industrial demand is also rising, supported by manufacturing reshoring and electrification initiatives .

The United States Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as NextEra Energy, Inc., Duke Energy Corporation, Southern Company, Exelon Corporation, Pacific Gas and Electric Company (PG&E Corporation), Dominion Energy, Inc., FirstEnergy Corp., Public Service Enterprise Group (PSEG), NRG Energy, Inc., The AES Corporation, Entergy Corporation, Xcel Energy Inc., Eversource Energy, Avangrid, Inc., CenterPoint Energy, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The U.S. power market is poised for transformative changes driven by technological advancements and a strong push for sustainability. As the adoption of smart grid technologies and energy-efficient solutions accelerates, the market will likely see enhanced operational efficiencies. Additionally, the increasing integration of artificial intelligence in energy management systems will optimize resource allocation and consumption patterns. These trends, coupled with a growing emphasis on energy resilience, will shape the future landscape of the power sector, fostering innovation and investment.

| Segment | Sub-Segments |

|---|---|

| By Generation Source | Natural Gas Coal Nuclear Hydropower Wind Solar Bioenergy Geothermal Other (including Waste-to-Energy) |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Regulated Utilities Competitive Retail Providers Community Choice Aggregators |

| By Pricing Mechanism | Regulated Tariffs Market-Based Pricing Power Purchase Agreements (PPAs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Sector Insights | 120 | Utility Executives, Regulatory Affairs Managers |

| Renewable Energy Projects | 80 | Project Managers, Sustainability Directors |

| Energy Policy Analysis | 60 | Policy Analysts, Government Officials |

| Consumer Energy Usage | 100 | Residential Energy Managers, Commercial Facility Managers |

| Grid Management Practices | 70 | Grid Operators, System Planners |

The United States Power Market is valued at approximately USD 1,350 billion, reflecting significant growth driven by increasing electricity demand, investments in renewable energy, and advancements in grid modernization and energy storage technologies.