Region:Asia

Author(s):Shubham

Product Code:KRAA0882

Pages:91

Published On:August 2025

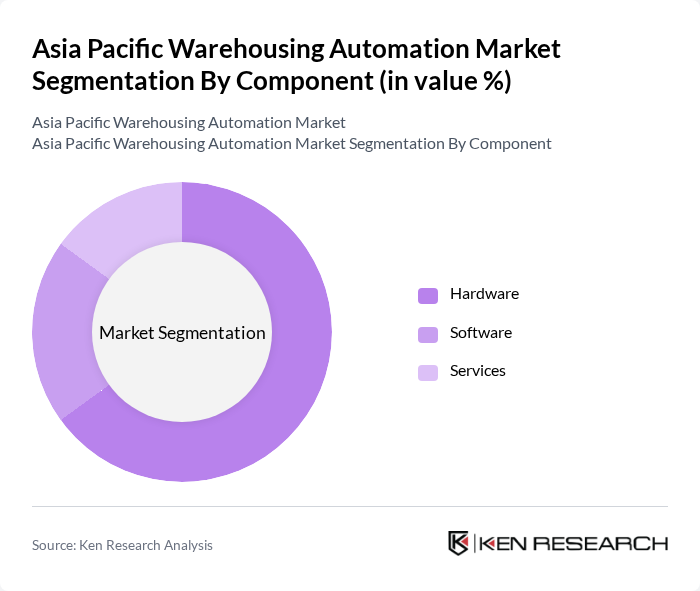

By Component:The components of warehousing automation include hardware, software, and services. The hardware segment encompasses various automated systems such as Automated Storage and Retrieval Systems (AS/RS), conveyor systems, robotics, and automated guided vehicles (AGVs). The software segment includes Warehouse Management Systems (WMS) and control software, while the services segment covers consulting, maintenance, integration, and training .

The hardware segment is currently dominating the market, driven by the increasing demand for efficient and automated solutions in warehousing operations. Automated Storage and Retrieval Systems (AS/RS) and robotics are particularly popular due to their ability to enhance productivity and reduce labor costs. The trend towards e-commerce has further accelerated the adoption of these technologies, as businesses seek to streamline their operations and improve order fulfillment times. As a result, hardware solutions are expected to maintain a significant share of the market .

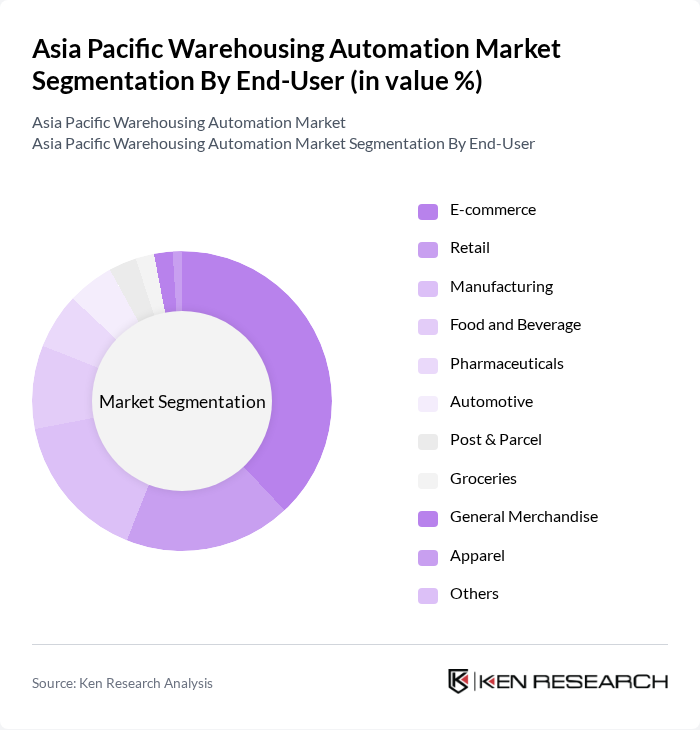

By End-User:The end-users of warehousing automation include various sectors such as e-commerce, retail, manufacturing, food and beverage, pharmaceuticals, automotive, post and parcel, groceries, general merchandise, apparel, and others. Each sector has unique requirements that drive the adoption of automation technologies to enhance efficiency and reduce operational costs .

The e-commerce sector is the leading end-user of warehousing automation, driven by the exponential growth of online shopping and the need for rapid order fulfillment. Retailers are increasingly investing in automated solutions to manage inventory efficiently and enhance customer satisfaction. The demand for faster delivery times and improved accuracy in order processing has led to a surge in automation adoption across e-commerce platforms, solidifying its position as the dominant end-user in the market .

The Asia Pacific Warehousing Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daifuku Co., Ltd., Murata Machinery, Ltd. (Muratec), SSI Schaefer, Swisslog (KUKA Group), Dematic (KION Group AG), Honeywell Intelligrated, Vanderlande Industries, Knapp AG, Jungheinrich AG, Yaskawa Electric Corporation (Yaskawa Motoman), Toshiba Global Logistics, ST Engineering, Godrej Consoveyo Logistics Automation Ltd. (GCLA), Toyota Industries Corporation, Bastian Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Asia Pacific warehousing automation market appears promising, driven by ongoing technological innovations and the increasing need for efficiency in supply chains. As companies continue to adopt advanced automation solutions, the focus will shift towards enhancing operational efficiency and reducing costs. Additionally, the integration of AI and IoT technologies is expected to revolutionize warehousing operations, enabling real-time data analytics and improved decision-making processes. This evolution will likely lead to a more agile and responsive warehousing environment, catering to the dynamic demands of the market.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Automated Storage and Retrieval Systems (AS/RS), Conveyor Systems, Robotics & Automated Guided Vehicles (AGVs), Sortation Systems, Automated Palletizing Systems, Automatic Identification and Data Collection (AIDC), Piece Picking Robots, Others) Software (Warehouse Management Systems (WMS), Control Software, Analytics Platforms, Others) Services (Consulting, Maintenance, Integration, Training, Others) |

| By End-User | E-commerce Retail Manufacturing Food and Beverage Pharmaceuticals Automotive Post & Parcel Groceries General Merchandise Apparel Others |

| By Region | China Japan South Korea India Southeast Asia Oceania Others |

| By Application | Order Fulfillment Inventory Management Shipping and Receiving Returns Processing Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships (PPP) Others |

| By Policy Support | Tax Incentives Grants for Automation Technologies Subsidies for Energy Efficiency Others |

| By Distribution Mode | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Automation | 100 | Warehouse Managers, Operations Directors |

| Manufacturing Supply Chain Automation | 90 | Production Managers, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 80 | Logistics Coordinators, IT Managers |

| Cold Chain Logistics Automation | 60 | Cold Storage Managers, Quality Assurance Officers |

| Third-Party Logistics Providers | 50 | Business Development Managers, Strategy Executives |

The Asia Pacific Warehousing Automation Market is valued at approximately USD 12 billion, driven by the rapid growth of e-commerce, the need for efficient supply chain management, and advancements in automation technologies like robotics and artificial intelligence.