Region:Europe

Author(s):Dev

Product Code:KRAA0400

Pages:86

Published On:August 2025

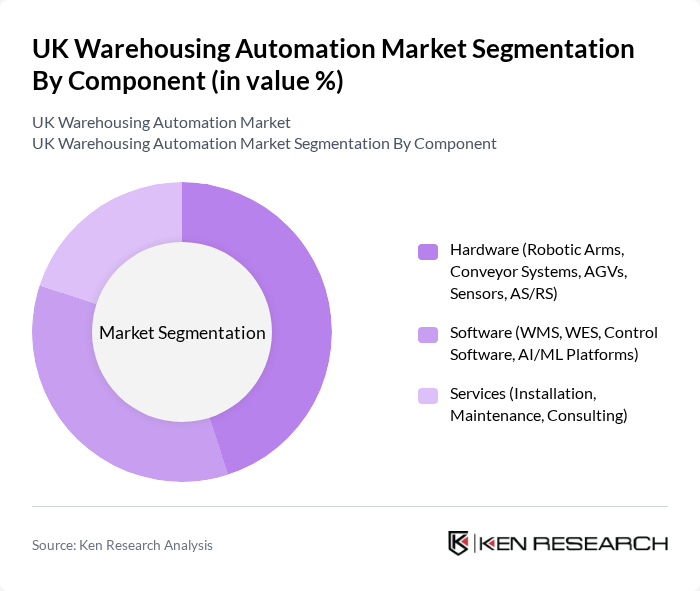

By Component:The components of the market include hardware, software, and services. Hardware encompasses robotic arms, conveyor systems, automated guided vehicles (AGVs), sensors, and automated storage and retrieval systems (AS/RS). Software includes warehouse management systems (WMS), warehouse execution systems (WES), control software, and AI/ML platforms. Services cover installation, maintenance, and consulting .

The hardware segment is currently dominating the market, driven by the increasing adoption of robotic systems and automated guided vehicles (AGVs) in warehouses. Companies are investing heavily in hardware to enhance operational efficiency and reduce labor costs. The trend towards automation in logistics is pushing the demand for advanced hardware solutions, making it the leading sub-segment in the UK Warehousing Automation Market .

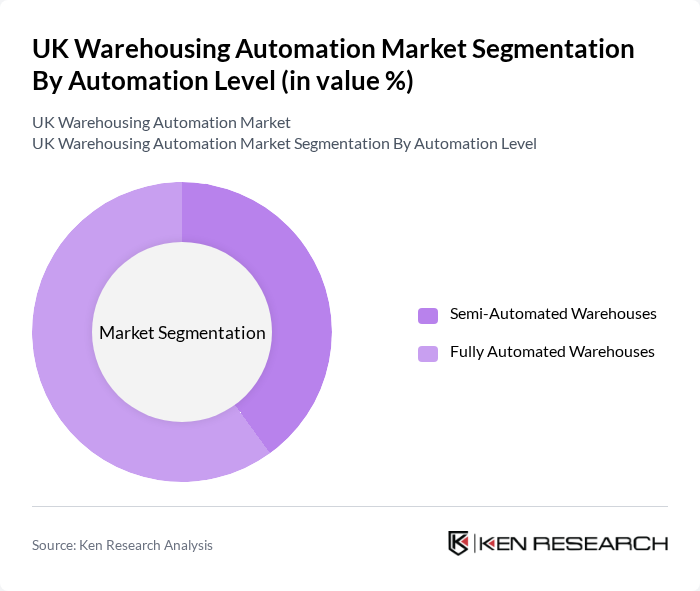

By Automation Level:The market is segmented into semi-automated warehouses and fully automated warehouses. Semi-automated warehouses utilize a combination of manual and automated processes, while fully automated warehouses rely entirely on automated systems for operations .

Fully automated warehouses are leading the market due to the growing need for efficiency and speed in logistics operations. The shift towards e-commerce has necessitated the implementation of fully automated systems that can handle high volumes of orders with minimal human intervention. This trend is expected to continue as companies seek to optimize their supply chains and reduce operational costs .

The UK Warehousing Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dematic, Honeywell Intelligrated, Siemens Logistics, Amazon Robotics (formerly Kiva Systems), Vanderlande Industries, Swisslog (KUKA Group), Knapp AG, SSI Schaefer, GreyOrange, Geek+ (Geek Plus Robotics), Locus Robotics, Bastian Solutions (Toyota Advanced Logistics), Murata Machinery, Ocado Group, TGW Logistics Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UK warehousing automation market appears promising, driven by ongoing technological advancements and the increasing need for efficiency. As businesses continue to adapt to the evolving landscape of e-commerce and logistics, the integration of smart technologies will play a crucial role. Companies are expected to invest in automation solutions that enhance operational efficiency, reduce costs, and improve customer satisfaction. The focus on sustainability and data-driven decision-making will further shape the market dynamics in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Robotic Arms, Conveyor Systems, AGVs, Sensors, AS/RS) Software (WMS, WES, Control Software, AI/ML Platforms) Services (Installation, Maintenance, Consulting) |

| By Automation Level | Semi-Automated Warehouses Fully Automated Warehouses |

| By Application | Inventory Management Order Fulfillment Picking and Sorting Shipping and Receiving Returns Processing Cross-Docking Others |

| By End-User | Retail E-commerce Food and Beverage Pharmaceuticals Automotive Consumer Electronics Third-Party Logistics (3PL) Others |

| By Region | England Scotland Wales Northern Ireland |

| By Technology | Automated Storage and Retrieval Systems (AS/RS) Conveyor and Sortation Systems Autonomous Mobile Robots (AMRs) Automated Guided Vehicles (AGVs) Internet of Things (IoT) Artificial Intelligence (AI) & Machine Learning Cloud Computing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Automation | 100 | Warehouse Managers, Operations Directors |

| Manufacturing Automation Solutions | 80 | Production Managers, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 110 | Logistics Coordinators, IT Managers |

| Third-party Logistics Providers | 90 | Business Development Managers, Automation Specialists |

| Cold Storage Automation | 60 | Facility Managers, Quality Control Supervisors |

The UK Warehousing Automation Market is valued at approximately USD 2.2 billion, driven by the increasing demand for efficient supply chain management and the rapid growth of e-commerce, alongside significant investments in automation technologies.