Region:Asia

Author(s):Shubham

Product Code:KRAA0765

Pages:84

Published On:August 2025

By Type:The market is segmented into various types of automation solutions, including Automated Storage and Retrieval Systems (AS/RS), Conveyor Systems, Robotics Solutions, Sortation Systems, Warehouse Management Software (WMS), Automated Guided Vehicles (AGVs) & Autonomous Mobile Robots (AMRs), Palletizing & Depalletizing Systems, Picking & Handling Robots, and Others. Among these, Warehouse Management Software (WMS) and Robotics Solutions are leading sub-segments due to their critical roles in optimizing warehouse operations, real-time data analytics, and inventory management. The increasing complexity of supply chains and the need for flexible, scalable automation are driving demand for advanced WMS and robotics solutions .

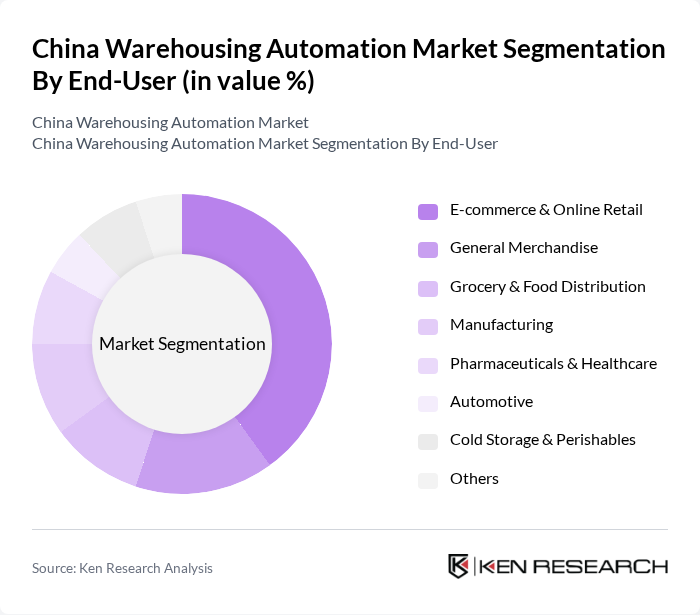

By End-User:The end-user segmentation includes E-commerce & Online Retail, General Merchandise, Grocery & Food Distribution, Manufacturing, Pharmaceuticals & Healthcare, Automotive, Cold Storage & Perishables, and Others. The E-commerce & Online Retail sector is the dominant end-user, driven by the surge in online shopping, the need for rapid order fulfillment, and the expansion of omnichannel retail. The increasing consumer preference for fast delivery and the growth of online marketplaces are propelling investments in warehousing automation solutions tailored for this sector .

The China Warehousing Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alibaba Group (Cainiao Network), JD Logistics, Geek+, Hikrobot, Quicktron, SIASUN Robot & Automation, Dematic, Honeywell Intelligrated, Murata Machinery, SSI Schaefer, Vanderlande, Knapp AG, Daifuku Co., Ltd., BPS Global, Shanghai Jingxing Storage Equipment Engineering contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Chinese warehousing automation market appears promising, driven by ongoing technological innovations and increasing investments in smart logistics solutions. As companies prioritize efficiency and sustainability, the integration of IoT and AI technologies will become more prevalent, enhancing operational capabilities. Furthermore, the expansion of e-commerce will continue to necessitate advanced warehousing solutions, ensuring that automation remains a critical component of supply chain strategies in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Storage and Retrieval Systems (AS/RS) Conveyor Systems Robotics Solutions Sortation Systems Warehouse Management Software (WMS) Automated Guided Vehicles (AGVs) & Autonomous Mobile Robots (AMRs) Palletizing & Depalletizing Systems Picking & Handling Robots Others |

| By End-User | E-commerce & Online Retail General Merchandise Grocery & Food Distribution Manufacturing Pharmaceuticals & Healthcare Automotive Cold Storage & Perishables Others |

| By Application | Inventory Management Order Fulfillment Shipping and Receiving Returns Processing Cross-Docking Real-Time Monitoring & Analytics Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Fulfillment Centers Retail Distribution Centers Cold Storage Warehouses Others |

| By Component | Hardware Software Services Others |

| By Organization Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Investment Source | Private Investments Government Funding Venture Capital Corporate Investments Others |

| By Policy Support | Subsidies for Automation Technologies Tax Incentives for Warehousing Investments Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Automation | 100 | Warehouse Managers, Operations Directors |

| Manufacturing Sector Automation | 60 | Production Managers, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 110 | Logistics Coordinators, IT Managers |

| Cold Chain Logistics Automation | 50 | Facility Managers, Quality Control Officers |

| Third-party Logistics Providers | 80 | Business Development Managers, Strategy Analysts |

The China Warehousing Automation Market is valued at approximately USD 13 billion, driven by the rapid growth of e-commerce, demand for efficient supply chain management, and investments in automation technologies like robotics and warehouse management software.