Region:Europe

Author(s):Shubham

Product Code:KRAA1127

Pages:85

Published On:August 2025

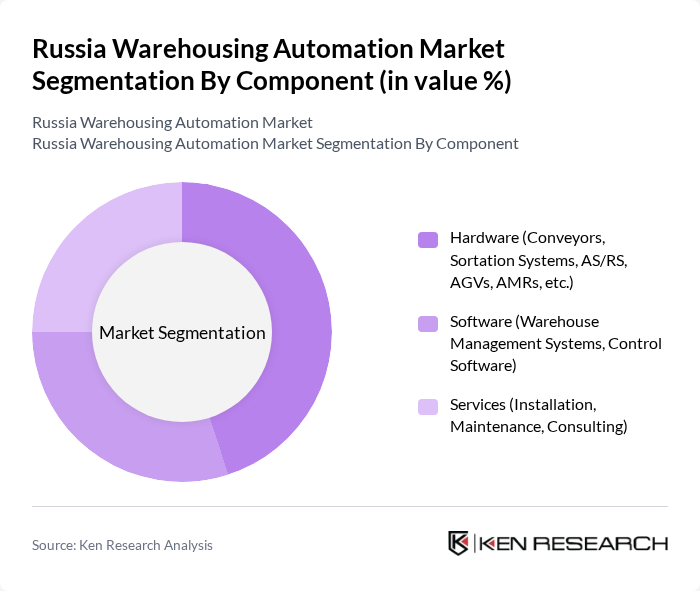

By Component:The components of warehousing automation include hardware, software, and services. Hardware encompasses systems such as conveyors, sortation systems, automated storage and retrieval systems (AS/RS), autonomous mobile robots (AMRs), and automated guided vehicles (AGVs). Software includes warehouse management systems, warehouse execution systems, and control software, while services cover installation, maintenance, training, and consulting .

The hardware segment is currently dominating the market, driven by the increasing adoption of automated systems that enhance operational efficiency and reduce labor costs. The demand for advanced technologies such as conveyors, AS/RS, and robotics is particularly high among large enterprises and third-party logistics providers aiming to optimize supply chain processes. The continued growth of e-commerce and the need for rapid order fulfillment are expected to further boost the hardware segment's market share .

By Automation Type:The automation types in warehousing include automated storage and retrieval systems (AS/RS), conveyor and sortation systems, autonomous mobile robots (AMRs), automated guided vehicles (AGVs), warehouse management systems (WMS), automatic identification and data capture (AIDC), and others. Each type plays a crucial role in enhancing the efficiency, accuracy, and scalability of warehousing operations .

Among the automation types, automated storage and retrieval systems (AS/RS) are leading the market due to their ability to significantly enhance storage density, improve inventory accuracy, and reduce retrieval times. The rapid expansion of e-commerce and the need for efficient, high-throughput order fulfillment are driving investments in AS/RS technologies. Additionally, the adoption of AMRs and AGVs is accelerating as companies seek to further streamline material handling processes and minimize manual labor requirements .

The Russia Warehousing Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dematic, Swisslog, Honeywell Intelligrated, Siemens Logistics, Vanderlande, SSI Schaefer, Jungheinrich, Knapp AG, Murata Machinery, Daifuku, TGW Logistics Group, Interroll, Logisystem (Russia), SkladTech (Russia), Consort Group (Russia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russia warehousing automation market appears promising, driven by technological advancements and increasing demand for efficient logistics solutions. As e-commerce continues to expand, businesses are likely to invest more in automation technologies to streamline operations. Additionally, the integration of artificial intelligence and machine learning will enhance decision-making processes, leading to improved inventory management and operational efficiency. Overall, the market is poised for significant transformation, aligning with global trends toward automation and digitalization.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Conveyors, Sortation Systems, AS/RS, AGVs, AMRs, etc.) Software (Warehouse Management Systems, Control Software) Services (Installation, Maintenance, Consulting) |

| By Automation Type | Automated Storage and Retrieval Systems (AS/RS) Conveyor and Sortation Systems Autonomous Mobile Robots (AMRs) Automated Guided Vehicles (AGVs) Warehouse Management Systems (WMS) Automatic Identification and Data Capture (AIDC) Others |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By End-User Industry | Retail E-commerce Manufacturing Food and Beverage Pharmaceuticals Automotive Third-Party Logistics (3PL) Others |

| By Function | Inbound Logistics Picking & Packing Outbound Logistics Inventory Management Order Fulfillment Returns Processing Cross-Docking Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Automation | 60 | Warehouse Managers, Operations Directors |

| Manufacturing Automation Solutions | 50 | Production Managers, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 55 | Logistics Coordinators, IT Managers |

| Cold Storage Automation | 40 | Facility Managers, Quality Control Supervisors |

| Automated Inventory Management | 45 | Inventory Managers, Technology Implementation Leads |

The Russia Warehousing Automation Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for efficient supply chain management and advancements in automation technologies.