Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA1993

Pages:98

Published On:August 2025

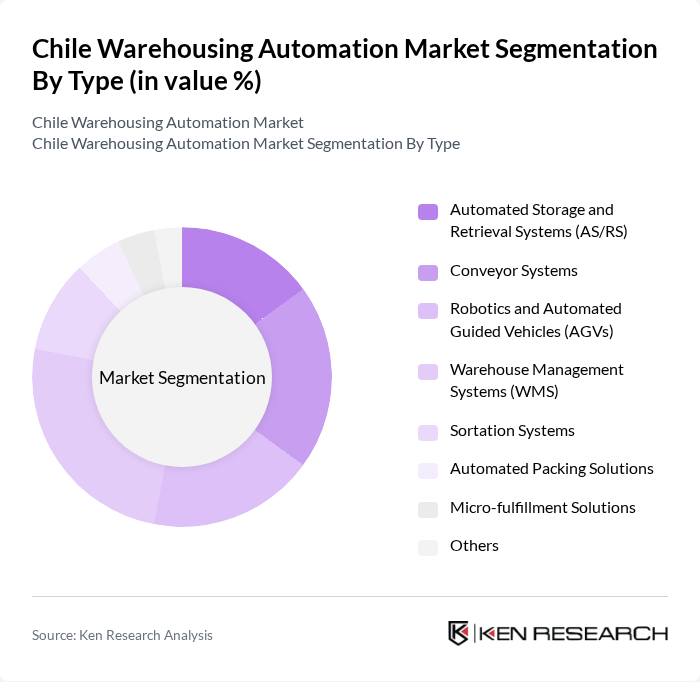

By Type:The market is segmented into various types of automation solutions, including Automated Storage and Retrieval Systems (AS/RS), Conveyor Systems, Robotics and Automated Guided Vehicles (AGVs), Warehouse Management Systems (WMS), Sortation Systems, Automated Packing Solutions, Micro-fulfillment Solutions, and Others. Among these, Warehouse Management Systems (WMS) are leading the market due to their critical role in optimizing warehouse operations and inventory management, driven by the increasing complexity of supply chains and the need for real-time data analytics. The adoption of robotics and micro-fulfillment solutions is also accelerating, particularly in the food retail and e-commerce sectors.

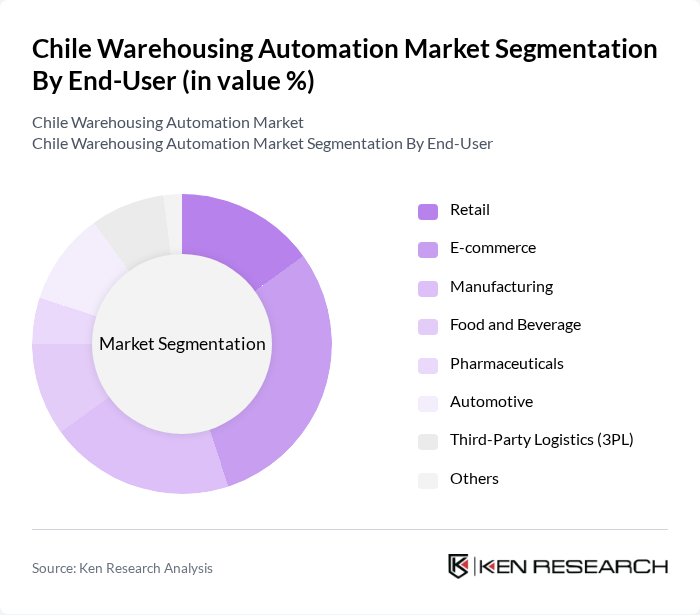

By End-User:The end-user segmentation includes Retail, E-commerce, Manufacturing, Food and Beverage, Pharmaceuticals, Automotive, Third-Party Logistics (3PL), and Others. The E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping and the need for efficient order fulfillment and inventory management solutions to meet consumer demands. Third-party logistics providers are also increasing their adoption of automation to support value-added warehousing and distribution services for diverse industries.

The Chile Warehousing Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SSI Schaefer, Dematic, Swisslog, Honeywell Intelligrated, Siemens Logistics, Zebra Technologies, Murata Machinery, Daifuku Co., Ltd., Vanderlande Industries, Knapp AG, Interroll Holding AG, TGW Logistics Group, Bastian Solutions, MHS Global, Maersk Logistics & Services, Friosan, Honeywell Chile S.A., Mecalux S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Chile warehousing automation market is poised for significant transformation as companies increasingly embrace digitalization and automation technologies. With the anticipated growth in e-commerce and logistics infrastructure, businesses are likely to invest heavily in advanced solutions. Additionally, the integration of IoT and AI technologies will enhance operational efficiency and inventory management. As companies adapt to these trends, the market is expected to evolve, presenting new opportunities for innovation and growth in the warehousing sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Storage and Retrieval Systems (AS/RS) Conveyor Systems Robotics and Automated Guided Vehicles (AGVs) Warehouse Management Systems (WMS) Sortation Systems Automated Packing Solutions Micro-fulfillment Solutions Others |

| By End-User | Retail E-commerce Manufacturing Food and Beverage Pharmaceuticals Automotive Third-Party Logistics (3PL) Others |

| By Application | Inventory Management Order Fulfillment Shipping and Receiving Returns Management Cross-Docking Cold Storage Automation Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Fulfillment Centers Retail Distribution Centers Others |

| By Component | Hardware Software Services |

| By Investment Source | Private Investment Public Funding Foreign Direct Investment (FDI) Joint Ventures |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Automation | 60 | Warehouse Managers, Operations Directors |

| Pharmaceutical Distribution Centers | 50 | Supply Chain Managers, Compliance Officers |

| E-commerce Fulfillment Centers | 70 | Logistics Coordinators, IT Managers |

| Food and Beverage Warehousing | 40 | Quality Assurance Managers, Warehouse Supervisors |

| Third-Party Logistics Providers | 45 | Business Development Managers, Automation Specialists |

The Chile Warehousing Automation Market is valued at approximately USD 110 million, driven by the increasing demand for efficient supply chain management, rapid automation technology adoption, and the growth of e-commerce, which requires faster and more reliable warehousing solutions.