Region:Global

Author(s):Geetanshi

Product Code:KRAB0064

Pages:97

Published On:August 2025

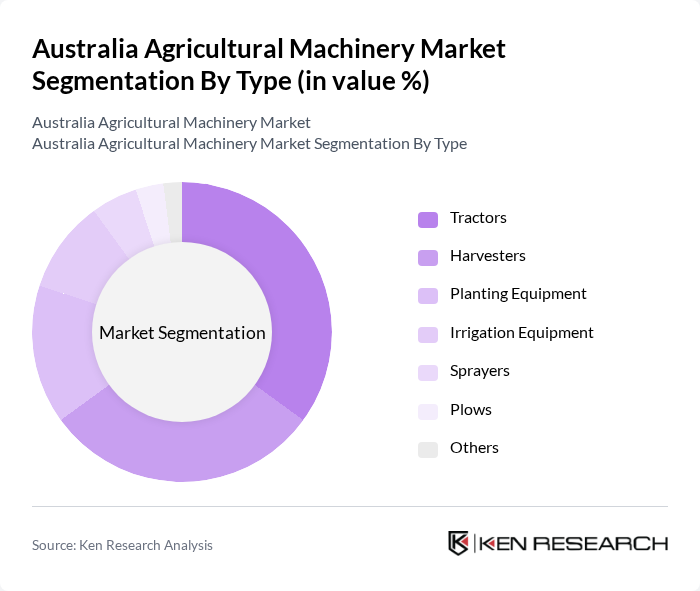

By Type:The agricultural machinery market is segmented into tractors, harvesters, planting equipment, irrigation equipment, sprayers, plows, and others. Tractors and harvesters are the largest and most essential segments, driven by their critical roles in modern farming. Tractors are indispensable for a wide range of agricultural tasks, while harvesters are vital for efficient and timely crop collection, making them the backbone of mechanized agriculture in Australia .

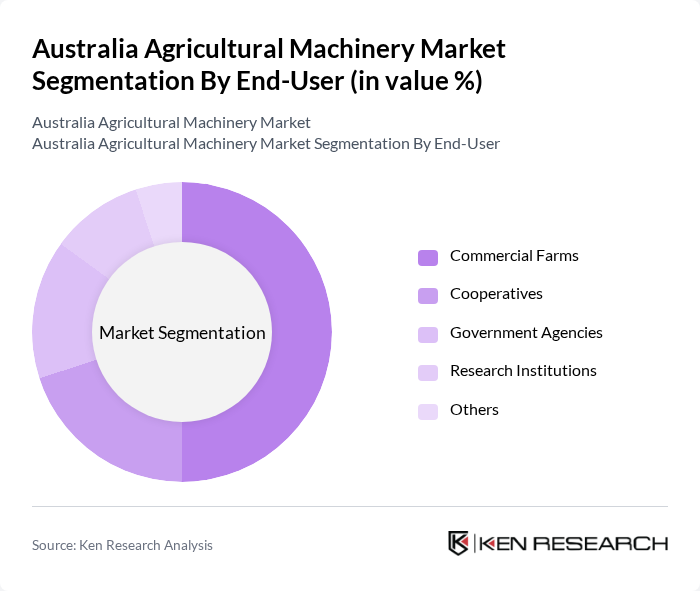

By End-User:End-user segmentation includes commercial farms, cooperatives, government agencies, research institutions, and others. Commercial farms represent the leading segment, as they require advanced machinery to support large-scale and highly mechanized operations. The ongoing trend toward agricultural mechanization and the adoption of precision technologies have further increased machinery demand among commercial farms, solidifying their dominance in the market .

The Australia Agricultural Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere Limited (Australia), AGCO Corporation (Australia), CNH Industrial (Case IH & New Holland Agriculture), Kubota Australia Pty Ltd, CLAAS KGaA mbH (Australia), Mahindra Automotive Australia Pty. Ltd., TAFE – Tractors and Farm Equipment Limited, KUHN Group (Australia), Daedong Industrial Co., Ltd. (Kioti Australia), Orbia Advance Corporation S.A.B. de C.V. (Netafim Australia), SDF Group (Australia), Yanmar (Australia), Trimble Inc. (Australia), AG Leader Technology (Australia), Raven Industries (Australia), Trelleborg Group (Australia), Pöttinger (Australia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian agricultural machinery market appears promising, driven by ongoing technological innovations and increasing demand for sustainable practices. As farmers increasingly adopt automation and smart farming technologies, the market is expected to witness significant transformations. Additionally, the focus on eco-friendly solutions will likely lead to the development of more efficient machinery, aligning with global sustainability goals and enhancing competitiveness in international markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors Harvesters Planting Equipment Irrigation Equipment Sprayers Plows Others |

| By End-User | Commercial Farms Cooperatives Government Agencies Research Institutions Others |

| By Application | Crop Production Livestock Production Forestry Land Development and Seedbed Preparation Sowing and Planting Weed Cultivation Plant Protection Harvesting and Threshing Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Distribution Mode | Wholesale Distribution Retail Distribution Direct-to-Consumer Others |

| By Price Range | Low-End Machinery Mid-Range Machinery High-End Machinery Others |

| By Brand Preference | Local Brands International Brands Emerging Brands Others |

| By Farm Size | Large Farms Medium Farms Small Farms |

| By Region | New South Wales Victoria Queensland South Australia Western Australia Tasmania Northern Territory Australian Capital Territory |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Market Insights | 120 | Farm Owners, Agricultural Equipment Dealers |

| Harvesting Equipment Usage | 90 | Farm Managers, Equipment Operators |

| Irrigation Systems Adoption | 70 | Agronomists, Irrigation Specialists |

| Precision Agriculture Technologies | 60 | Technology Providers, Crop Consultants |

| Market Trends in Agricultural Robotics | 50 | Research Analysts, Agricultural Innovators |

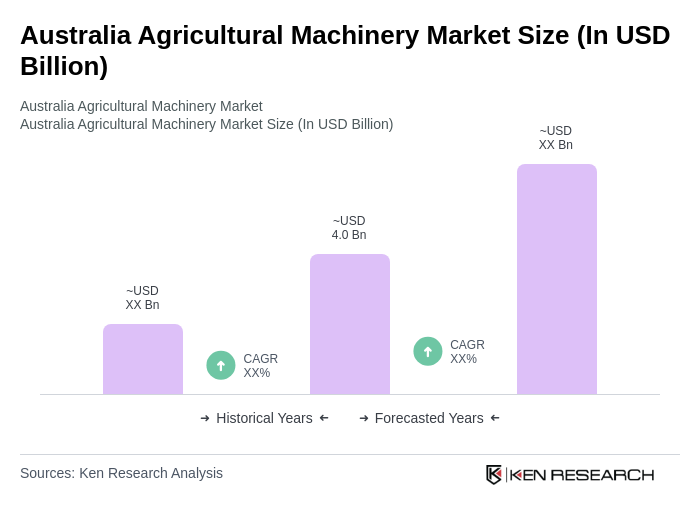

The Australia Agricultural Machinery Market is valued at approximately USD 4.0 billion, reflecting a significant growth driven by advancements in automation, precision farming, and smart technologies like GPS guidance and telematics.