Region:North America

Author(s):Shubham

Product Code:KRAC0846

Pages:88

Published On:August 2025

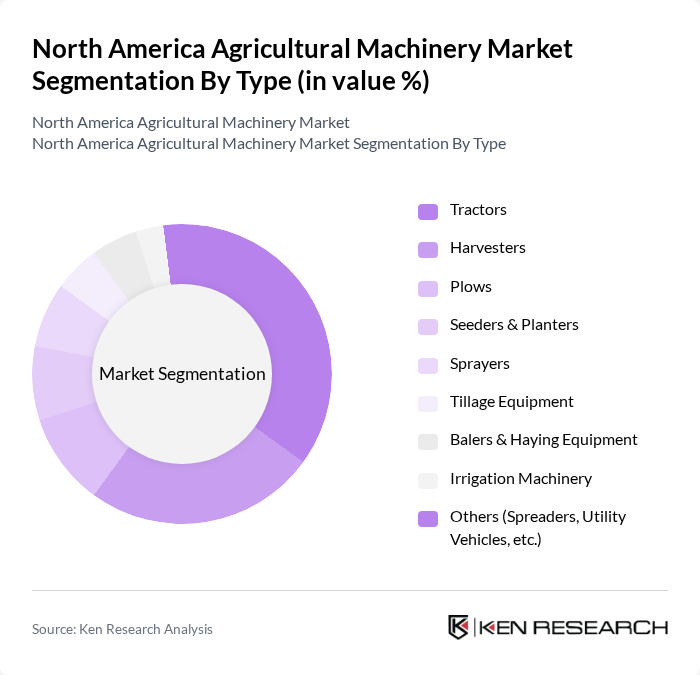

By Type:The agricultural machinery market can be segmented into various types, including tractors, harvesters, plows, seeders & planters, sprayers, tillage equipment, balers & haying equipment, irrigation machinery, and others such as spreaders and utility vehicles. Among these,tractors and harvestersare the most significant contributors to market growth due to their essential roles in modern farming practices and the increasing adoption of autonomous and smart equipment .

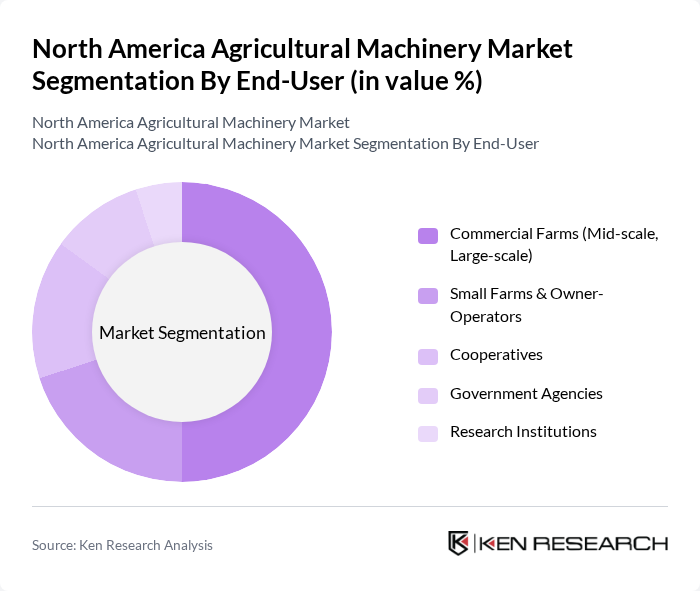

By End-User:The end-user segmentation includes commercial farms (mid-scale and large-scale), small farms & owner-operators, cooperatives, government agencies, and research institutions.Commercial farmsare the leading segment, driven by the need for high-efficiency machinery to meet the growing food demand and optimize production processes. The trend of farm consolidation and the adoption of advanced machinery is particularly strong among mid- and large-scale operations .

The North America Agricultural Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere, AGCO Corporation, CNH Industrial N.V., Kubota Corporation, Mahindra & Mahindra Ltd., Trimble Inc., Raven Industries, Inc., CLAAS Group, Case IH (CNH Industrial), New Holland Agriculture (CNH Industrial), AG Leader Technology, Yanmar Co., Ltd., SDF Group, JCB, Bobcat Company, Versatile (Buhler Industries Inc.), Kinze Manufacturing, Inc., Great Plains Manufacturing (Kubota), HORSCH Maschinen GmbH, Monosem (John Deere) contribute to innovation, geographic expansion, and service delivery in this space.

The North American agricultural machinery market is poised for transformative growth, driven by technological advancements and a shift towards sustainable practices. As farmers increasingly adopt precision agriculture and automation, the demand for innovative machinery will rise. Additionally, government support for sustainable farming practices will further enhance market dynamics. The integration of IoT technologies will enable real-time data analysis, optimizing farming operations and improving yields, thus shaping a more efficient agricultural landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors Harvesters Plows Seeders & Planters Sprayers Tillage Equipment Balers & Haying Equipment Irrigation Machinery Others (Spreaders, Utility Vehicles, etc.) |

| By End-User | Commercial Farms (Mid-scale, Large-scale) Small Farms & Owner-Operators Cooperatives Government Agencies Research Institutions |

| By Application | Crop Production Livestock Management Soil Preparation Irrigation Precision Agriculture |

| By Sales Channel | Direct Sales Distributors & Dealers Online Sales |

| By Distribution Mode | Retail Outlets Wholesale E-commerce Platforms |

| By Price Range | Low-End Machinery Mid-Range Machinery High-End Machinery |

| By Region | United States Canada Mexico Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Market Insights | 100 | Farm Owners, Equipment Operators |

| Harvesting Equipment Preferences | 80 | Agricultural Managers, Crop Producers |

| Tillage Equipment Usage | 60 | Farm Equipment Dealers, Agronomists |

| Precision Agriculture Technologies | 50 | Technology Integrators, Farm Consultants |

| Market Trends in Sustainable Machinery | 60 | Environmental Specialists, Sustainable Farming Advocates |

The North America Agricultural Machinery Market is valued at approximately USD 37.5 billion, reflecting a significant growth driven by technological advancements, increased food production demand, and the adoption of efficient farming practices.