Region:Europe

Author(s):Shubham

Product Code:KRAC0879

Pages:80

Published On:August 2025

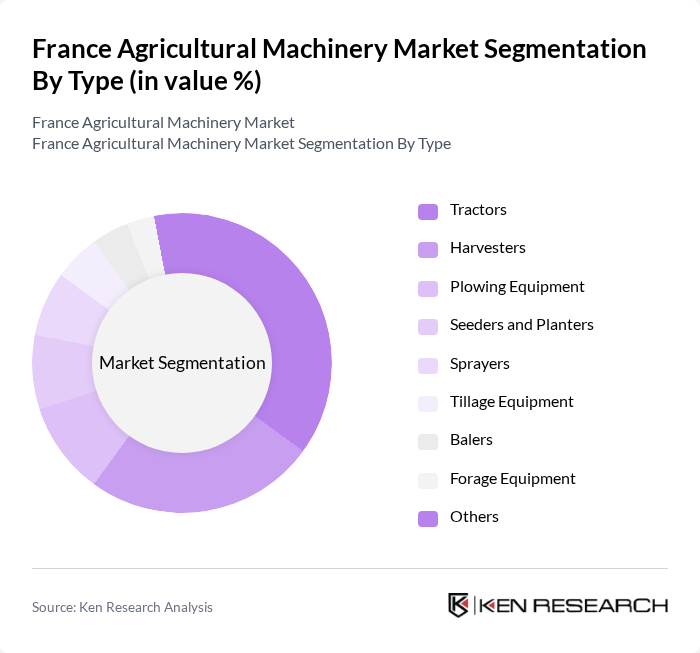

By Type:The market is segmented into various types of agricultural machinery, including tractors, harvesters, plowing equipment, seeders and planters, sprayers, tillage equipment, balers, forage equipment, and others. Each of these subsegments plays a crucial role in enhancing agricultural productivity and efficiency. Among these, tractors and harvesters are the most dominant due to their essential functions in modern farming practices and the ongoing shift toward mechanization and automation .

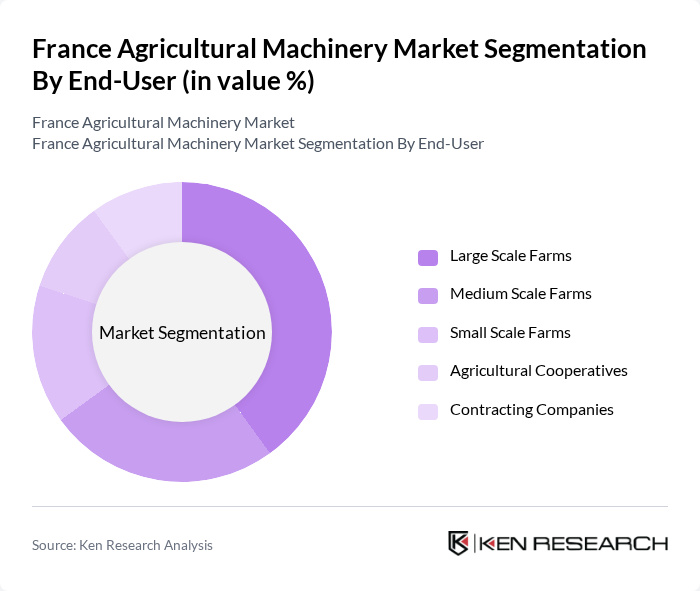

By End-User:The end-user segmentation includes large scale farms, medium scale farms, small scale farms, agricultural cooperatives, and contracting companies. Large scale farms dominate the market due to their capacity to invest in advanced machinery and technology, which enhances productivity and operational efficiency. The trend toward farm consolidation and the increasing prevalence of contract farming are also driving demand for high-capacity and technologically advanced equipment .

The France Agricultural Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere, CNH Industrial, AGCO Corporation, Claas KGaA mbH, Kubota Corporation, SDF Group (Same Deutz-Fahr), Massey Ferguson, Fendt, Valtra, JCB, Manitou Group, Kuhn Group, Kverneland Group, Lemken GmbH & Co. KG, Pöttinger Landtechnik GmbH, Väderstad AB, Artec Pulvérisation, Grégoire SAS, Monosem (John Deere), Sulky Burel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the agricultural machinery market in France appears promising, driven by technological advancements and increasing demand for sustainable practices. As farmers increasingly adopt automation and smart farming solutions, the market is expected to evolve significantly. Additionally, the focus on eco-friendly machinery and practices will likely shape investment strategies, encouraging innovation and modernization. The integration of IoT and data analytics will further enhance operational efficiency, positioning the sector for robust growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors Harvesters Plowing Equipment Seeders and Planters Sprayers Tillage Equipment Balers Forage Equipment Others |

| By End-User | Large Scale Farms Medium Scale Farms Small Scale Farms Agricultural Cooperatives Contracting Companies |

| By Application | Crop Production Livestock Farming Horticulture Forestry Viticulture |

| By Distribution Channel | Direct Sales Dealers and Distributors Online Sales Rental Services |

| By Price Range | Budget Segment Mid-Range Segment Premium Segment |

| By Region | Northern France Southern France Eastern France Western France Central France |

| By Policy Support | Subsidies Tax Exemptions Grants for Innovation Training Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Manufacturers | 60 | Product Managers, Sales Directors |

| Harvesting Equipment Suppliers | 50 | Operations Managers, Technical Support Leads |

| Farmers and Agricultural Cooperatives | 120 | Farm Owners, Cooperative Managers |

| Distributors and Retailers of Agricultural Machinery | 40 | Sales Representatives, Inventory Managers |

| Agricultural Technology Innovators | 40 | R&D Managers, Product Development Specialists |

The France Agricultural Machinery Market is valued at approximately USD 5.8 billion, reflecting a five-year historical analysis. This growth is driven by technological advancements, increased food production demand, and the adoption of efficient farming practices.